Established

Maximum Lavarage

Minimum Account

Established

Maximum Lavarage

Minimum Account

Switching from a demo to a live account is a relatively straightforward process. Depending on your broker, it could be as simple as clicking on a webpage a couple of times to fund an account, and start trading live. Ultimately, most brokers are trying to get you to trade live, and the demo is the…

Switching from a demo to a live account is a relatively straightforward process. Depending on your broker, it could be as simple as clicking on a webpage a couple of times to fund an account, and start trading live. Ultimately, most brokers are trying to get you to trade live, and the demo is the first part of the process in taking a new client on.

One of the biggest things that should be noted is that trading a live account is much different than a demo account, at least from a psychological standpoint. After all, now you are starting to lose money and that is much more painful than being wrong on a trade. If you’re wrong in a demo account, your pride is at stake. If you are wrong in a live account, your pride AND your money are on the line.

Table of Contents

When it comes to opening a live account, you will need to provide a certain amount of documentation. In general, you are typically offered a live account only after you can prove your identity, your residency, and any other legal documents necessary for the regulatory entity that the broker needs to deal with. Overall, you are looking at some type of government identification, and some type of utility bill from the address you are living at. Beyond that, there will be some legal documentation to sign that will be provided by the firm’s attorneys.

There is probably going to be some code of conduct agreement, as well as even more if there is such thing as a social trading platform. This obviously will differ from broker to broker, but in general these are the “hoops” that you will jump through.

Funding will vary from broker to broker, but most of them will accept bank wires, checks, and various types of electronic payment such as PayPal, Skrill, and many others. It is the funding part that the proof of identity is so important to the brokers, as there are stringent anti-laundering laws internationally that brokerage accounts used to be used against. Funding can take as little as a few minutes, or as much as a couple of days depending on the broker and the form used.

Funding will vary from broker to broker, but most of them will accept bank wires, checks, and various types of electronic payment such as PayPal, Skrill, and many others. It is the funding part that the proof of identity is so important to the brokers, as there are stringent anti-laundering laws internationally that brokerage accounts used to be used against. Funding can take as little as a few minutes, or as much as a couple of days depending on the broker and the form used.

The psychology of going live is a bit of a mix. Initially, it’s an exciting time to be a trader because suddenly it becomes “real.” However, fear becomes a serious problem as well. Suddenly, losing matters, and you will notice that you are much less comfortable trading than you are when it is all paper trading. The psychological part of trading is without a doubt the most difficult, but it is also the most important. It is your psychology that will get you through the rough times, and keep you grounded during the high times. I cannot stress this enough: your success lies within the realm of psychology, and of course money management as well.

As mentioned previously, Money management is a huge part of your success or failure. The reality is that random trading can be profitable if you use the proper money management, and the psychology that is necessary. This is why so many traders can use the same system as another and come out with completely different results. It comes down to being able to keep your losses small, and let your winners run. I know that it is a cliché thing to say, but it is true, and that’s why you hear so much about it.

Established

Maximum Lavarage

Minimum Account

Established

Maximum Lavarage

Minimum Account

One of the biggest mistakes that I see traders making is that they don’t succeed in demo trading initially before risking money. That’s what a demo account is supposed to be there for, although I would admit that most brokers use it as a sales tool. Far too many people are too excited about trading with real money to learn how to profit over the longer-term. Most brokers know this, so they don’t have any issue giving away these free demo accounts, because they know that you will more than likely jump into the market long before you are profitable.

However, I would ask you this: “how can you expect to make money in the real world if you can’t make it in a simulated environment?” It’s very much akin to allowing a medical doctor to practice in the real world that failed in medical school. Far too many people think they are going to come into the markets and make a killing right away, not understanding just how difficult it is going to be profitable and successful in this endeavor. Overall, it can be a very rewarding career to be involved in, but you need to take your time and be patient about the way the market moves.

Switching from demo to live is relatively simple most of the time, but you do need to have the proper documentation. The real challenge comes down to making it. If you are not profitable in a demo account, there’s no way you’re going to do it in a live account. In fact, I can guarantee that you are going to end up losing your money. The average retail account is blown out in 90 days. Keep that in mind, but what I would say is that it’s all avoidable though, if you only take the time to learn how to trade, and only then start putting money to work.

Table of Contents

Looking for a reliable forex brokerage that puts your trading needs first? Enter Lovacrypto – your gateway to the exciting world of forex trading. With a user-friendly platform, competitive spreads, and a wealth of educational resources, Lovacrypto.com is designed to help traders of all levels succeed in the forex market.

In today’s fast-paced trading environment, having access to the right tools and information can make all the difference. That’s why Lovacrypto offers a range of features designed to empower traders and enhance their trading experience. From advanced charting tools to real-time market data, Lovacrypto.com provides everything you need to make informed trading decisions.

But what truly sets Lovacrypto apart is its commitment to customer satisfaction. With a dedicated support team available 24/7, you can rest assured knowing that help is always just a click away. Whether you have a question about a trade or need assistance with a technical issue, Lovacrypto’s support team is there to help.

Of course, no brokerage is without its flaws, and Lovacrypto.com is no exception. But despite its shortcomings, Lovacrypto remains a top choice for traders worldwide. With its intuitive platform, competitive pricing, and commitment to customer service, Lovacrypto is well-positioned to help you achieve your trading goals.

So why wait? Sign up for a Lovacrypto account today and take your trading to the next level. Whether you’re a seasoned trader or starting, Lovacrypto.com has everything you need to succeed in the forex market.

Exploring the functionality and features of LovaCrypto’s WebTrader platform, let’s break down its capabilities into a concise bullet list:

In summary, Lova Crypto’s WebTrader platform offers comprehensive features to meet traders’ diverse needs. With its user-friendly interface, multi-asset trading capabilities, advanced charting tools, social trading integration, and robust security measures, the platform provides traders with the tools and support they need to succeed in today’s dynamic markets.

At LovaCrypto, traders can access diverse financial instruments spanning various markets, empowering them to explore and capitalize on various opportunities. Whether you’re a seasoned investor or just starting your trading journey, our platform offers the tools and resources you need to thrive. Let’s delve into the array of assets available for trading:

By offering leveraged trading on diverse assets, LovaCrypto.com provides traders the flexibility and opportunity to pursue their investment objectives. However, it’s essential to approach leveraged trading cautiously and prioritize risk management to safeguard your capital and maximize your potential returns.

When it comes to online trading, security and regulatory compliance are non-negotiables. Lova Crypto understands this imperative and has implemented robust measures to safeguard user accounts, ensure KYC/AML compliance, and protect user funds.

Lova Crypto maintains a secure and trustworthy trading environment by prioritizing security, ensuring KYC/AML compliance, and implementing stringent measures to protect user funds. Traders can confidently engage with the platform, knowing their assets are safeguarded, and regulatory obligations are diligently met.

When considering investing with LovaCrypto, it’s natural to wonder about regulation. Here, we’ll explain what it means for you as an investor.

In short, while regulation is important, it’s not the only thing to consider when choosing a platform like LovaCrypto.com. Transparency, reputation, and education also play big roles in building trust. Do your homework and be cautious with any investment, whether the platform is regulated.

LovaCrypto.com prioritizes trader education, offering a range of resources to enhance trading knowledge and skills:

1. Dive into Knowledge

Traders can access a wide range of materials, including webinars, articles, and e-books. These resources cover various topics, from basic trading principles to advanced strategies, catering to traders of all experience levels.

2. Empower Your Trading

The platform provides robust trading tools such as economic calendars, e-books and technical analysis indicators. These tools equip traders with real-time market insights, helping them make informed decisions and seize opportunities as they arise.

3. Elevate Your Trading Journey

Education is key to success in trading, and LovaCrypto is committed to supporting traders on their journey. The platform empowers traders to grow their skills and navigate the markets confidently by offering comprehensive educational resources and powerful trading tools.

LovaCrypto understands the value of rewarding its traders, so it offers a range of bonuses and promotions to enhance their trading journey. Here’s what traders can expect:

Traders should carefully review the terms and conditions of each bonus and promotion LovaCrypto offers. These terms outline requirements or restrictions, such as minimum deposit thresholds, trading volume targets, and withdrawal conditions. By familiarizing themselves with the terms and conditions, traders can maximize the benefits of bonuses and promotions while ensuring responsible trading practices.

Delving into the regulatory aspect of Lova Crypto is crucial for investors seeking security and trustworthiness in their trading platform. Let’s explore the significance of regulation and how it pertains to Lova Crypto.

In conclusion, while regulatory oversight provides an additional layer of assurance, investors can still find value in platforms like Lova Crypto that prioritize transparency, trustworthiness, and investor education. By conducting thorough due diligence and leveraging available resources, investors can make informed decisions tailored to their financial goals and risk tolerance.

As investors navigate the realm of online trading, understanding the intricacies of depositing and withdrawing funds is paramount. Here’s an extensive analysis of the financial transactions process with Lova Crypto, presented from the perspective of a third-party reviewer.

LovaCrypto offers investors many funding methods catering to diverse preferences and needs. From traditional bank wire transfers to modern online payment platforms and cryptocurrency wallets, users have ample choices to initiate deposits seamlessly. The platform’s intuitive interface guides investors through the deposit process, ensuring a user-friendly experience. Moreover, LovaCrypto maintains transparency regarding deposit fees, empowering investors to make informed decisions about their financial transactions.

Compliance with Anti-Money Laundering (AML) regulations is a top priority for LovaCrypto, as evidenced by its stringent security protocols and Know Your Customer (KYC) procedures. By implementing robust measures to mitigate the risk of illicit activities, LovaCrypto instils trust and confidence in its investor community. Withdrawal requests are processed efficiently, with the platform striving to expedite transactions and provide timely access to funds. Responsive customer support channels further enhance the withdrawal experience, ensuring investors receive prompt assistance whenever needed.

While LovaCrypto operates as a reputable online trading service provider, it’s essential to note that no financial authority regulates the platform. While this lack of regulation may raise concerns among some investors, it’s important to consider Lov Crypto’s reliability and transparency track record. By adhering to stringent security measures and industry best practices, LovaCrypto aims to mitigate risks and protect investors’ interests to the best of its ability.

LovaCrypto.com offers investors a comprehensive and secure financial transaction experience cwithdiverse funding options, robust security protocols, and responsive customer support. While regulatory considerations may warrant attention, LovaCrypto’s commitment to transparency and investor protection remains steadfast. As investors navigate their financial journey with Lova Crypto, they can trust the platform’s reliability and dedication to facilitating seamless transactions.

LovaCrypto’s Fee Structure

In the realm of trading, comprehending the financial intricacies is paramount. LovaCrypto provides a comprehensive insight into its fee structure, ensuring users understand the costs involved. Let’s delve into the specifics:

1. Spreads: A Comprehensive Analysis

Spreads, the disparity between the bid and ask prices, are the spreads that are the main income of a broker. LovaCrypto is committed to offering competitive spreads across a spectrum of trading instruments, fostering an environment where users can execute trades with confidence and efficiency.

2. Commissions: Shedding Light on Trade Execution

Beyond spreads, users may encounter commissions and charges levied for executing trades. These fees are explicitly disclosed, enabling users to accurately assess the cost implications of their trading activities. LovaCrypto strives to maintain equitable commission rates, ensuring users receive fair transaction value.

3. Additional Charges: Exploring Beyond Spreads and Commissions

In addition to spreads and commissions, users should be aware of ancillary charges such as inactivity fees or withdrawal charges. While LovaCrypto endeavours to keep these fees to a minimum, users must familiarize themselves with any potential additional costs associated with their trading activities.

4. Fee Transparency: Empowering Informed Decision-Making

Transparency lies at the core of Lova Crypto’s ethos. LovaCrypto.com empowers users to make informed decisions regarding their trading endeavours by providing a detailed breakdown of its fee structure. With a commitment to fair pricing and transparent communication, LovaCrypt.como aims to facilitate a seamless trading experience for all users.

LovaCrypto strongly emphasises providing exceptional customer support to its users, ensuring a seamless trading experience. Here’s how they make themselves available to assist traders:

Contact Channels:

By offering multiple communication channels, including phone support, email assistance, live chat, and a detailed FAQ section, LovaCrypto ensures that traders can access the necessary support and guidance to navigate the platform effectively and address any issues they may encounter.

Johnathan Edwards

Forex trading involves significant loss risk and is unsuitable for all investors. The high level of leverage can work against you and for you, potentially leading to substantial losses, including exceeding your initial investment. Before engaging in forex trading, it’s crucial to carefully consider your financial objectives, level of experience, and risk appetite. Do not invest money that you cannot afford to lose. Seek advice from an independent financial advisor if you have any doubts. The content on this website is provided for informational purposes only and should not be taken as investment advice.

We value your insights and personal stories about trading with Lovacrypto or other forex brokers. Your experiences can provide invaluable guidance to fellow traders and those considering their options in the forex market. Whether it’s about regulation, leverage, cryptocurrency trading, or any other aspect of your trading journey, we’d love to hear from you.

Please leave a comment below to share:

Your feedback enriches our community’s knowledge and helps traders make informed decisions based on real-world experiences. Let’s build a supportive and informative trading community together!

Table of Contents

Demo accounts enable new investors to test their ideas and learn how to use trading technologies without risk. Users can use the demo account to trade with simulated money and see what their returns would be if they traded with real money. Demo accounts are often used in schools and universities to teach investing and compete in trading competitions.

Demo accounts are commonly used by stock traders, currency exchange traders, and commodities dealers, but not by long-term investors. A demo account is less effective since the longer it takes to produce earnings from an investment, the more time it takes away from compounding real money.

Using demo accounts, investors can practice trading on a platform without putting their own money at risk. You will not be exposed to the dangers associated with live trading platforms on a demo account. As a result, you can learn how platforms work without putting your money at danger.

A demo account guarantees that you will not lose money, but it also guarantees that you will not make money. To reduce risk when trading on the real market, traders must learn discipline and establish techniques.

In general, opening a demo trading account is pretty simple. Choose a Broker – Most brokers provide demo trading interfaces to help you become acquainted with the features and create techniques. Choose which broker to use initially.

Registration is necessary, and you must provide your personal information. Name, address, and financial information will be requested. Your identification will almost certainly have to be validated as well.

Once you’ve decided on a broker, you can install MetaTrader4. Once you have decided on a broker, you will require a trading platform. MetaTrader 4 and MetaTrader 5 are the most popular trading platforms.

You will obtain login details after registering with a trading program. You will be able to open an account.

Traders can use a demo account to test out a program for up to three months before deciding whether to purchase the complete edition. The three-month term is basically offered to guarantee that the prospective buyer has enough information to make them desire to buy.

Traders can use a demo account to test out a program for up to three months before deciding whether to purchase the complete edition. The three-month term is basically offered to guarantee that the prospective buyer has enough information to make them desire to buy.

Demo accounts are an excellent method to learn about various trading tactics and software. Paper trading is a lot safer way for a beginner investor to make technical mistakes than real trading. Investors can benefit from the customised trading software provided by each firm.

A demo account lets you to test methods without risking any money, whether you are a novice or an experienced trader. Trading on a demo account allows the trader to test the approach before trading with real money.

Even though many traders begin with equities, commodities and Forex can be profitable. The same strategies, however, may not be applicable in all three asset groups. A demo account allows experienced traders to experiment with several asset classes.

A forex demo account is distinct from a genuine account in that it is utilised as a training account for traders to practise trading without putting real money at risk. Real accounts, on the other hand, use actual money, and traders put their own money at risk. A demo account enables users to trade with fictitious money in order to imitate the earnings they would receive if they traded with real money. Demo accounts are often used in colleges and institutions to teach investing and compete in trading competitions.

However, studies have shown that even if a person has obtained extensive trading expertise through the use of virtual accounts, things may turn out differently when real money is involved. Because you are not putting anything at risk is more accessible when dealing with virtual money than when trading with actual money.

You may be able to open up to five demo accounts depending on the broker. Some, however, provide up to 19 demo accounts. There is no way to predict how many demo accounts are available at any particular time. All brokers do not limit the number of demo accounts.

If your broker has a demo account limit, you can contact their customer service via email or live chat to request more demo accounts.

There are brokers who will only allow you to open one account of each type per email address.

As a result, you are not able to establish any additional accounts until you give them with another email address or open a new account. Traders do not benefit from this practise because it requires them to spend their resources on opening new accounts rather than allowing them to open as many as they like.

In most circumstances, you won’t need more than five accounts, and depending on your plan, one may enough.

In any case, you should practise on a demo account until you are really proficient.

Demo platforms are usually free. There is no risk of losing money because you will not be dealing with real money. As a result, there are no deposits, withdrawals, or training fees involved.

Different accounts have different settings. Before you open a trading account, you should answer the following questions:

How much money do you want to put down? You should keep in mind that trading with money you cannot afford to lose is not a good idea.

What is your level of risk tolerance? If you are a cautious trader, you can open a micro account and trade micro-lots. However, if you wish to trade more aggressively, you should open a regular account.

Do you require any specialised equipment? Many forex brokers provide their best trading tools to its professional clients, which may include cutting-edge news analysis or access to a diverse set of indicators.

Once you’ve determined what kind of trader you are, your trading objectives, and your risk tolerance, you’ll be able to choose which account is best for you.

Unfortunately, the answer is no. Demo accounts are only for practise purposes. You do not deposit anything because the account is not funded with real money.

As a result, any profits you would have made would be ineligible for withdrawal.

Forex Trading Knowledge Questions and Answers

AvaTrade has yet again improved their cryptocurrency trading offering.

AvaTrade is introducing three new cryptocurrency pairs: NEOUSD, EOSUSD & MIOTAUSD in addition to the 15 crypto assets already on offer.

These new pairs have been available since July 1st, 2019 and provide an excellent opportunity to diversify your clients’ portfolios and increase their exposure to this vibrant 24/7 market.

| Asset | Typical Spread | Leverage | Margin | Min Nominal Trade Size |

| NEOUSD | 1.5% Over-market | 2:01 | 50% | 10 |

| EOSUSD | 2% Over-market | 2:01 | 50% | 10 |

| MIOTAUSD | 1.5% Over-market | 2:01 | 50% | 10 |

To unify their cryptocurrency instrument labels, They are relabeling their existing Ethereum, Ripple & Litecoin instruments, by replacing the existing instruments with new USD labelled ones:

| Asset | Old Symbol | New Symbol |

| RIPPLE | XRP | XRPUSD |

| ETHEREUM | ETH | ETHUSD |

| LITECOIN | LTC_Mini | LTCUSD |

These new pairs have also been available since July 1st,

The trading conditions for each one is identical to those of the older respective assets they replace.

Effective immediately, new positions are only available on the new pairs.

Avatrade Clients will not be able to open new positions on the old assets, but those already open will remain unaffected until July 29th.

Existing positions on XRP, ETH and Litecoin-mini that remain open on July 29th will be automatically replaced with corresponding positions on the new pairs, , at the same opening price and at no cost to clients.

as any broker that values their clients would do , Avatrade makes sure that the clients will not be affected by the change.

Table of Contents

Neteller one of the most known Digital fiat currency wallet provider , has started allowing its users to buy, sell, and hold cryptocurrencies including BTC, BCH, ETH, ETC, and LTC.

They do this on the large scale with a pilot in 10 countries and soon another 50 countries to join . They understand that if you do this effort it will only succeed if you can do this on a global scale.

Neteller is a service which is operated by Paysafe Financial Services Ltd.,

paysafe

founded in 1999, Paysafe Financial Services entered the market with the mission to provide an online alternative to the known traditional payment methods.

Most of the traders aiming us now neteller as one of the companies through which we made our deposits and if we had any profits also our withdrawals. A couple of years ago they left the Forex and Binary industry behind since the charge-back issue became just too expensive.

But as any companies knows, if you do not adept you die. The binary option market is all but dead and the Forex industry has moved also into the directions of the cryptocurrencies. thus, neteller understands that this is where the future is.

So Lasts week they announced that they are now offering a wallet with buy and sell cryptocurrency options.

As of today, Neteller users can buy, hold and sell cryptocurrencies via a recognized cryptocurrency exchange including bitcoin, bitcoin cash, ethereum, ethereum classic and litecoin, purchased using any one of 28 fiat currencies available in the Neteller wallet.

It may not seem so exciting but for many users that love this service it actually is. More and more currencies will be added making them an true exchange in the near future.

Now one is able to fund their neteller account through many different means (Mobile, Epay, Paysafecard, local bank deposits, and bitcoin)

Conditions for buying and selling cryptocurrencies through Neteller

The rates offered are somewhat in the lower middle of the current market making them go for the save route. The average market rates on the major cryptocurrency exchanges differ all in all not that much anyways, as this is not the main reason to choose to buy Bitcoin through Neteller

The minimum cryptocurrency purchase or sale amount is “approximately equal to 10 EUR,” the firm clarified, adding that the maximum amount depends on the transaction limits associated with each account.

When You open an account with Neteller you have to choose your default currency. This is of course for most people in accordance on their geographical locations, people in Britain will go for the pound most Europeans go for the euro and pretty much the rest of the work goes for the US Dollar, thou other currencies are available

The fee is 1.5 percent for purchasing and selling cryptocurrencies from wallets with EUR or USD as the default currency.

The fee rises to 3 percent for wallets with other default currencies.

At this moment till last week Neteller users can pay, get paid on thousands of sites, and send money around the world through their system.

The company claims to have “millions of point-of-sale, ATM and online locations” for users to withdraw or spend their cash.

Last July 25, Paysafe ( which as you remember is the company that owns Neteller

We could now see that this was like their test run on this concept.

We do not know the numbers that Skrill produced since they offered this service but it must have been encouraging enough for Paysafe to include their flagship brand in this endevour.

We will see where this leads but we are hopeful that this is the next step in global acceptance to the cryptocurrency revolution. Let me know what you think

Table of Contents

The currency trading industry and now also the cryptocurrency trading industry have gone through enormous volatile times the last couple of years. Now with trump and its trade wars. The fast rise and somewhat recline of the cryptocurrencies and the fast pace of international politics and economies that create high rises and steep fall of the currencies.

So what does it all mean and what can you do before start to trade on these news headlines.

Good brokers like LegacyFX and UBCFX provide the traders with the latest market news and updates on a continuous basis but if you are new to trading you still have no idea what to do with this.

You start by understanding that the

You have to understand that you only trade with money that you are able to lose, going hungry because you want to open a trade is not the right wy to go about it.

You should by now understand that the value of currencies goes up and down every day.

This in general becomes apparent the moment you go on vacation and what you bought last year with your money now is not the same amount you get today at the exchange.

This is on a large scale, what a lot of people do not know is that there is a foreign exchange market – or ‘Forex’ for short – or “FX” for even shorter, where you can potentially make a profit from the movement of these currencies.

The most known Trader is George Soros who made a billion dollars in a day by trading currencies. This is of course on a scale that we are not able to reach and you need a huge amount of money to begin with. Still he made a billion in one day!!

The internet has played a huge part in making trading in currencies accessible for the masses. You also do not need huge amounts of money to actually do this. Now keep in mind that if you make 10% profit on your investment but the investment was just $50 you basically just end up with $55. still no bank will give you 10% interest on your money.

Many people and I am talking millions are now trading every day, most do this on the side and don’t do this as a full-time job, but there are today enough people that are full time traders and making enough money to live comfortably.

The Forex market for the retail market was born, it started around 15 years ago to become more serious as technologies advanced and the stream of information became almost instant, this is important for trading as one second can make the difference between profit or loss.

So, the moment the technology was there the people that wanted to trade were there all that was needed were the Forex brokers that offered the platform for trading.

There are latterly hundreds of companies of not thousands that offer this service and there are good ones like LegacyFX and there are scams (these tend to not last long)

The Forex market is the largest financial market on the planet and has been for many years now.

Its average daily trading volume is more than $4 trillion. (just let that number sink in for a second). Of this total amount around 5% is the retail market meaning traders like you and me. Still 5% of 4 Trillion is still a number with a lot of zeros behind it.

If you compare that with the New York Stock Exchange, which only has an average daily trading volume of $55 billion. You truly see the size.

To give you another example:

if you were to put ALL of the world’s equity and futures markets together, their combined trading volume would still only equal a 25% of the daily Forex market. Insane right?

Why does this even matter?

It matters because there are so many buyers and sellers that transaction prices are kept low. To explain how trading the Forex market is different than trading stocks, here are a few major benefits.

The mechanics of a trade are virtually identical to those in other markets. The only difference is that you’re buying one currency and selling another at the same time.

This is also the reason as to why the currencies are quoted in pairs, like EUR/USD or USD/GBP.

The exchange rate represents the purchase price between the two currencies.

Example:

The EUR/GBP rate represents the number of GBP one EUR can buy (relevant now with all the Brexit issues going on) . If you think the Euro will increase in value against the British Pound, you buy Euros with British Pounds. If the exchange rate rises, you sell the Euros back, and you cash in your profit.

Now the same works for strading Bitcoin, ethereum, Litecoin or other cryptocurrencies. this has become an entire new market and has introduced many people to Forex . you should here be also aware that trading cryptocurrencies is like regular trading so you will be able to lose great sums of money.

the Best thing i found about trading cryptocurrencies is that the Leverage by default tends to be very low which makes the risk of losing it all much smaller.

Sounds simply enough?

The same could be asked as to why not everyone plays poker, you can make money. The comparison between the 2 is actually closer than you might think.

All traders that are successful will tell you that 80% of successful trading is psychology and the other 20% is research. It takes time to get the research down, but it can take a lifetime to master the psychology.

People tend to do things differently when real money is on the line and are accepting losses in the hope that the trend will reverse or taking out profit too early because they don’t want to lose what they just have gained. In short, the psychology is the hard part.

One should be aware that you can loose real money and a lot of it very fast if you don’t know what you are doing.

Now most Good Forex brokers offer some educational tools, some more than others that will teach you how to trade. There is also something that is called social trading that will allow you to follow other traders and see what they are doing in order for you to learn and make money at the same time.

Now all that I want to say is good luck. 😊

it almost is surreal as they pushed against this from the beginning but now S China digital money may soon be a reality.

The Bank of China (PBOC) is hiring cryptography experts by the masses as reported by the South China Morning Post (SCMP)

this is the latest in the Chinese efforts to have a state controlled cryptocurrency for its own means.

The institution is one which worries a lot about the effect of investor activity in the cryptocurrency market. this in great contrasted to the directive issues in 2014 by the PBOC that Bans any activity related to the cryptocurrency market.

Yet the Central bank of china started to build their own work force for building and developing their crypto in 2017.

in 2017 the Yicai Global reported that this targeted workforce would work from central Beijing as was to be names the digital currency research institute

This research institute would primarily focus on the latest in digital currency technologies and all the different applications that would benefit from cryptocurrencies.

the former deputy director of the PBOC’s science department, Mr Yao Qiann would be in charge of the overall project

since then they are expending with opening a new research institute expanded in Nanjing . the idea for this center is to create more interest n the technologies and its possible applications.

the pilot programs are to be implemented by state controlled banks and academic institutions which should result in blockchain hubs that would attract new developing talent and additional capital to further develop the cryptocurrencies.

“Beijing’s ideal digital currency must ensure the smooth running of monetary and financial stability policies and at the same time protect consumers.”

Apparently, the ultimate goal for the Digital Currency Research Institute (DCRI) was to clear the path for a national cryptocurrency. Reports indicate that the fintech hubs will serve a purpose higher than initially believed. Reportedly, the hubs will serve as testing ground for China digital money. Here, the currency will undergo tests from prototype phase to future mass production.

and thus we get to the point that they are looking aggressively for new talent in the cryptographers and computer scientists sectors. now that more and more student have said good bey to the united states in the last couple of months after feeling they were less welcome this drive for finding new employment has only intensified and is answered by the large amount of brilliant young people coming back to live in chine after their education abroad.

The salaries are even higher then what they would have earned if they would stayed in the US and gone of to work in some of the companies in the Silicon Valley.

So we could expect that China is now also looking to become a world player in this industry as they have become the leaders in so many other fields.

Table of Contents

Everyone that has been trading for some time has most likely traded on the metatrader 4 trading platform of metaquotes. This has been the standard in the industry for the last couple of years.

But more and more brokers Like CMSTrader and UBCFX are offering alternatives that might suite certain traders even better then the MT4 as they have a lower learning curve and are designed more intuitive.

One of these platforms is the Sirix Trading Platform.

The Sirix Trading platform is

Sirix, a fully packed trading software with numerous with numerous options and special indicators that are designed by the software company to present you with a personalized trading experience.

• Ease of Use: if you are a trader you will be able to access your Sirix trading platform and see all your trades and other information at any place and time. The Web-trader is a fully function trading platform that does not require you to do any download. This has more or less become the norm of the industry and if you for example take the Sirix Trading platform of LegacyFX you will be able to have a download desktop version, a web version and a mobile version.

these in general all have the same functionalities but of course is the mobile version a bit more limited due to the smaller screen real estate.

• Indicators and Options: this platform provides build I more than 50 Indicators which for most traders is over kill but it does allow most traders to find the right indications to match their trading behavior and trading strategies.

The Charting Package that Sirix provides is easy enough to understand and gives you as a trader all the information you need, there are different time frames that in combination with the ability to display lines and annotations make this platform feel like it is designed for you.

• Social Trading: Sirix has a full feature social trading module that allows you to watch the trades of others which might give you new insights and trading ideas. If you come a across a trader that is particular successful you are able to copy that traders’ trades and create a full automated copy trader,

You as the trader are still in charge and you have the option to trade with lesser or higher amount then the trader you are copying.

In order to use the social trading, you have to open an account with their social trading community.

This can only be done by using a nickname an order to protect you identity. When you are part of the community then you are part of all the brokers that offer this feature to their traders. Meaning you are able to follow a trader that is trading with 12trader while you are trading with account from UBCFX or any other broker that has Sirix.

Now I have to mention that if you look to only trade social then the Etoro Platform is still a better solution s this system is built only for social trading and they have pretty much defined the concept.

this is the latest platform that was launched by Leverate.

it focuses , just like the name says more n the trading of cryptocurrencies.

as this company understands that this is the direction where the market is going and more and more traders are asking for trading in Bitcoin or ripple trading to just name a few they have added this feature to the Sirix Platform , this means that every broker that has the sirix trading platform is in theory able to offer trading in cryptocurrencies.

in addition they have launched also a platform that is only trading cryptocurrencies but that will be another review as i have yet to see and play with this system

The Intuitive aspect of this platform is one of the key features and makes the threshold of trading lower for newbies. There is also a fastn amount of Sirix Tutorials out there that will help even the total beginners with the Sirix Platform

Now of the traders that need bots and more indicators then there sis still nothing that beats the metatrader 4 trading platform but for many traders Sirix offers more then enough and makes the trading experience easier then with MT4.

More and more brokers are offering this alongside their other trading platform so you as a trader will come across more and more brokers that have the Sirix Trading platform in their arsenal.

• UBCFX

• LegacyFX

• 12Trader

• CMStrader

Table of Contents

On September 11, Sweden will host Blockchain & Bitcoin Conference Stockholm organized by Smile-Expo – international coordinator of business events.

The conference will introduce various topics regarding blockchain and will drive attention to the most topical problems of the cryptocurrency market today.

One of the invited experts is the Member of Swedish Parliament Mathias Sundin who is involved in the Tax Committee and the Finance Committee. The specialist has co-founded a revolutionary technological organization Warp Institute and joined financial company Goobit. At the event, the speaker will analyse the power of decentralized systems, evaluating its long-term strenghts.

Head of Digital and Innovation at Landshypotek Bank Merete Salmeling will deliver the presentation, too. She will explain how DLT can be integrated into the real estate, and what advantages it brings.

President of Blockchain Alliance Europe Tanja Bivic Plankar will join the conference as well. Being an initial coin offerings expert, she will share knowledge about ICOs, describe recent innovations in the token sale sphere and talk about the regulatory framework.

Regulatory and legal challenges coming with innovations will also be discussed by Dr. Guenther Dobrauz-Saldapenna – Partner & Leader PwC Legal Switzerland. The speaker is a lawyer, VC investor, and banking specialist. He provides business consultations and has already written 10 books discovering innovative processes, money and technology.

Blockchain & Bitcoin Conference Stockholm is the second crypto event in Sweden carried out by Smile-Expo. The company has already held 40 successful crypto conferences in 25 countries.

Use an opportunity to meet leading DLT specialists, ask questions and learn new topical information about the blockchain industry at first hand at the conference!

Details of the event and registration are available on the official website of Blockchain & Bitcoin Conference Stockholm.

Table of Contents

The Blockchain & Bitcoin Conference Stockholm is a highly anticipated crypto event in Sweden. and is being held for the second time.

after the success of the first one they look to make this event a annual one. since the crypto industry is going more and more out of the shadows and becomes more mainstream you will find that the quality of people involved also grows.

this is clearly displayed in the extensive list of speakers at this event.

bringing together the international business community in order to share their experience of integrating blockchain and cryptocurrencies; discussing blockchain industry issues and finding ways to solve them; encouraging a balanced growth of the cryptocurrency market.

Conference topics:

Speakers:

the list of world-renowned blockchain experts, including government officials, foreign investors, entrepreneurs, lawyers, and developers is impressive and should get this event the notice it deserves.

investors, business people, lawyers, startup founders, and those aiming to launch a token sale.

:to receive full information with case studies about the blockchain application, to discover how to comply with the legal norms in the blockchain industry, to find business partners, and to enhance your brand awareness.

Standard ticket – 240 EUR

Student ticket – 121 EUR

A valid student ID should be presented at check-in. No refunds on the day of the event.

Blockchain & Bitcoin Conference Stockholm is a part of the series of Blockchain World Events held in 25 countries. The organizer is Smile-Expo International Company.

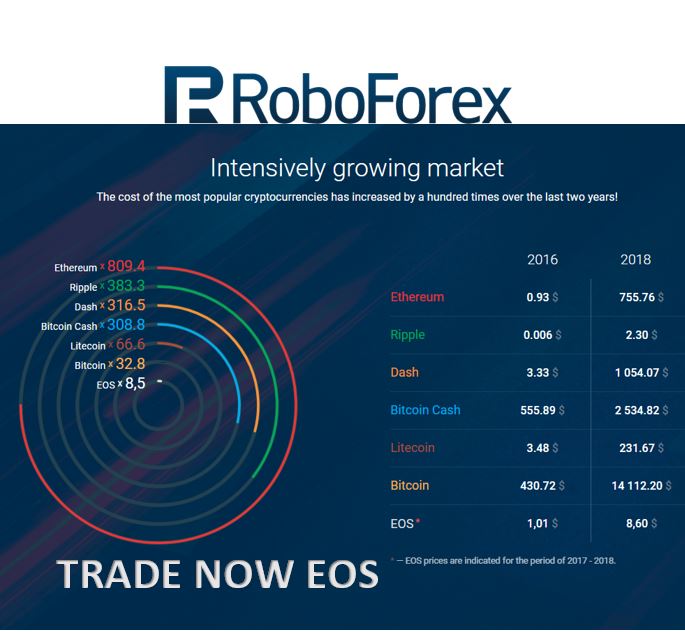

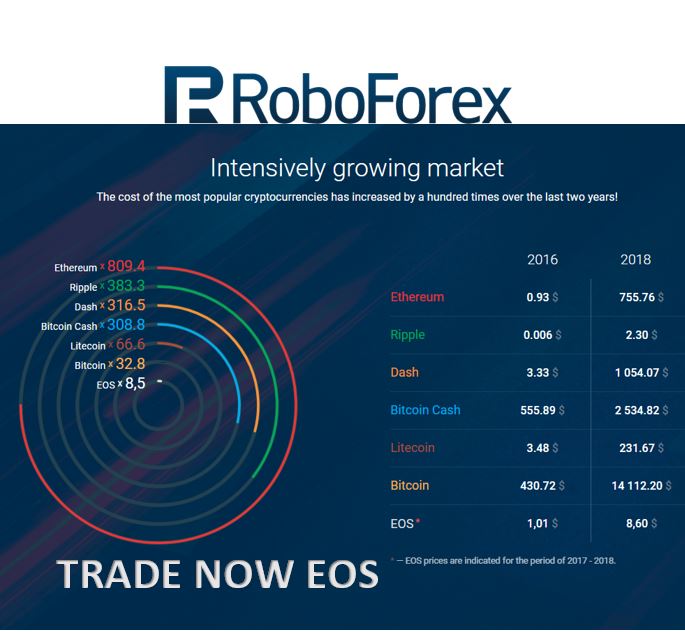

RoboForex announced today adding EOS, a cryptocurrency which is now available for trading with the broker on both MT4 and MT5 platforms.

RoboForex keeps expanding its crypto portfolio.

The latest addition is EOSUSD, which is already available to the clients through MT4 and MT5, alongside with six other crypto pairs:

BTCUSD, ETHUSD, BCHUSD, DSHUSD, LTCUSD, and XRPUSD.

The EOSUSD trading conditions are the following:

EOS is a cryptocurrency that was introduced in 2017 and is based on blockchain and smart contracts. Its key features are scalability, decentralized apps, and huge throughput (a few million transaction per second).

This is another step towards developing our crypto portfolio.

Our clients do value the flexibility and state of the art technologies we offer them As for us, our mission is meeting their expectations and constantly improving the trading conditions by opening the door to new instruments and opportunities.

says Denis Golomedov, ;Marketing Director at RoboForex.

This Broker has been on the forefront of crypto trading on the Metatrader 4 and Metatrader trading platforms from the beginning and pushing for more and more trad-able assets to be added to their offering .

it took this broker a little bit of time but now that they got them selves into the cryptocurrency trading arena they come to lead the pack. this in combination with their the trading platforms they are offering makes this a broker to take notice of.

as yet there are not enough brokers that offer metatrader 5 and especially one where you are able to trade bitcoin ethereum, litecoin and now also EOS.

About RoboForex

RoboForex is a brokerage company catering to clients from various countries. The broker’s focus is providing the traders with access to its own financial market platforms.

RoboForex Ltd is a licensed company (License No. IFSC/60/271/TS/17).

Lesson 2 – Pair characteristics (the majors and the crosses), Understanding Forex Pairs

Lesson 3 – Introduction to charting

Lesson 1 – What is Forex and how does It work

What is Price Action Trading and How to Use it

How to Recognize False Breakouts

NSFX Demo Account Review | 2018 Must Read |

Stockscale io Review – Demo Account – top 100 Broker ?

FX Broker ActivTrades Wins the “Le Fonti Forex Broker of the Year Award”

4 Things to Always Do Before You Start Trading

Trade.com Demo Account Review | Must Read |