Broker news

Plus500 Review 2020 – Is This Broker LEGIT?

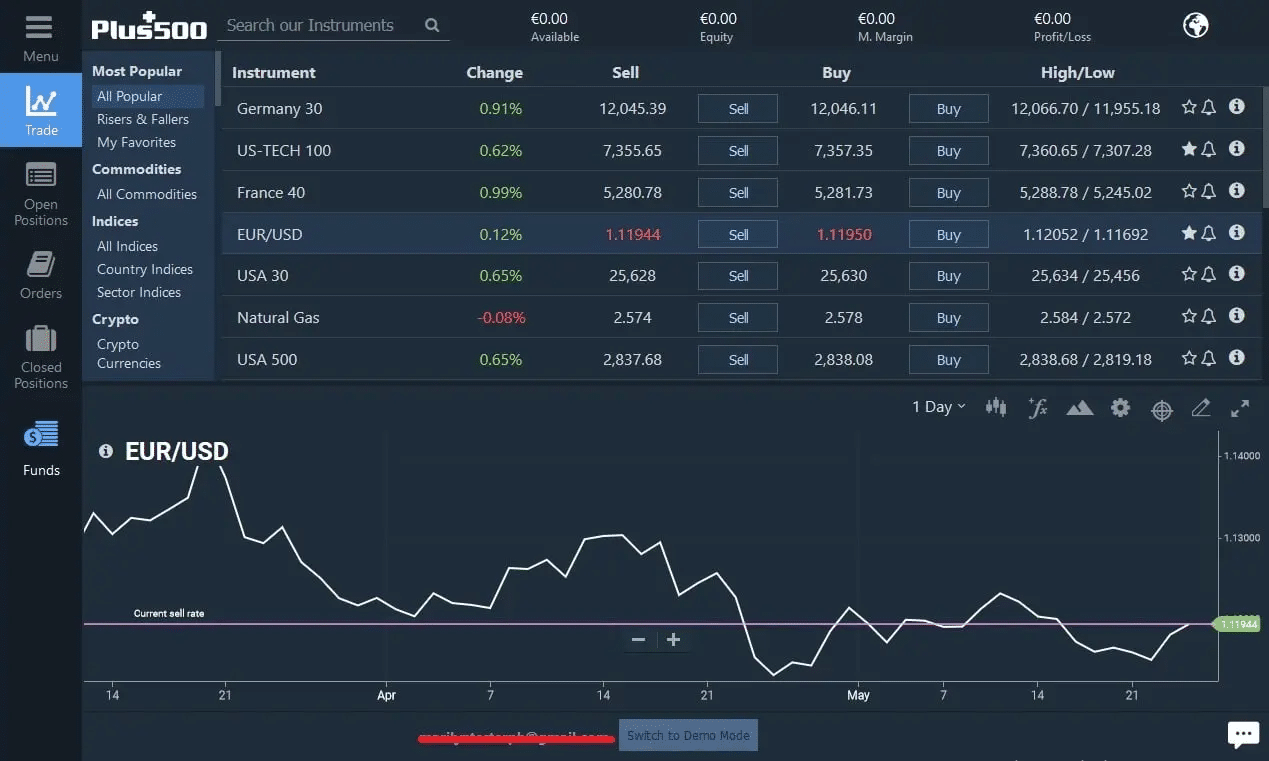

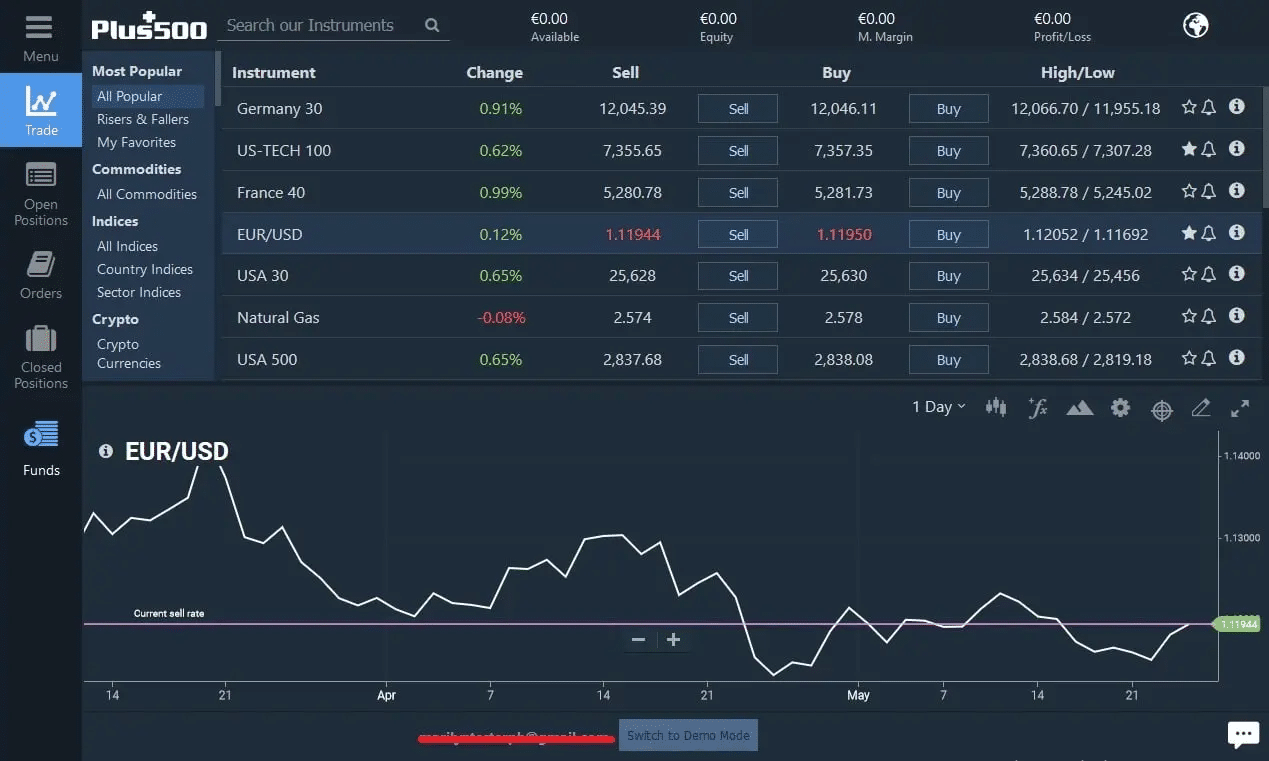

To address this question I will explain two different perspectives about how safe it is to trade CFDs through Plus500. First, we will approach the matter of safety from the perspective of how safe your investment is.

Is Plus500 Safe?

To address this question I will explain two different perspectives about how safe it is to trade CFDs through Plus500.

How safe is it to trade CFDs?

First, we will approach the matter of safety from the perspective of how safe your investment is.

According to the Financial Conduct Authority (FCA), the UK’s financial regulatory body, and the European Securities and Markets Authority (ESMA), investors who trade CFDs are exposed to a high risk, as trading CFDs involves taking very short-term positions – usually overnight – in highly volatile financial instruments.

In fact, research shows that more than 80.5% of investors who trade CFDs through Plus500 lose money when trading as the high costs associated with these transactions, the amount of leverage used, and the inherent volatility of the markets tends to evaporate their account balances.

In March 2019, ESMA decided to renew a restriction that forbids the marketing, distribution, and sale of CFD products to retail clients in Europe for a period of three months starting on May 1, 2019.

These restrictions included a limit on the degree of leverage that a client could take on various types of CFDs, the minimum required margin that would trigger a margin call, and a restriction on the incentives offered to trade CFDs.

Additionally, the institution enforced the publication of risk warnings that seek to inform investors about the potential of losing money when trading.

Therefore, before you trade CFDs with this provider, you should make sure you understand CFDs.

Furthermore, investors are also advised to invest money they can afford, as the money will be exposed to high risk, either entirely or partially.

How safe it is to trade with Plus500?

Now that we have covered the matter of how safe are CFDs, we can now move forward to review how safe Plus500 is as a trading platform.

Overall, Plus500 is considered to be a safe broker due to the fact that it is regulated by various top-tier financial authorities including the Financial Conduct Authority (FCA) in the United Kingdom (traders are protected under the Financial Services Compensation Scheme (FSCS)),the Monetary Authority of Singapore (MAS), and the Australian Securities and Investment Commission (ASIC). Plus500CY Ltd is authorized & regulated by CySEC (#250/14). You can check out our guide if you are looking for the best broker in Australia. We also ranked the best forex brokers in Australia.

Additionally, Plus500 is a publicly-traded firm listed at the London Stock Exchange (LSE) which adds a significant degree of transparency to its operations, especially when it comes to the company’s solvency and liquidity, which is crucial to protect the money it holds for its investors.

The fact that Plus500 is regulated by different institutions around the world lowers the risk of relying on this broker to make trades, as these regulatory bodies promote transparency and a certain degree of reliability to the company’s operations.

That said, a large percentage of Plus500 accounts lose money due to the inherent risks associated with CFDs and these regulators do not provide any cushion to traders who lose money when trading these financial instruments.

Finally, Plus500 has a Trustpilot score of 4.

Balance Protection Amount | Regulated by | Plus500 Entity | |

Regulated by the Financial Conduct Authority (FRN 509909) | Plus500UK Ltd | ||

South Africa, New Zealand and South Africa | No balance protection | ASIC (AFSL #417727), Financial Markets Authority (FSP #486026), and FSCA (FSP #47546) | Plus500AU Pty Ltd |

EU, Norway, Switzerland (EEA) | Cyprus Securities and Exchange Commission (#250/14) | Plus500CY Ltd | |

No balance protection | Israel Securities Authority (#515233914) | Plus500IL Ltd | |

No balance protection | Monetary Authority of Singapore (#CMS100648-1) and the IE Singapore (#PLUS/CBL/2018) | Plus500SG Pte Ltd |

Broker news

Capitalix-It is a good choice in 2024?

Range of Markets

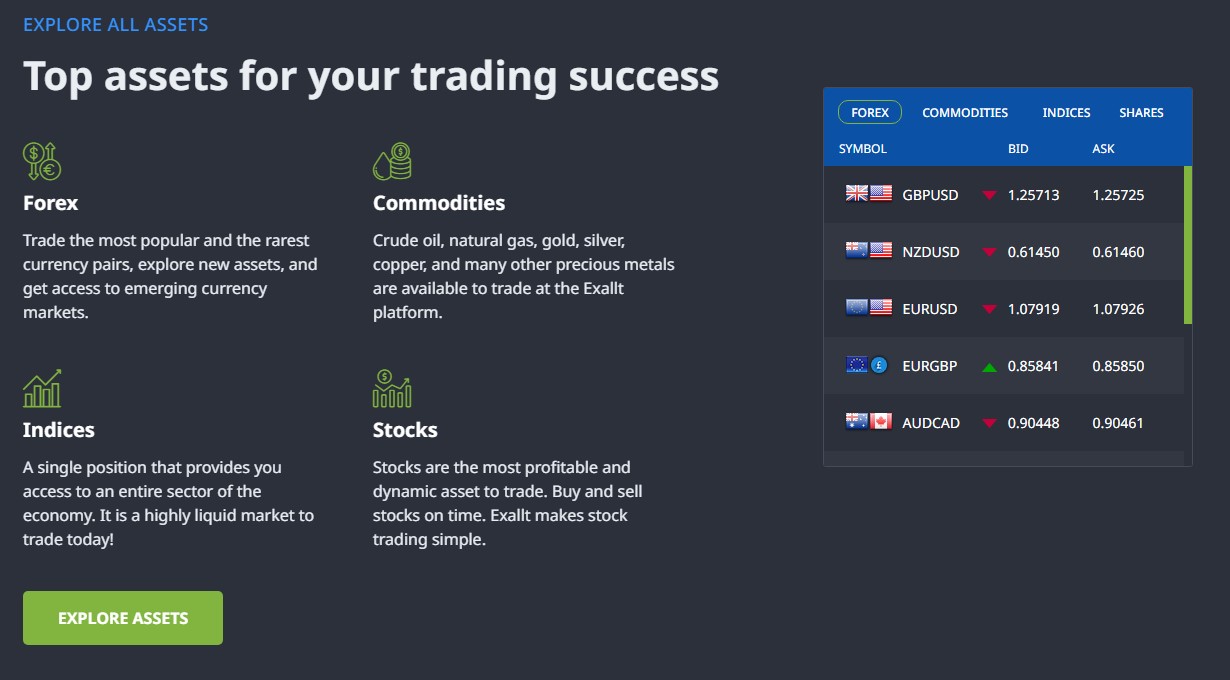

Capitalix offers a diverse range of trading instruments, catering to the varied interests and strategies of traders. Here’s a closer look at what you can trade on Capitalix:

- Forex Pairs: Capitalix provides traders with the opportunity to trade in a wide variety of major, minor, and exotic currency pairs. This includes popular pairs like EUR/USD, GBP/USD, and USD/JPY, allowing traders to take advantage of the liquidity and volatility in the forex market.

- Commodities: For those interested in commodities trading, Capitalix offers access to a range of commodities, including precious metals like gold and silver, energy commodities such as crude oil and natural gas, and agricultural products like coffee and sugar. Commodities trading can be a good way to diversify your portfolio.

- Indices: Capitalix also provides the option to trade on leading global indices, which is perfect for traders looking to gain exposure to specific economies or market sectors. This includes indices like the Dow Jones Industrial Average, NASDAQ, S&P 500, and others.

- Stocks: Traders at Capitalix can engage in stock CFD trading, with access to shares from leading global companies. This allows traders to speculate on the price movements of individual companies without needing to own the underlying stocks.

- Cryptocurrencies: Recognizing the growing interest in digital currencies, Capitalix offers trading on some of the most popular cryptocurrencies, including Bitcoin, Ethereum, Ripple, and Litecoin. Cryptocurrency trading is known for its high volatility, which can present both opportunities and risks for traders.

Unique Offerings: One of the unique aspects of trading with Capitalix is their commitment to providing traders with access to a wide range of markets and instruments. This diversity enables traders to explore different sectors and asset classes, all from a single trading platform. Additionally, Capitalix’s platform includes advanced charting tools and real-time market data, which can help traders make informed decisions.

Risk Management

Capitalix provides traders with a suite of top-tier risk management tools, including:

1. Stop Losses: This tool enables traders to set predefined exit points to mitigate losses if the market moves unfavorably.

2. Take Profits: Take Profits allows traders to secure profits by automatically closing positions when a specified price target is reached.

3. Limit Orders: Limit Orders empower traders to enter the market at predefined price levels, ensuring execution at favorable rates.

4. Trailing Stop: The Trailing Stop feature empowers traders to safeguard their profits by automatically adjusting stop loss levels as the market moves favorably. This dynamic tool helps traders lock in gains while allowing for potential further upside.

5. Margin Calls: Margin Calls serve as alerts, notifying traders when their equity falls below a certain threshold, prompting them to take necessary action to manage risk.

Trading Hours

When it comes to trading hours, you will be able to trade between 5-7 days a week, depending on your chosen market:

- Forex 24/5. Monday through Friday.

- Crypto assets 24/7. From Monday to Sunday.

- Commodities usually 23/6. From Sunday to Friday. Closed for one hour, from 22:00 to 23:00

- The opening hours of the Indices and stock market depend on the country and the session: North American, European, or Asian.

Capitalix offers a trio of platforms designed to cater to the needs of modern traders: the widely acclaimed MetaTrader 4 (MT4), their proprietary WebTrader, and a mobile application for trading on the go. Each platform is engineered with precision, focusing on enhancing the trading experience through a blend of functionality and accessibility.

MetaTrader 4 (MT4): MT4’s reputation precedes itself, being the choice of many professional traders for its robust analytical tools, advanced charting capabilities, and the ability to support automated trading systems known as Expert Advisors (EAs). Its user-friendly interface, combined with powerful technical analysis features, makes it a top pick for traders looking for depth and flexibility in their trading operations.

WebTrader: Capitalix’s WebTrader platform is a testament to their commitment to providing seamless trading experiences. It’s accessible directly from your web browser, eliminating the need for any downloads. This platform stands out for its intuitive design, making it easy for both novices and experienced traders to navigate. Features like real-time quotes, customizable indicators, and advanced charting make it a solid choice for those who prefer web-based trading.

Mobile Application: Recognizing the shift towards mobile trading, Capitalix has developed a mobile app that mirrors the functionality of its desktop counterparts. Available for both iOS and Android devices, the app ensures traders can manage their portfolios, monitor the markets, and execute trades anytime, anywhere. With push notifications for market events and a user-friendly interface, it’s an excellent tool for traders who value mobility and convenience.

In summary, Capitalix’s suite of trading platforms is designed to meet the diverse needs of the trading community. Whether you’re drawn to the advanced capabilities of MT4, the accessibility of WebTrader, or the convenience of mobile trading, Capitalix provides a solid foundation for your trading activities.

Customer Service

Capitalix emphasizes the importance of accessible and responsive customer support for its traders. Recognizing that timely assistance can significantly impact trading success, Capitalix has developed multiple channels for traders to reach out for help:

Live Chat Functionality: Available directly on the Capitalix platform, the live chat feature offers immediate assistance from knowledgeable support staff, ensuring that your trading queries are resolved without delay.

Email Assistance: For queries that require detailed explanations or for traders who prefer written communication, Capitalix can be reached at [email protected]. The support team is dedicated to providing prompt and thorough responses.

Phone Support: Capitalix understands the value of human interaction and offers phone support through several international numbers, catering to traders worldwide:

- Argentina: +541139857766

- Chile: +56227120378

- Guatemala: +50224581123

- Mexico: +525599900281

- Panama: +5078355542

- Peru: +5154375826

- India: +918327121011

- Brazil: +551150265398

- Japan: +815030923470

- Germany: +41275087668

- Seychelles: +2484632032

- United Arab Emirates: +97142491118

Online Presence and Messaging: Engage with Capitalix on social media and through messaging apps for updates, support, and community interaction. The official Telegram channel, @capitalixbot, is a great resource for direct communication.

Comprehensive FAQ Page: Before reaching out, traders can explore the FAQ page for answers to commonly asked questions, offering an immediate resource for information and support.

Conclusion capitalix review

Capitalix is preferred for traders due to its competitive leverage offerings, comprehensive asset selection, including forex, cryptocurrencies, commodities, indices, and stocks, exceptional customer support, commitment to regulatory standards, user-friendly platforms, and extensive educational resources. Capitalix provides traders the tools and support to navigate the financial markets effectively and maximize their trading potential.

FAQ:

What is Capitalix?

Capitalix is a dynamic online trading platform offering forex, stocks, commodities, and cryptocurrencies trading with a focus on providing a secure, innovative, and user-friendly trading experience.

Where is Capitalix based?

Capitalix operates from Seychelles, adhering to the regulatory framework established by the Financial Services Authority (FSA).

Is Capitalix regulated?

Yes, Capitalix is regulated by the Financial Services Authority (FSA) of Seychelles, ensuring a trustworthy and transparent trading environment.

What types of accounts does Capitalix offer?

Capitalix offers several account types, including Basic, Silver, Gold, Platinum, and VIP, to cater to various trading needs and experience levels.

What is the minimum deposit required at Capitalix?

The minimum deposit to start trading with Capitalix is $250, making it accessible for beginners and experienced traders alike.

Does Capitalix offer educational resources?

Absolutely! Capitalix provides a wealth of educational materials, including webinars, e-books, and articles, to help traders at all levels improve their trading skills.

What trading platforms are available at Capitalix?

Traders at Capitalix can use the MetaTrader 4 platform, WebTrader, and a mobile trading app, all equipped with advanced trading tools and features.

Can I trade cryptocurrencies on Capitalix?

Yes, Capitalix offers trading on a variety of cryptocurrencies, including Bitcoin, Ethereum, and Litecoin, among others.

Are there any fees for depositing or withdrawing funds?

Capitalix does not charge any fees for deposits. While withdrawals are also free of charge from our side, it's wise to check if your bank or payment provider applies any fees.

How long do withdrawals take at Capitalix?

Withdrawal requests are processed within 1 to 2 business days, ensuring you can access your funds promptly.

Is customer support available at Capitalix?

Yes, Capitalix provides 24/5 customer support through live chat, email, and phone to assist you with any queries.

How can I open an account with Capitalix?

Opening an account is simple. Just visit the Capitalix website, fill out the registration form, and follow the steps to complete your account setup.

Does Capitalix offer a demo account?

Yes, Capitalix offers a demo account loaded with virtual funds, allowing you to practice trading strategies risk-free.

What leverage does Capitalix offer?

Capitalix offers leverage up to 1:200 for forex trading, with variations depending on the account type and instrument.

Are my funds safe with Capitalix?

Absolutely. Capitalix employs strict security measures, including segregated accounts, to ensure the safety of your funds.

Can I trade on mobile with Capitalix?

Yes, Capitalix's mobile trading app allows you to trade on the go, providing access to all the major features of the desktop platform.

What instruments can I trade with Capitalix?

Capitalix offers a wide range of trading instruments, including forex pairs, commodities, indices, stocks, and cryptocurrencies.

Does Capitalix offer any bonuses or promotions?

While Capitalix occasionally offers bonuses and promotions, we encourage traders to check our website for the latest offers and read the terms and conditions carefully.

How does Capitalix protect my personal information?

Capitalix uses SSL encryption and adheres to strict data protection policies to safeguard your personal and financial information.

Can I lose more money than I deposit?

No, Capitalix offers negative balance protection, ensuring you can never lose more than your account balance.

What are the spreads at Capitalix?

Spreads at Capitalix are competitive and vary by account type and market conditions. Detailed information is available on our website.

How can I learn to trade with Capitalix?

Capitalix offers comprehensive educational resources, including webinars, articles, and e-books, catering to both beginners and experienced traders.

What makes Capitalix stand out among other brokers?

Capitalix's commitment to security, customer support, and providing a user-friendly trading experience sets it apart in the forex trading industry.

Can I trade with Capitalix from any country?

Capitalix serves traders from various countries. However, due to regulatory restrictions, our services might not be available in certain jurisdictions.

How can I contact Capitalix for more information?

For more information, you can contact our customer support via live chat, email at [email protected], or by calling our direct support numbers available on our website.

Risk Disclosure:

Trading with Capitalix involves significant risk and might not be suitable for everyone. You could lose more than your initial deposit, so don’t invest money you can’t afford to lose. Market prices can change quickly, and using leverage increases both potential gains and losses. Make sure you understand the risks, consider your investment goals and experience level, and seek advice if needed. Capitalix offers resources to help, but the final decision on trades is yours. Remember, past success doesn’t guarantee future results.

Author :

Broker Reviews

Exallt Review – Demo Account – top 75 Broker ?

Table of Contents

Introduction to Exallt Review

Let us start from the beginning. People should remember that Exallt offers many investment tools in the capital markets. Creating a portfolio with cryptocurrencies, stocks, commodities, ETFs, and more is possible.

It is a new brokerage that has just opened its door. That said, Exallt Live can offer exemplary services and products.

To get more details, proceed with Exallt review. The next sections will provide a detailed professional analysis of the broker and its offerings.

| Broker Name: | Exallt |

| Broker Type: | CFD broker |

| Operating since year: | 2023 |

| Regulation: | Only KYC/AML |

| Broker status: | Independent Broker |

| Customer Service | |

| Phone: | +44 2086382873 |

| Email: | [email protected] |

| Languages: | English, Spanish |

| Availability: | phone, email, Social Media |

| Trading | |

| Trading platforms: | Desktop, Mobile and Webtrader |

| The Trading platform Time zone: | |

| Demo account: | Yes |

| Mobile trading: | yes |

| Web-based trading: | yes |

| Bonuses: | yes |

| Other trading instruments: | Forex, CFD, crypto, commodities, indices, stocks |

| Account | |

| Minimum deposit ($): | $5000 |

| Maximal leverage: | 1:400 |

Exallt Trading Products and Interesting Details

Commodities

Explore top commodities, trade what you want, when you want.

Explore trending commodities such as gold, silver, oil, and others, use innovative tools and make informed trading decisions at Exallt. Benefit from advanced charting and analysis as well as ultra-fast transaction processing. Exallt delivers a trading environment that helps investors to grow.

Interestingly, it is possible to trade different types of commodities. For example, oil and natural gas. Moreover, precious metals such as gold and silver.

Forex

Forex trading is made simple by Exallt.

Forex is the most traded market in the world. It is a decentralised global market for the trading of currencies. The most popular FX pairs involve major international currencies and experience the highest trading volumes and liquidity. This market determines foreign exchange rates for every currency.

Indices

Expand your trading opportunities. Trade the most popular indices at Exallt!

Indices are another in-demand trading asset. An index measures the performance of a group of stocks, bonds, or other assets. By trading indices, you can gain exposure to a wide range of assets without buying them individually. Most index trading is done with financial derivatives like CFDs. This makes it an ideal way to diversify your portfolio and manage risk.

Stocks

Trade stocks at Exallt.

Exallt is about making stock trading easier. Get real-time access to stocks from top exchanges of the world. Diversify your portfolio with a large variety of leading global stocks. Stock trading ensures two ways of earnings: through capital appreciation or dividend payments. This market features the potential for the highest returns.

Cryptocurrencies

Exalt – the easiest and the most secure way to trade cryptocurrencies.

If you can time the market right, trading cryptocurrencies gives you much higher returns than traditional investments. It minimizes risk as you speculate on the rise and fall of the market without owning the asset. Being decentralised, cryptocurrencies allow for more freedom in trading, as there are no restrictions on how much can be traded or how often.

Exallt and its Trading Platform

It is hard not to mention its platform. Hopefully, it is quite easy to use the platform.

As a reminder, trading is simple. The first step is to select an asset. All users have to do is click on the “asset” tab on the platform. They need to choose a preferred asset from the extensive tradable asset selection offered by the firm.

The next step is deciding on the amount a trader wants to invest in any trade. Unsurprisingly, the higher the investment, the higher the potential rewards.

Moreover, deciding whether to go short or long on their preferred asset is important. Advanced charts, graphical trading tools, technical indicators, and live analysis help to make an informed decision on probable future price movements.

It is important to remember about risk factors. When a trade position opens, customers should protect their positions from market risks. Customers should use Stop Loss and Take Profit orders. Thanks to Stop Loss orders, it is possible to reduce potential losses. Moreover, Take Profit orders allows users to lock in their profits.

Users should remember that Stop Loss and Take Profit orders will automatically close their positions when triggered.

Exallt and Education

Hopefully, Exallt Live offers interesting information. It is desirable to read every chapter of the guide. Moreover, people will find this guide brimming with information for their financial education. Furthermore, Exallt ’s goal is to educate investors and bring transparent investing to anyone who wants it, not just the elite.

Security Of Funds

RISK MANAGEMENT

Exallt continually detects, assesses, monitors, and controls each risk associated with platform users’ trading transactions, operations, and actions. This means that they continuously evaluate the effectiveness and compliance of the policies, approaches, and procedures. Such a system approach allows Exallt to cover its financial needs and capital requirements quickly.

SEGREGATED ACCOUNTS

Exallt is incredibly proud of ensuring the ultimate protection of clients’ funds. They apply a model that keeps our clients’ funds separate from the company funds. In the unlikely event that Exallt would ever enter liquidation, the clients’ funds are wholly segregated off the balance sheet and cannot be used to cover the company’s debts and pay back creditors.

REACHING THE TOP EU BANKING INSTITUTIONS

Exallt attentively chooses the financial services to partner with. Exalt needs additional facilities to support and conduct transactions. They partnered with payment service providers to work with numerous banks worldwide, including central tier-one banks such as Barclays, HSBC & Deutsche Bank. Rest assured, the security of Clients’ funds, alongside Execution and Customer support, forms the essential focus of Exallt’s activity.

Exallt Review: Conclusion

As can be seen from the review of Exallt , it makes sense to cooperate with this firm. . Moreover, its website provides many interesting details, and it is desirable to have a look through their website to see how well Exallt suits you.

We strongly hope that this Exallt review will give you accurate information about the broker enabling you to make the right decision of choosing this broker.

Broker news

The Advantages and Disadvantages of a Forex Demo Account

Table of Contents

The Advantages and Disadvantages of a Forex Demo Account

forex demo account

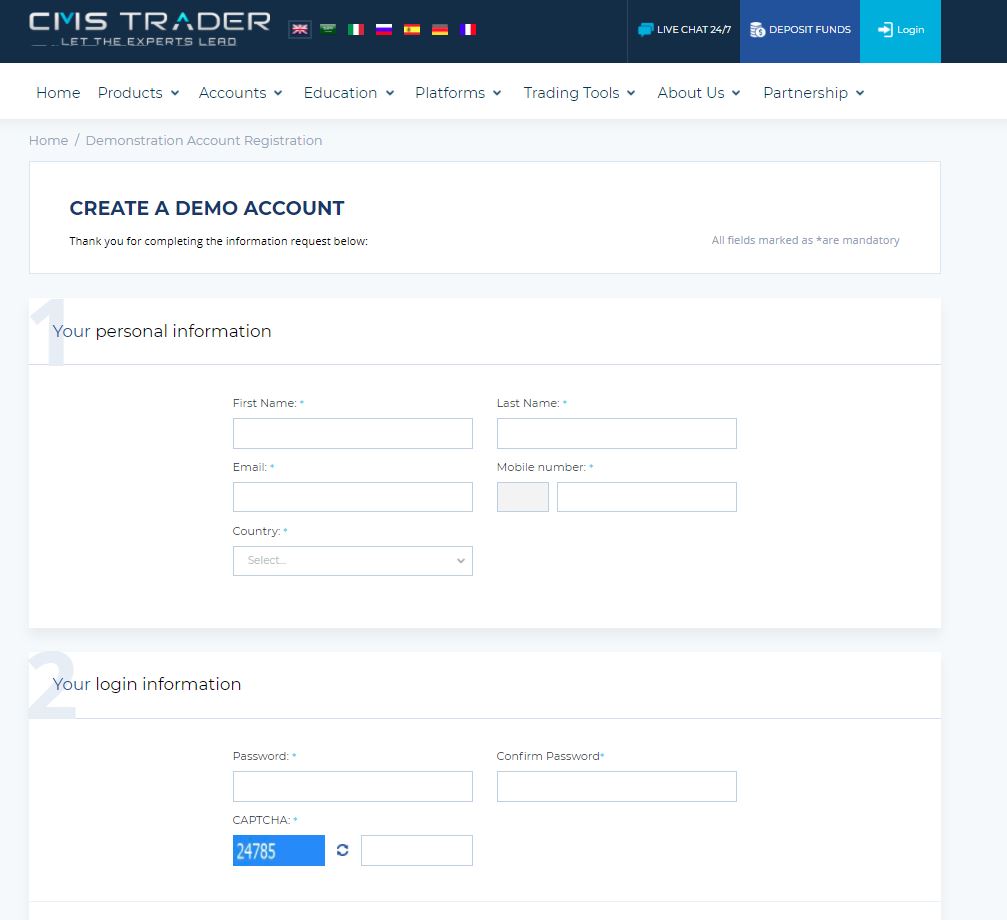

Creating a demo account with a forex broker is free,

and you will be able to trade with virtual funds without risking any money. The advantage of a demo account is that you can learn the basics before making a real money trade. Typically, a broker will have two versions: a desktop version and a mobile version. The desktop version is easier to navigate and will typically offer all of the same functions as the mobile app. A trading terminal that can be accessed via a web browser is compatible with most operating systems and browsers.

If you are new to the market, a forex demo account will give you the opportunity to try out trading strategies before committing to real-money investments. After you have gained some experience with the demo account, you should aim to move to a live account and apply the strategies you’ve developed there. Make sure you set short-term goals and stick to them if you want to make money from the forex market. Remember that practice makes perfect!

While a forex demo account is free, it’s not a good idea to invest your own money in it. There are too many risks, and you might end up losing your entire investment. You need to know that there is no “get-rich-quick” scheme in the forex market. You can use a demo account to test out different strategies before investing real money. And if you do not want to lose money, you can always open another one until your virtual funds are exhausted. This is the safest and most realistic way to learn the market and become a successful forex trader.

A forex demo account is ideal for a beginner to learn new strategies and habits. Once you learn to use a forex trading platform, you can test out your strategies and create your own trading strategy. You can even practice using fake money. You can even make trades with this virtual money. And when you learn to control your emotions, you’ll have more confidence in making the right moves in the market. Then, you can move on to a real account.

A forex demo account is an excellent way to gain confidence in your trading skills.

Since it’s a virtual account, you’ll be able to trade without any risk. It’s also important to practice market entry and exit. In a real-world situation, you may need to exit a trade and re-invest to make a profit. A forex demo account is a great way to practice risk management in the forex market.

A forex demo account will help you decide if you’d like to trade currency.

There’s no need to worry about making the wrong decision, as you can use the demo account to test your strategy. You can always come back to the real-world version later. Once you’ve decided, you can proceed to live trading. You can also practice your skills on your live trading account to learn the ins and outs of forex.

A forex demo account allows you to test out a broker’s services and trading strategies without any risk.

In addition to allowing you to test trading strategies, a demo account also lets you evaluate broker services. It is an excellent way to learn about a new broker and develop your own personal trading style. Once you’ve chosen a broker, you can start practicing in the real market. You’ll be glad you did! You’ll be surprised at the number of benefits that a forex demo account has to offer.

While a forex demo account can be a valuable tool for learning new trading strategies, it should also be used for practice. In addition to testing new techniques and strategies, a demo account should also enable you to brush up on your trading skills. While a demo account can be a helpful tool for developing your trading style, it should never be your primary source of income. In fact, a forex demo can be a great source of profits and knowledge.

Using a demo account is beneficial for a number of reasons. It gives you a chance to experiment with the different strategies and learn the differences between them. By utilizing a demo, you can get a feel for what works and what doesn’t. Often, a trading simulator is a great way to gauge your skills. The more experience you have, the better you’ll become at trading. It’s a great way to develop your forex skills.

Broker news

Trade Forex & Cryptocurrencies through CMSTrader.

Table of Contents

Trade Forex & Cryptocurrencies through CMSTrader.

The first crypto currency, called Bit-Gold, was created by Nick Szabo; and it was designed and based on an encrypted algorithm that draws its value from the numbers of transactions made on the asset.

That currency was not used or traded enough so it disappeared for a while – until on 2009, Satoshi Nakamoto, a computer programmer’s pseudonym, designed a better algorithm that draws the value from the entire cryptocurrency system collectively, making it an all-around secure asset.

Meaning, to hack the new algorithm, you would need to hack every server that contains the cryptocurrency around the world, which is virtually impossible. This has made Nakamoto’s asset safer than money in the bank- he called it Bitcoin.

Today, there are more than some 1000 different cryptocurrencies and the block chain technology that they are based on is being implemented in almost every bank around the world!

The idea behind cryptocurrencies is to put the power back in the public hands and loosen the banks’ grip on the financial world.

This of course makes the banks less then happy and governments around the world that are aware that they loose the hold on their financial control of their citizens are trying to implement creative ways to stop them.

But, even thou they keep on spreading news to undermine this development the idea spread like wildfire and some of the currencies jumped from few cents to thousands of dollars.

As cryptos are becoming slowly more mainstream the days of making a killing in just a few weeks are pretty well gone, but for those that rode that wave made enormous amounts of money and a ridiculous return of investment.

The moment this took of the cryptocurrency News site, and cryptocurrency exchange providers were popping up as mushrooms.

It seems as if this is the future and it is already here.

How do we know there is not a Cryptocurrency Bubble and everything will come crashing down ?

As you read before, the bitcoin is celebrating 10 years anniversary soon; and just in the last 10 months alone, more than 680 new cryptocurrencies based on the same technology were created.

Think about this , this is a huge amount of companies, developers applications and possibilities.

Add to that the fact that China is banning all cryptocurrencies from the country to keep control in the banks hands by what the finance world is calling “the purge” before the new Chinese crypto’s birth.

Long story short, now is the time and way to take control back from the banks and make money without anyone putting his hand in your pocket.

Trade Crypto currencies

You are able to trade a number of cryptocurrencies as you were and are able to trade regular currencies like the Us Dollar or the Euro. Those forex brokers that understood that there would be an interest in trading these cryptocurrencies entered this arena with their experience and knowledge and strted to provide this cryptocurrency trading experience to their clients.

One such Broker is CMSTrader

Trade Forex & Cryptocurrencies through CMSTrader.

Currency trading and learning Forex with CMSTrader

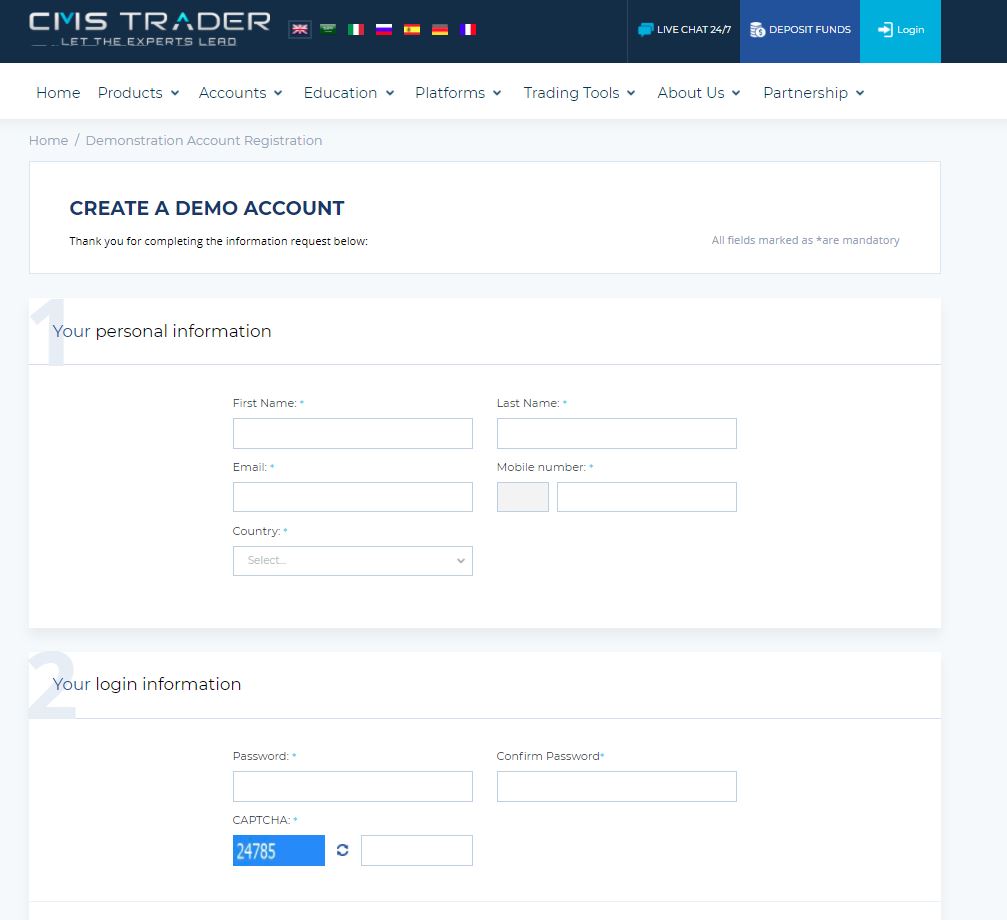

CMStrader has a full service demo account where you are able to practice and get to know their system .

we advice you to use it s it will show you everything you need to know about this broker.

the fact that they offer one of the best trading signals services in the industry is for new traders a bonus ., these signals in general are not for the demo account but you have a few signals that you can use there , this will also allow you to test these.

The Forex currency trading market is the largest financial market in the world, with trading volume up to 3.5 trillion dollars daily, covering the risks .

With CMSTrader, all traders with low, medium and large capital can participate and learn Forex in order to become better equipped to handle this massive online market that no one can control the prices or trading of, as seen in local markets. The only way to win in the Forex market is to play it intelligently.

Simply put, this is the global market used to earn profits and take control over one’s own financial situation without a boss telling them what to do, and due to their devotion to your best interests, risks do not stand a chance.

Now I do not think it is wise to take out your pension and start trading without you knowing what you are doing , like anything else you need to educate yourself. This broker offers the tools and support to do just that. At the same time they are in the market famous for their trading signals.

These Trading signals are suggesting you when to trade, what to trade when to get in and when to get out.

Which, believe me can be very helpful if you just enter this industry.

So, let me give you a rundown of the services they offer

Advantages of trading with CMSTrader:

- More than 132 currency pairs ( focus only on a few and know them well but you have here enough choice )

- You can execute deals with a single click in real time trading. (This saves time and makes it easy)

- Narrow points difference (fixed-variable-ICN), and competitive prices without commissions or hidden fees. (What you see is what you get, makes them trustworthy)

- Direct contact with a room

- The opportunity to change your fortune by earning profit 400 times the value of your account (1:400 leverage).

- Cash flow, execution with a single click, and flow up to a maximum of $ 20 million per deal.

- Daily news and information about the market.

- Access to Forex education resources, get a personal assistant who helps you with learning about the industry

In short this is a broker that will guide you into the industry and if you are already trading they will help you get more out of your activity.

Trade Crypto currencies through CMSTrader

Broker news

FX Broker ActivTrades Wins the “Le Fonti Forex Broker of the Year Award”

Leading Broker ActivTrades Wins Le Fonti Forex Broker of the Year Award for the Second Time

, one of the world’s leading online Forex Brokers, has won the Le Fonti Forex Broker of the Year Award for the second year running.

ActivTrades was awarded at the Le Fonti Awards (Photo: Business Wire)

A UK-regulated firm with offices in Europe and the Middle East, ActivTrades was selected as the winner by the editorial staff of over 120 journalists at Le Fonti, the international and independent media company and research center.

Le Fonti credited the broker for “aiming to maximize its clients’ trading through a unique mix of superior value proposition, diverse product offering and stellar customer service“. Le Fonti’s judges added that ActivTrades offers “some of the tightest spreads in the industry” and a “wide range of professional webinars

ActivTrades specializes in providing industry-leading trading services in Forex and Contracts for Difference.

As part of the company’s ongoing commitment to protect its global customer base, ActivTrades doubled its client insurance in September to £1 million, at no additional cost to the customer. This upgraded protection provides further assurances to clients with significantly larger investments.

Ricardo Evangelista, International Desk Manager at ActivTrades, said, “Our corporate values center on the needs of our clients and it is hugely satisfying to have our efforts recognized for the second year running

“In times of rapid industry changes, we pride ourselves on going the extra mile for our clients. Our global customer base of over 50,000 is increasing year-on-year and in the third quarter of 2017 we recorded nearly 20,000 active traders. This is a testament to our ability to meet the market’s expectations as well as our ongoing commitment to expand and add value to our services

A highly anticipated celebration uniting the world’s leading corporate stars, the Le Fonti Awards recognizes industry leaders in fields such as finance, banking, business, and insurance.

ABOUT ACTIVTRADES

ActivTrades is a leading independent broker providing online trading services in Forex, Contracts for Difference (CFDs) and Spread Betting, operating since 2001. From its headquarters in London and its offices in Milan, Sofia and Dubai, ActivTrades serves an expansive global clientele who, over the years, have come to value its continuous innovation, excellent trading environment and effective risk management.

ActivTrades’ award-winning customer service is available 24 hours a day, Sunday evening through to Friday, and assists clients in 14 languages via phone, email and live chat.

A number of globally recognized awards have confirmed ActivTrades’ high standards over the years in areas like customer service, client protection and trading execution. The firm was also included in the Sunday Times Profit Track 100 list in 2017 for its large profit growth.

All leveraged products carry a high degree of risk to your capital and are not suitable for all investors.

ActivTrades PLC is authorized and regulated by the Financial Conduct Authority, registration number 434413.

The ActivTrades Excess of FSCS Insurance is subject to the Terms and Conditions of the policy wording; eligibility to the Financial Services Compensation Scheme depends on the nature and status of the claim.

View source version on businesswire.com: http://www.businesswire.com/news/home/20171120005576/en/

Broker news

Donald Trump blasts ‘fools’ who oppose good Russian ties

US President-elect Donald Trump has posted a progression of tweets censuring the individuals who contradict great relations with Russia as “‘dumb’ individuals, or nitwits”.

Mr Trump promised to work with Russia “to comprehend a portion of the numerous… squeezing issues and issues of the WORLD!”

His remarks came after an insight report said Russia’s leader had attempted to help a Trump race triumph.

Mr Trump said Democrats were to be faulted for “gross carelessness” in permitting their servers to be hacked.

In a progression of tweets on Saturday, Mr Trump said that having a decent association with Russia was “no terrible thing” and that “lone “idiotic” individuals, or simpletons, would believe that it is awful!”

He included that Russia would regard the US increasingly when he was president

Broker news

Bulls and Bears Took on More Currency Exposure in Week Through January

he most striking improvement among theoretical situating toward the finish of a year ago and the primary session of 2017 is not that modification were little. There was just a single gross theoretical position modification of more than 10k contracts. With sterling apparently not able to maintain even humble upticks, the bears added 13.1k contracts to the gross short position, lifting it to 120.2k contracts.

Or maybe, it is eminent that examiners for the most part added to positions, long and short, as opposed to close positions at the very end of the year. Examiners added to net long outside cash prospects positions, aside from in the Japanese yen and Swiss franc where 2.6k and 2.5k contracts were exchanged separately. Examiners likewise added to gross short positions. Here there was just a single exemption, the Japanese yen. Despite the fact that the dollar shut comprehensively higher in front of the end of the week, every one of the monetary forms we track here, spare the Mexican peso, picked up against the dollar in the three sessions since the finish of the CFTC reporting period.

Every once in a while it is helpful to review why many market members take a gander at the theoretical situating in the cash fates advertise. It is not that the outside trade is essentially a prospects showcase. It is principally an over-the-counter market in which every day turnover midpoints in abundance of $5 trillion a day.

Trade exchanged monetary forms and alternatives represented around 3% of the normal day by day turnover as indicated by the BIS study. Be that as it may, past reviews have discovered some contemporaneous connection between’s market heading and net position changes. We think it additionally offers knowledge into a specific market section of pattern supporters and energy brokers. It is not by any means the only device, yet one of a few data sources.

One ramifications of this is albeit theoretical positions in the money fates market are moderately extensive, it is still little contrasted and the money showcase. Along these lines, it is difficult to see the genuine essentialness of a record vast position, as though there is some market top. At some point, examiners are not driving the costs, possibly there is another fragment, national banks, enterprises, as well as genuine cash that is more essential at any given minute.

We invest some energy taking a gander at gross positions instead of just net theoretical positions, which is the more customary approach. We think a more granular look is frequently fundamental. There is a distinction between short-covering, for instance, and new purchasing, however it appears to be identical in the net. Additionally, the gross position is the place the introduction is not the net position. A net position of zero does not mean the market is nonpartisan. Net positions could be huge, which implies a short press or a negative stun could in any case troublesome. The positions that must be balanced are captured in the gross measure not the net figure.

We find numerous customers are likewise keen on theoretical situating in the US Treasuries and oil. The net and gross short theoretical Treasury position has swelled to new records. The bears added 23.8k contracts to the as of now record net short position, lifting it to 616.2k contracts. The bulls attempted to pick a base and added about 20k contracts to the gross long position, which now remains at 471.2k contracts. These modification prompted to a 3.8k contract increment in the net short position to 344.9k contracts.

The bulls delayed in the oil prospects toward the finish of 2016. They exchanged short of what one thousand contracts, leaving 608.1k gross in length contracts. The bears added 4.1k contracts to the gross short position, giving them 168k. These conformities trimmed the net long position by very nearly 5k contracts to 440.1k.

Broker news

3 ways to profit in the ‘year of the dollar’

In December, the Federal Reserve raised loan fees for the second time since the Great Recession and included the desire of a 2017 financing cost climb to its gauge. Furthermore, only a couple days prior, the abundantly anticipated minutes from the most recent Fed meeting demonstrated the most hawkish tone from the national bank in two years.

In the meantime, Europe has been dove into political turmoil after a year ago’s Brexit vote and the later abdication of Italy’s leader. Somewhere else, the Bank of Japan proceeds down the way of negative rates and forceful security purchasing.

Put it all together, and it isn’t astounding that the U.S. Dollar Index is up against 14-year highs.

Speculators may have missed so much discussion on account of babble about the Dow Jones Industrial Average at the end of the day almost hitting 20,000. Be that as it may, paying little respect to your assignment to stocks or your venture skyline, this sort of huge picture incline in the dollar implies right now is an ideal opportunity to position your portfolio to benefit and, maybe most critical, to keep away from a portion of the pitfalls that can originate from a solid local cash.

Here are a couple ideas dollar exchanges ought to consider:

Residential plays over multinationals

There’s a considerable measure of seek after shopper stocks in 2017 on account of an enhancing work market and any desires for a jolt under a GOP-controlled Congress and President Donald Trump. In any case, remember that not all retailers are made equivalent especially those with abroad operations that are adversely affected by the wide dissimilarity in monetary standards at this moment.

For example, retailer Wal-Mart Stores Inc.(WMT) said troublesome money trade rates shaved very nearly 2.5% off profit for each partake in the second quarter of 2016. On the other hand consider that in the monetary final quarter of 2016, athletic attire goliath Nike Inc.(NKE) saw its income development cut down the middle because of forex weights, from 12% year-over-year in consistent cash measures to only 6% including real money changes.

To take advantage of the “reflation” exchange that numerous financial specialists are counts on in 2017, you need to represent the headwinds that a solid dollar are making for multinationals at this moment. The most ideal approach to do that is to consider customer plays that do by far most of their business here in the U.S. – for example, Foot Locker Inc.(FL), which has been an uncommon splendid spot in retail throughout the most recent couple of years.

Supported money ETFs

Obviously, in the event that you need a steady portfolio, you can’t just purchase just local centered values. Geographic expansion is similarly as imperative as enhancement crosswise over parts and resource classes. Such a large number of financial specialists keep on holding worldwide plays in light of a legitimate concern for a balanced portfolio, regardless of the possibility that it implies battling a daunting struggle as a result of a solid dollar.

The uplifting news, notwithstanding, is that you don’t need to leave yourself to torment through a solid dollar and a powerless euro when you put resources into Europe. Nor do you need to stress over the yen-dollar conversion standard when you put resources into Japan. That is on account of there’s an entire group of cash supported ETFs to permit financial specialists to put their cash in outside business sectors yet keep away from forex issues.

Consider that Japan’s Nikkei 225 file is up around 25% from its July 2016 lows. The WisdomTree Japan Hedged Equity Fund(DXJ) is up 35% in a similar period on account of assurance from forex issues and a somewhat better-performing rundown of stocks – while the non-supported iShares MSCI Japan ETF(EWJ) is up only 10% in a similar period because of battling a difficult task against a solid dollar.

In the event that you need to differentiate your portfolio comprehensively, you ought to consider supported assets that incorporate the Japan-centered DXJ, the WisdomTree Europe Hedged Equity Fund(HEDJ) to play Europe or the iShares money Hedged MSCI EAFE ETF (HEFA) for developing markets.

Dollar list ETF

In the event that you are searching for an immediate play on a rising dollar as opposed to putting resources into stocks, figuring out how to exchange remote trade can appear like an overwhelming undertaking. Gratefully, there’s the PowerShares DB US Dollar Index Bullish Fund(UUP).

This ETF is attached to the U.S. Dollar Index, which is a measure of the greenback against a wicker container of other worldwide monetary standards including the yen and the euro. It’s a straight money play, however that doesn’t make it straightforward or hazard free. In the event that the dollar debilitates, you’ll lose cash similarly as though you’re putting resources into a stock that has fallen on difficult circumstances. Furthermore, obviously, PowerShares takes a little cut of your speculations en route that indicates 0.8% yearly, or $80 a year on each $10,000 contributed.

Still, in the event that you need to conjecture on the dollar or support against a solid U.S. cash keeping down other worldwide ventures on your rundown, it’s maybe the least demanding approach to do as such for generally financial specialists.

Broker news

Vanguard Overtakes PIMCO in Bond ETF World

Vanguard Overtakes PIMCO in Bond ETF World

After leading the bond market for the past several years, PIMCO finally lost its position as the world’s largest bond mutual fund provider to Vanguard. This is primarily thanks to the departure of Bill Gross last year that led to massive outflows from PIMCO funds.

According to the reports, investors shed $5.6 billion from the PIMCO Total Return ETF (NYSEARCA:BOND) in April, following $7.3 billion in March and $8.6 billion in February. The withdrawals pulled down the total AUM to $110.4 billion at the end of April. This is much below the Vanguard Total Bond Market ETF (NYSEARCA:BND), which had total AUM of $117.3 billion as of April 30. In fact, the ultra-popular PIMCO Total Return ETF now has just nearly $2.7 billion in AUM.

Beyond PIMCO’s downfall, the success of Vanguard could be traced to its low-cost products and commission-free trades. The expense ratio of Vanguard products is 76% less than the industry average. Further, the growing appeal of the passively managed fund that tracks the indices or other benchmarks has helped Vanguard to become the largest mutual bond fund provider in the world. Earlier in the year, Vanguard overtook Boston-based State Street Global Advisors to become the second-largest ETF sponsor.

That being said, we have taken a closer look at some of Vanguard’s largest bond funds for investors seeking to take advantage of the index-based strategy. Investors should note that about one-fourth of Vanguard’s total asset base came from the ultra-popular Vanguard Total Bond Market ETF, followed by $15.9 billion in the Vanguard Short-Term Bond ETF(NYSEARCA:BSV) and $9.9 billion in the Vanguard Short-Term Corporate Bond Index ETF (NASDAQ:VCSH).

BND in Focus

This fund provides exposure to various corners of the bond market by tracking the Barclays Capital U.S. Aggregate Float Adjusted Index. It holds a large basket of 7,477 securities with effective maturity of 7.80 years and average duration of 5.60 years. From a bond type look, federal debt accounts for about 47% of the portfolio, while corporates and collateralized securities account for the rest (see: all the Total Bond market ETFs here)

Broker news

How to choose your Forex Broker

As if there wasn’t already enough to learn when trading forex, the forex broker you choose is actually the biggest trade you’ll ever make. You’re giving all your trading capital to that company, with the expectation that you’ll be able to trade with it and withdraw it when it’s time to take your profits.

You may have great forex strategies, but if your broker runs off with your money, all your hard work and research was for nothing. Follow these five in-depth tips on how to find a great forex broker, so you end up with the right broker that meets your needs, without exposing you to any scams.

Table of Contents

Before looking at brokers, assess your own needs. Here are some things to consider:

- Are you going to day trade a lot or a little?

- Trade very small moves, or capture bigger moves?

- If you day trade a whole lot and catch small moves, consider an ECN broker. You’ll pay a commission on trades but the spreads are much tighter, which matters when trading small moves. Search only for “ECN Forex Brokers.”

If you don’t think you’ll need an ECN broker, then you still have a big pool of potential brokers left like Galore pro.

If you’re going to do “scalp” trading, you will need an ECN broker.

How much capital do you have? With a small amount of capital, you have to trade micro-lots. If you have over $5,000 you can start day trading mini lots. Don’t open a standard lot account unless you have at least $50,000.

Choose a broker and account type (lot size) that matches your capital.

When it comes to depositing and withdrawing funds from your account, different brokers offer various methods. Select a broker that aligns together with your needs

What the Broker Should Offer

Now that you know what you want, and have hopefully narrowed the list of potential brokers, look for the following in the agents you’re still considering.

No “dealing desk.” If you’re a day trader you want to be interacting directly with the market, and not sending your order to a trading table which then initiates it in the market. That takes too much time, and often results in “re-quotes.” This is when the price has changed since you placed your purchase, and the broker asks you if you wish to proceed. Because of the time delay, your trade opportunity is likely gone.

Make sure your broker is regulated in a country with a well established financial system. A brokerage regulated in Cyprus, for example, is better than no regulation, but you could still have problems. Pick brokers regulated by U.S., U.K., Canadian, Japanese, New Zealand or Australian authorities, as examples.

You’re a day investor, so demand competitive spreads. For example, if day trading the EUR/USD during a major session expects the spread to be close to one pip (point in percentage) with a non-ECN accounts. Two pips are too high; eliminate that broker as an option. With an ECN account, the spread should be half a pip or less during major sessions.

Look for a broker that’s available when you need them. Open a demo accounts with agents you are interested in, then send them lots of emails with questions. Monitor how fast and how thoroughly they respond. If the customer service isn’t good, get rid of that broker from the set of your potentials.

Be Wary of “Losing Trader” Reviews

Part of your research in choosing a broker should be looking at written reviews of the broker as well as discussion forums.

Be wary of these though. Unless the information comes from a credible source, and most forums are not credible sources, you’re likely to find fake evaluations, both positive and negative.

Most day traders will lose money, and since most investors can’t admit that to themselves, they blame others when it happens to them. Just because someone complains about losing money doesn’t make the broker they were using bad, even though the writer may blame the broker.

Look up what people are saying, but maintain objectivity. Lots of false information gets published with no credible reference.

Personally Test out the Broker

Your list of potential brokers ought to be smaller now. But with therefore much false info out there, don’t make a decision yet. Instead, test out the brokers you are most interested in.

First, open up a demo account and take note of the trading conditions. Your orders should execute instantly. Spreads should be tight and the platform stable, not crashing all the time.

If the demo works well for several weeks, then open a live account, with a fraction of the capital you intend to deposit. For example, if you have $10,000 to deposit, start by only putting in $1,000.

Trade the live accounts with your partial deposit for at least two weeks. During this period, continue to test customer support, asking them queries and assessing how quickly they react.

Initiate a withdrawal for some of the funds in your account. Depending on your withdrawal method, this may cost you several dollars, but it’s worth it to know whether withdrawals can be done easily.

If everything seems good after all this, you’ve done your due diligence. Deposit the rest of your capital and begin trading as usual.

Videos Of interest4 years ago

Videos Of interest4 years agoLesson 2 – Pair characteristics (the majors and the crosses), Understanding Forex Pairs

Videos Of interest4 years ago

Videos Of interest4 years agoLesson 3 – Introduction to charting

Videos Of interest4 years ago

Videos Of interest4 years agoLesson 1 – What is Forex and how does It work

Videos Of interest4 years ago

Videos Of interest4 years agoWhat is Price Action Trading and How to Use it

Videos Of interest4 years ago

Videos Of interest4 years agoHow to Recognize False Breakouts

Broker Reviews4 years ago

Broker Reviews4 years agoNSFX Demo Account Review | 2018 Must Read |

Broker Reviews2 years ago

Broker Reviews2 years agoStockscale io Review – Demo Account – top 100 Broker ?

Broker news4 years ago

Broker news4 years agoFX Broker ActivTrades Wins the “Le Fonti Forex Broker of the Year Award”

Videos Of interest4 years ago

Videos Of interest4 years ago4 Things to Always Do Before You Start Trading

Broker Reviews2 years ago

Broker Reviews2 years agoTrade.com Demo Account Review | Must Read |