German start-up ready to completely change the cannabis industry!

According to the white paper from Juicy Fields, or as they call it, “Greenpaper,” “the global cannabis market will be …

Plus500 is an all-round solution for traders. The platform allows trading CFDs on over 2,000 different assets. Plus500 is an established name and one of the largest brokers in the market. The company was founded in 2008 and is seated in London. Plus500 is regulated and authorized by the UK Financial Conduct Authority (FCA). Additionally,…

Plus500 is an all-round solution for traders. The platform allows trading CFDs on over 2,000 different assets.

Table of Contents

Plus500 is an established name and one of the largest brokers in the market. The company was founded in 2008 and is seated in London. Plus500 is regulated and authorized by the UK Financial Conduct Authority (FCA). Additionally, Plus500 has a seat in Cyprus and is regulated there by the CySEC (Cyprus Security and Exchange Commission). By operating in these legal spaces, Plus500 is subject to high requirements that guarantee the protection of users. Plus500 also has branches in countries outside of Europe.

Plus500 has a very simple user interface and managing the platform can be learned quickly and intuitively. To trade with real money, verification is required with a photo ID. As soon as this is done, you can start.

There are several ways to make deposits on Plus500. Specifically, it is possible to make deposits with a credit card, bank transfer, SOFORT-Überweiseung, Ideal, PayPal, Skrill, Trustly, Multibanco, MyBank, Bpay, and Przelewy24. The minimum deposit required is € 100 like most other brokers.

A big advantage of Plus500 is the multiple languages supported on the platform. It is available in more than 50 countries and over 30 languages.

>>Click here for the Plus500 website<<

76,4 % of small investors lose their money

In this example, we want to take a look at the currently hot Tesla share. To do this, simply enter the name in the search field. After clicking it, a window with the data opens on the right. We can buy the stock or we can also short sell it. The important thing to remember here is: You are never the owner of the underlying asset, in this case the Tesla share. The CFDs only show the price development of the underlying asset and you participate in profits and losses. The rights normally given shareholders (Tesla in this case) are not applicable here.

Plus500 offers the most common options when setting up a trade. The two options “Close at Profit Order” (Stop limit order) and “Close at Loss Order” (Stop Loss Order). “Guaranteed Stop Order” represents the lowest risk of loss. “Trailing Stop Order” is a trailing stop loss. You enter the difference in pips (1 pip = $0.1 so $15 = 150 pips), then the mark indicating the stop loss will be trailing the current price by as much when the price develops in your facor. Let’s consider for example a Trailing Stop Order of 150 pips when buying Tesla shares at a price of $2,000. The share moves up to $2,017. $2,017-$15=$2,002. If the price now drops to $2,002 the position will be closed. If the price further rises to $2,040, the stop loss will follow it to $2,025.

Plus500 offers charting for each trading pair via the web interface for analyzing past and current price developments. There is also a large selection of indicators for professional traders. In addition to the web interface, there is a trading software for Windows (Windows 10 Trader) and for mobile phones. With the Android or iPhone app, you can keep an eye on your trades around the clock.

The leverage at Plus500 is different for each trading pair and goes up to a maximum of 1:30.

Plus500 has CFDs on over 2,000 assets in its range, covering the asset classes stocks, commodities, precious metals, cryptocurrencies, and indices. Trading pairs for cryptocurrencies are: BTC/USD, BTC/ETH, ETH/USD, Krypto 10-Index/USD (maps the 10 largest cryptocurrencies by market capitalization), LTC/USD, NEO/USD, XRP/USD, IOTA/USD, XLM/USD, EOS/USD, BCH/USD, ADA/USD, TRX/USD and XMR/USD.

Of course, every company lives off of a well functioning business model. Plus500 takes no fees, but instead makes profit from the spread, i.e. the difference between the bid and ask prices, and through margin. With margin, Plus500 lends the trader capital to leverage his position.

Until he returns this capital, he pays interest. The user can see these individual so-called “swap fees” in the information on the respective trading pair (overnight funding). Plus500 does not charge any account management fees or other commissions. Inactivity fees are also low at $10 after 3 months of inactivity. In other words, Plus500 is on the cheaper side with its fees.

The Plus500 demo account is especially interesting for new traders. It offers the possibility to learn about trading and the platform with no risk. No identification is required for demo accounts.

>> Here you can set up a demo account on Plus500 <<

76,4 % of small investors lose their money

When speculating making profits isn’t guaranteed. Unfortunately, most people lose money when trading CFDs. At Plus500, 76.4% of retail investor accounts lose money when trading CFDs. Therefore, one should always consider whether one can afford to take a high risk and lose money.

Plus500 is an all-rounder for traders who only want to bet on price developments. The platform is easy to learn and with just a few mouse clicks you can access a wide range of assets. Plus500 is subject to high regulatory requirements and is considered safe.

The fees are relatively low and there is always a risk when speculating. With the demo account, it is possible to visualize risks and test strategies without risking money. All in all, Plus500 is a front runner also when compared to other platforms of its type.

>> Click here to go to Plus500’s website <<

76,4 % of small investors lose their money

In order to support and motivate the CryptoTicker team, especially in times of Corona, to continue to deliver good content, we would like to ask you to donate a small amount. Independent journalism can only survive if we stick together as a society. Thank you

Instant Crypto Credit Lines™ from only 5.9% APR. Earn up to 8% interest per year on your Stablecoins, USD, EUR & GBP. $100 million custodial insurance.

Ad

This post may contain promotional links that help us fund the site. When you click on the links, we receive a commission – but the prices do not change for you! 🙂

Disclaimer: The authors of this website may have invested in crypto currencies themselves. They are not financial advisors and only express their opinions. Anyone considering investing in crypto currencies should be well informed about these high-risk assets.

Trading with financial products, especially with CFDs involves a high level of risk and is therefore not suitable for security-conscious investors. CFDs are complex instruments and carry a high risk of losing money quickly through leverage. Be aware that most private Investors lose money, if they decide to trade CFDs. Any type of trading and speculation in financial products that can produce an unusually high return is also associated with increased risk to lose money. Note that past gains are no guarantee of positive results in the future.

According to the white paper from Juicy Fields, or as they call it, “Greenpaper,” “the global cannabis market will be …

The Fairspin blockchain casino is the first online casino to combine classic gambling and blockchain. With the integration of the …

The coronavirus epidemic has greatly impacted our day to day lives, prompting a mass transition to the online format. Blockchain …

Table of Contents

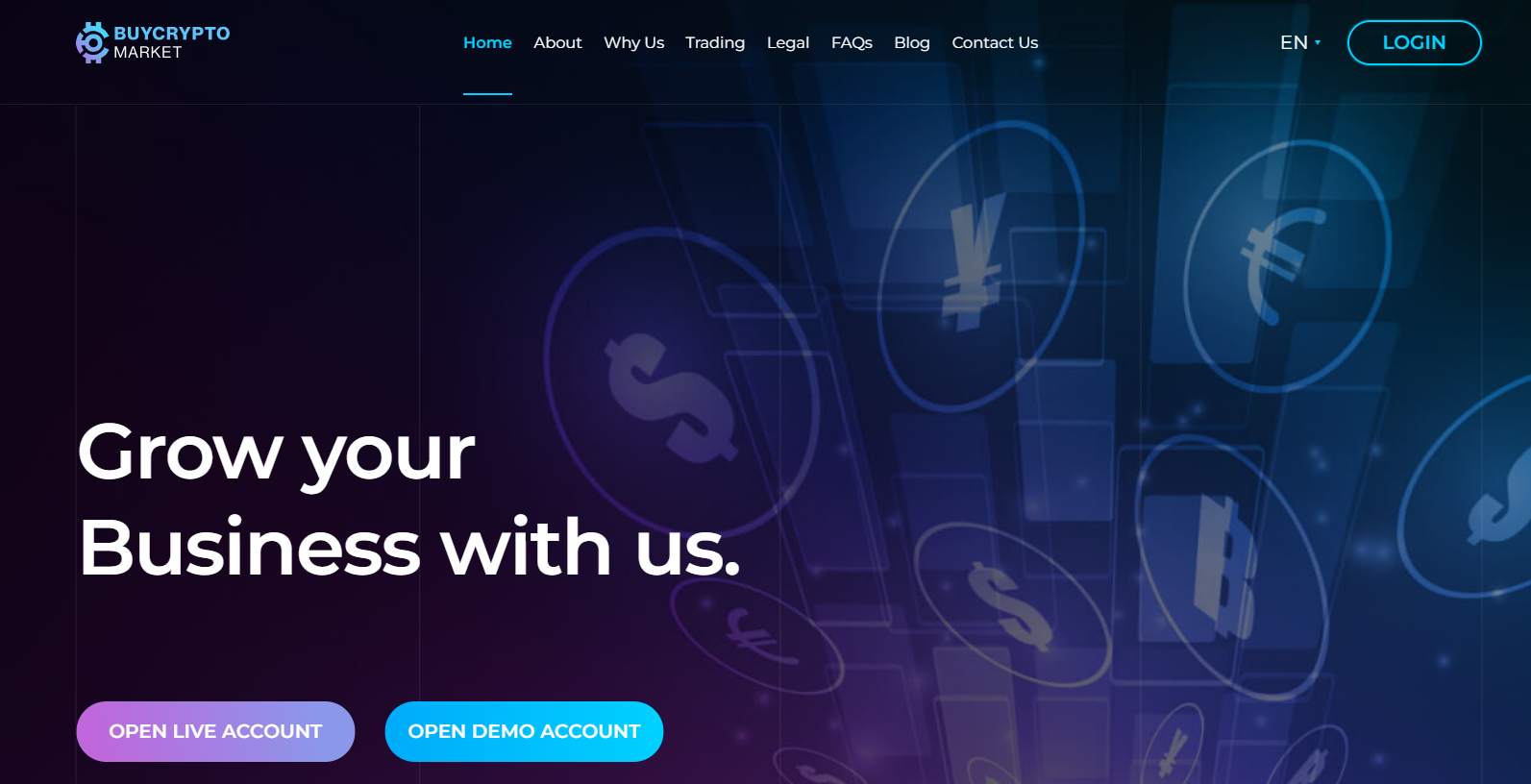

buycryptomarkets is a global forex and CFD broker with trading platforms that is suitable and fully functional for all devices.

This is a good option for all levels of traders, although the product portfolio is average, and there is an inactivity fee to be aware of.

Initially formulated in 2023 to provide a robust forex trading platform, buycryptomarkets offers to include CFDs, indices, shares, commodities, and cryptocurrencies.

buycryptomarkets has several trading tools and features designed to make your trading experience as smooth as possible. The trading platform has been heralded as a simple and convenient platform without losing the functionality you would find at MetaTrader 4. Some education is also available through the trading platform, and highly responsive customer service is available 24 hours a day.

Please read my full buycryptomarkets review for further details of this forex broker so you can decide whether buycryptomarkets can meet your needs.

buycryptomarkets is a global forex, spread betting, and CFD online broker. buycryptomarkets is an online Crypto and Forex Broker providing traders across the globe with cutting-edge technology to trade the world’s markets. In a continuous effort to give their traders a more comfortable and safe trading experience, their experts have been improving their service and solutions ensuring traders have the freedom to trade whenever and wherever they like.

The product range at buycryptomarkets is average compared to other brokers. They offer a solid selection of currency pairs and CFDs, no futures CFDs, and an average number of commodity and stock index CFDs. additionally, they do offer leverage trading on the main cryptocurrencies.

Forex trading

More than 50 Forex pairs are available at buycryptomarkets with no commission and some of the tightest spreads in the industry.

Indices and Financial Trading

Indices and financial CFDs have flexible margin requirements and low spreads, representing some of the industry’s best spreads. There are no overnight or hidden fees of any description to worry about.

Commodities Trading

At buycryptomarkets, there are several commodity CFDs, including metals and energies.

Share CFDs Trading

Trade more than 100 company shares without ever owning the underlying security. At buycryptomarkets, you can access global stock exchanges with the option to go long and short and benefit from leverage. For non-leverage trading, there is zero commission.

There are a few trading account options at buycryptomarkets. there is not a lot of info concerning this till you are actually in the registration process.

the only thing you should know is that the minimum deposit for opening an account is only $250.

No matter your trading exposure, you deserve an opportunity to trade in CFDs. With access to multiple trading account types, you can choose the right account for yourself and start performing trades in multiple CFDs.

The more experience you gain in the online trading market, the higher trading account you can adopt to trade in more challenging environments. If you are a beginner, start by making a minimum deposit of $250 to trade with a basic account.

The web platform allows you to place trades directly from your web browser in an easy-to-use interface that is customisable and available in several languages. The web trading platform falls short because of its lack of social trading; however, it is well-designed with several useful features.

There is a two-step login for additional security, and you can search for an asset using its name or by category. Order types include:

I was impressed with both the portfolio and fee reports which were comprehensive and easy to use, with clear information on commission, swap fees, and performance.

There are also the following useful features available on the trading platform:

Trailing stop

Trailing the position of a current price can then trigger a stop order as the price reaches a predetermined distance from a stop order. It works similarly to a stop order but in a more controlled way that aligns with movements in the market.

Market Sentiment

This allows you to closely monitor movements in the market using data from other traders concerning a specific instrument.

This allows you to mitigate risks by investing in the same product in a different direction.

Charts

Real-time charts provide up-to-the-moment information, including historical trends, forecasts, and current trends.

The mobile trading platform is in keeping with the web trading platform, with much of the same functionality.

The actual design is well laid out and easy to use with customizability. I found the mobile app fast with personalised watch lists and the ability to open positions directly from real-time charts.

There are price alerts that include statistical alerts, which can be monthly or yearly for currency pairs, indices, etc. Clicking on the alert will automatically open the app on the instrument.

Customer service is excellent at buycryptomarkets, with immediate response times across multiple channels.

There are several channels for contacting customer support, including phone and email. When I tested their service, my query was dealt with immediately without even the intervention of a chatbot. The service provided via email and phone was similar, with fast, relevant responses to my queries. Customer service is provided 24/5, which is above average.

The account opening process is straightforward, fully digital and quick. You will need your ID.

To open your account, you should first decide on the account type you wish to open

Then you can follow these quick and easy steps:

Deposits and withdrawals and essentially free, and the minimum deposit is high compared to what you would find at other brokers.

Before making your first deposit, you will need to choose between the following base currencies:

EUR, USD, GBP

Deposit options include:

The minimum deposit is $5000, which is higher than other brokers. There are no fees should you choose to deposit via bank transfer from your bank account.

Bank transfers take several business days.

Withdrawals can be made using the same methods accepted for deposits, and there are no withdrawal fees for electronic wallets and credit/debit cards.

buycryptomarkets is not regulated by the Financial Conduct Authority (FCA) but is performing full due diligence to comply with AML regulations.

In addition, all client funds are held in segregated bank accounts to protect those funds should buycryptomarkets go bust.

The buycryptomarkets negative balance protection protects client funds should their balance go negative.

buycryptomarkets has low CFD and forex fees and average non-trading fees.

Fees can be separated into two main categories for a CFD and forex broker: trading and non-trading fees.

The trading fees will vary depending on the financial instruments you are trading within each asset class. Trading fees can be charged as a spread, a commission, or a financing rate.

Spreads differ between the bid and ask price for a foreign currency price. Here’s how buycryptomarkets spreads compare against some other forex brokers:

buycryptomarkets has low non-trading fees as they do not charge deposit and withdrawal fees, and there is no account fee.

Inactivity fees are charged. There are inactivity fees to be aware of. However, these will only kick in once your account has been inactive for several months and you have a positive balance.

buycryptomarkets is suitable for all levels of traders looking for a solid trading platform and very competitive spreads.

The selection of account types is aimed at both retail and professional investors.

There is a very high degree of risk involved in trading securities. Concerning margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to leverage, creditworthiness, limited regulatory protection, and market volatility that may substantially affect the price or liquidity of a currency or related instrument. It should not be assumed that these products’ methods, techniques, or indicators will be profitable or will not result in losses.

Table of Contents

Let us start from the beginning. People should remember that Exallt offers many investment tools in the capital markets. Creating a portfolio with cryptocurrencies, stocks, commodities, ETFs, and more is possible.

It is a new brokerage that has just opened its door. That said, Exallt Live can offer exemplary services and products.

To get more details, proceed with Exallt review. The next sections will provide a detailed professional analysis of the broker and its offerings.

| Broker Name: | Exallt |

| Broker Type: | CFD broker |

| Operating since year: | 2023 |

| Regulation: | Only KYC/AML |

| Broker status: | Independent Broker |

| Customer Service | |

| Phone: | +44 2086382873 |

| Email: | [email protected] |

| Languages: | English, Spanish |

| Availability: | phone, email, Social Media |

| Trading | |

| Trading platforms: | Desktop, Mobile and Webtrader |

| The Trading platform Time zone: | |

| Demo account: | Yes |

| Mobile trading: | yes |

| Web-based trading: | yes |

| Bonuses: | yes |

| Other trading instruments: | Forex, CFD, crypto, commodities, indices, stocks |

| Account | |

| Minimum deposit ($): | $5000 |

| Maximal leverage: | 1:400 |

Explore top commodities, trade what you want, when you want.

Explore trending commodities such as gold, silver, oil, and others, use innovative tools and make informed trading decisions at Exallt. Benefit from advanced charting and analysis as well as ultra-fast transaction processing. Exallt delivers a trading environment that helps investors to grow.

Interestingly, it is possible to trade different types of commodities. For example, oil and natural gas. Moreover, precious metals such as gold and silver.

Forex trading is made simple by Exallt.

Forex is the most traded market in the world. It is a decentralised global market for the trading of currencies. The most popular FX pairs involve major international currencies and experience the highest trading volumes and liquidity. This market determines foreign exchange rates for every currency.

Expand your trading opportunities. Trade the most popular indices at Exallt!

Indices are another in-demand trading asset. An index measures the performance of a group of stocks, bonds, or other assets. By trading indices, you can gain exposure to a wide range of assets without buying them individually. Most index trading is done with financial derivatives like CFDs. This makes it an ideal way to diversify your portfolio and manage risk.

Trade stocks at Exallt.

Exallt is about making stock trading easier. Get real-time access to stocks from top exchanges of the world. Diversify your portfolio with a large variety of leading global stocks. Stock trading ensures two ways of earnings: through capital appreciation or dividend payments. This market features the potential for the highest returns.

Exalt – the easiest and the most secure way to trade cryptocurrencies.

If you can time the market right, trading cryptocurrencies gives you much higher returns than traditional investments. It minimizes risk as you speculate on the rise and fall of the market without owning the asset. Being decentralised, cryptocurrencies allow for more freedom in trading, as there are no restrictions on how much can be traded or how often.

It is hard not to mention its platform. Hopefully, it is quite easy to use the platform.

As a reminder, trading is simple. The first step is to select an asset. All users have to do is click on the “asset” tab on the platform. They need to choose a preferred asset from the extensive tradable asset selection offered by the firm.

The next step is deciding on the amount a trader wants to invest in any trade. Unsurprisingly, the higher the investment, the higher the potential rewards.

Moreover, deciding whether to go short or long on their preferred asset is important. Advanced charts, graphical trading tools, technical indicators, and live analysis help to make an informed decision on probable future price movements.

It is important to remember about risk factors. When a trade position opens, customers should protect their positions from market risks. Customers should use Stop Loss and Take Profit orders. Thanks to Stop Loss orders, it is possible to reduce potential losses. Moreover, Take Profit orders allows users to lock in their profits.

Users should remember that Stop Loss and Take Profit orders will automatically close their positions when triggered.

Hopefully, Exallt Live offers interesting information. It is desirable to read every chapter of the guide. Moreover, people will find this guide brimming with information for their financial education. Furthermore, Exallt ’s goal is to educate investors and bring transparent investing to anyone who wants it, not just the elite.

RISK MANAGEMENT

Exallt continually detects, assesses, monitors, and controls each risk associated with platform users’ trading transactions, operations, and actions. This means that they continuously evaluate the effectiveness and compliance of the policies, approaches, and procedures. Such a system approach allows Exallt to cover its financial needs and capital requirements quickly.

SEGREGATED ACCOUNTS

Exallt is incredibly proud of ensuring the ultimate protection of clients’ funds. They apply a model that keeps our clients’ funds separate from the company funds. In the unlikely event that Exallt would ever enter liquidation, the clients’ funds are wholly segregated off the balance sheet and cannot be used to cover the company’s debts and pay back creditors.

REACHING THE TOP EU BANKING INSTITUTIONS

Exallt attentively chooses the financial services to partner with. Exalt needs additional facilities to support and conduct transactions. They partnered with payment service providers to work with numerous banks worldwide, including central tier-one banks such as Barclays, HSBC & Deutsche Bank. Rest assured, the security of Clients’ funds, alongside Execution and Customer support, forms the essential focus of Exallt’s activity.

As can be seen from the review of Exallt , it makes sense to cooperate with this firm. . Moreover, its website provides many interesting details, and it is desirable to have a look through their website to see how well Exallt suits you.

We strongly hope that this Exallt review will give you accurate information about the broker enabling you to make the right decision of choosing this broker.

Trading 212 Trading 212 deals View Similar Amazon US Trading 212 is a London-based brokerage platform that aims to democratize trading by making it accessible to the masses. Founded in 2006, Trading 212 allows users to trade in a variety of assets including Forex and currencies, gold, commodities, crypto, and stocks, etc.

Trading 212 is a London-based brokerage platform that aims to democratize trading by making it accessible to the masses. Founded in 2006, Trading 212 allows users to trade in a variety of assets including Forex and currencies, gold, commodities, crypto, and stocks, etc.

Trading 212 got the license to operate in the UK in 2013 and is approved by the FCA (Financial Conduct Authority of England and Wales). It has a freemium model offering the basic services without any charge hoping that the users opt for other paid services or transact on the CFD area of the platform.

As a user, you can use their web-based trading suite or download the application on your computer. There is even a mobile app available for both iOS and Android phones, in case you want to transact on the go.

Table of Contents

Trading 212 offers an easy DIY platform and allows over 1,800 instruments to trade, offering enough options to traders to decide where and how they want to invest their money. These instruments include major cryptocurrencies like Bitcoin, Ripple, LiteCoin, Ethereum, Monero, EOS, Dash, Neo and more. Traditional assets like stocks, commodities and indices can also be traded on the platform. The diverse list of assets and choices available to trade on the platform should be attractive to many users.

For first-timers, Trading 212 offers a demo account which lets you try out the platform and perform test transactions without registration. This demo account gives you a real-time experience of how the platform works on your computer and mobile applications. In case you decide to sign up, you do need to provide some official documents to verify your identity and address. These documents include:

These are simply standard requirements as part of anti-money laundering legislation.

There is a set of questions which you need to answer for the company to understand your experience level as a trader. Trading 212 might reject your application on sign up, if the firm feels that it might be too risky for you to transact on such a platform. The entire signup process may take a good 10-15 minutes, so keep that much time handy.

Trading 212 offers you three different types of account: Trading 212 Invest, Trading 212 CFD and Trading 212 ISA.

Trading 212 Invest is best suited for traders who like to invest and trade in equities. However, the platform does not allow short-selling of equities, so in case you’re only interested in this type of trading then Trading 212 is not the right platform for you. Trading 212 ISA is only for UK-based traders who want to benefit from tax-free trading up to a certain amount, while Trading 212 CFD is open for all international traders.

In terms of deposit and withdrawal options, Trading 212 offers multiple choices like bank transfers, credit and debit card payments, Skrill, PayPal, Dotpay, Giropay, and Direct eBanking. Note that it only accepts payments in currencies like GBP, EUR and USD.

The web platform is very easy to use and it offers an organized layout. On the extreme left, you have the instruments you follow by adding them to your watch-list. All your pending orders or previous purchases show right next to the watch-list. In case you want to modify your transaction after looking at the live trends, this can be done here as well.

The center part of the screen displays a detailed graph of any instrument that you want to follow. Useful tips and videos can be found on the bar on the right side. Various reports can be found grouped right under the login section.

The Trading 212 mobile application is also fairly easy to use and shows information in an easy to understand graphical format. Simple swipe gestures help you switch between different sections and instruments. You can set price alerts, access forum, reports, or training videos right from the menu. There is a demo account available for the mobile app too that allows you to transact in all the instruments.

Trading 212 is one of the few platforms that does not charge you for transactions and is transparent about the costs applicable with paid-for services. While withdrawing funds, there is a fee applicable on the wire transfers. Third-party transfer fees may also be levied, if applicable. The platform wants you to remain active and charges you for inactivity, if inactive for over 180 days consecutively.

Customer support is one of the most important features of any trading platform. Support is available by calling in, email or even through the contact page on the site. The website also has a live chat option in case you want to chat with a representative.

Trading 212 offers support in a wide range of languages including English, German, Dutch, Spanish, French, Italian, Polish, Serbian, Norwegian, Swedish, Czech, Russian, Romanian, Turkish, Arabic, and Chinese.

Trading 212 is a trusted broker registered in England and Wales, and is authorized by the Financial Conduct Authority (FCA). It is also registered in Bulgaria and is regulated by the local Financial Supervision Commission.

The company keeps the clients’ funds separate from the company funds and are protected under the Financial Services Compensation Scheme (FSCS) which offers a security of up to £85,000. In Bulgaria, 90% of deposits with a limit of €20,000 are secured by the Investors Compensation Fund or ICF Bulgaria.

Trading 212 allows users from across the globe to sign up, though regulations prohibit sign up from regions like American Samoa, Belgium, Democratic People’s Republic of Korea (DPRK), Guam, Northern Cyprus, Northern Mariana Islands, Puerto Rico, Turkey, United States of America, and United States Virgin Islands.

Trading 212 is a very user-friendly trading platform, especially for beginners. The fact that you can try out the platform both on mobile and web before taking the plunge is a big advantage. Limitations like no short-selling may be a turn off for traders. However, the fact that Trading 212 offers over 1,800 assets and is very transparent about charges makes it one of the easiest recommendations for us.

Table of Contents

Despite the placement as the planets greatest monetary market, the forex marketplace only became easily available to retail traders in latest years because of the introduction of sites based trading via on-line forex brokers.

Aspiring forex investors can right now make use of digital trading systems – like the extremely well-known MetaTrader software program

(offered as a free of charge download by MetaQuotes Software program Company ) to access the large forex market thou they might trade only in very small amounts themselves

The majority of on the web brokers will support MetaTrader and could also provide their own proprietary platforms or web-centred dealing interfaces.

These types of systems typically enable traders to do a quick overview of the currency marketplace and maybe carry out some specialized evaluation, in addition to permitting them to gain access to trading necessities like purchase access and deal delivery for a wide selection of foreign currency pairs.

Like a common way of motivating forex investors to use their offer setup solutions and first deposit funds with them to make use of as trading accounts perimeter, many online forex brokers will offer a free of charge fx practice account to potential or existing clients.

Referred to as a forex demonstration accounts, such unsecured debts enable a trader to encounter a hands-on demo of what seems prefer to trade currency pairs in the forex market with this broker without placing any actual money at risk.

Although using a FX trading demo account has several benefits for traders, some tricks are well worth talking about because the technicians of getting into a demonstration operate and the producing emotional responses an investor can possess while controlling it can differ significantly from the encounter of live forex trading utilizing their personal hard-attained money.

Additional common demonstration accounts circumstances which make them vary considerably from an actual cash financed account include broker-imposed period limitations and set debris of virtual foreign currency.

The subsequent areas of this content will talk about starting up an on the web trading demo accounts, in addition to probably the most significant benefits and negatives of using a demonstration forex account in comparison to utilizing a live fx accounts for trading foreign currencies.

Starting Up a Free of charge Forex Demonstration Account

Simply about any trustworthy fx broker will allow potential and current customers to open up up a demo account with them free of charge to enable investors to practice currency trading using digital money.

Demo accounts traders frequently also get access to at least a few of the broker’s customer providers and consumer support personnel to ensure that they can obtain a much better feeling for what coping with the broker will end up being like when they determine to finance a trading account with genuine cash.

Investors desperate to open up a demonstration trading accounts can typically get around to the site of one or even more forex demonstration brokers and adhere to guidelines shown there for opening up a demo or practise account with the brokers they select.

Selecting the greatest fx demo accounts for your requirements might require critiquing those provided by a number of online brokers with different features in order to make an knowledgeable decision which broker is the best partner for your start.

When starting a demonstration account, you may even require to choose a quantity of virtual money to fund the demonstration accounts with and get into some personal data to determine yourself with.

In case you feel worried about offering your true personal data to a broker you are will to try not really you have more freedom as no documentation is required for this in general, the moment you open a real account your KYC documentation will be needed for compliance and this protects the broker as well as the traders from money laundering and fraud.

You can also open up a new e-mail account to get communications about the demo forex account if you are concerned about getting your personal email address offered to third celebrations like digital email entrepreneurs.

The two beginner and experienced forex investors regularly make use of demo accounts to rehearse trading currencies and check out a fresh broker or trading strategy.

Some of the more common advantages of interesting in forex demo trading consist of the following:

Those fresh to trading foreign currencies or trading generally can use an fx demo accounts to find if they are psychologically and psychologically appropriate to the bustle of trading forex. Everyone is usually different, and some people might actually appreciate trading currencies, as the activity might not match others’ preferences, personas or lifestyles at all.

– Beginners who are still learning how to operate foreign currencies frequently experience substantially even more assured putting their real cash in danger in the marketplace if they have an opportunity to try points away from 1st. A demo account allows them to place their training into practice in a near to actual existence environment without placing their genuine money at risk. This enables those to make common beginner’s mistakes while they find out without needing to spend for the effects out with their very own bank.

One of the secrets to taking pleasure in long-term success when trading forex requires learning to apply well-established cash administration concepts. A demonstration accounts allows a brand-new or skilled trader to practice such methods completely on true exchange rate actions and see on their own how the common benefits accumulate to their demo account in digital money earnings.

Probably the most difficult elements of trading for many people consists of learning how to control their psychological reactions to earning and shedding deals in such a method that it stimulates overall success. Dealing properly with normally regular mental replies to producing and losing cash – such as dread, avarice and wish – can often differentiate the effective fx investor from the loss.

Smart experienced traders and beginners as well will generally wish to check the achievement of any new trading technique they arrive plan before applying it in a live trading environment. This kind of enables them to accustom themselves to pursuing the program and also to function out any insects in it that may become obvious while using it as real exchange price movements happen.

Unless you are utilizing the Mt4 system that a great deal of on-line forex brokers support, you will most likely want to make use of a demonstration accounts to observe whether a fresh fx broker’s private internet or client structured trading platform is usually ideal for your trading requirements.

Fx Brokers keen to possess you open up a live trading account with them will frequently provide demonstration investors gain access to their unique customer features, educational and information services, and customer support departments. This can be a great method to examine your quality of the broker’s general solutions before carrying out any actual trading money to ensure they are the type of trading partner you will need keeping your accounts.

US President-elect Donald Trump has posted a progression of tweets censuring the individuals who contradict great relations with Russia as “‘dumb’ individuals, or nitwits”.

Mr Trump promised to work with Russia “to comprehend a portion of the numerous… squeezing issues and issues of the WORLD!”

His remarks came after an insight report said Russia’s leader had attempted to help a Trump race triumph.

Mr Trump said Democrats were to be faulted for “gross carelessness” in permitting their servers to be hacked.

In a progression of tweets on Saturday, Mr Trump said that having a decent association with Russia was “no terrible thing” and that “lone “idiotic” individuals, or simpletons, would believe that it is awful!”

He included that Russia would regard the US increasingly when he was president

he most striking improvement among theoretical situating toward the finish of a year ago and the primary session of 2017 is not that modification were little. There was just a single gross theoretical position modification of more than 10k contracts. With sterling apparently not able to maintain even humble upticks, the bears added 13.1k contracts to the gross short position, lifting it to 120.2k contracts.

Or maybe, it is eminent that examiners for the most part added to positions, long and short, as opposed to close positions at the very end of the year. Examiners added to net long outside cash prospects positions, aside from in the Japanese yen and Swiss franc where 2.6k and 2.5k contracts were exchanged separately. Examiners likewise added to gross short positions. Here there was just a single exemption, the Japanese yen. Despite the fact that the dollar shut comprehensively higher in front of the end of the week, every one of the monetary forms we track here, spare the Mexican peso, picked up against the dollar in the three sessions since the finish of the CFTC reporting period.

Every once in a while it is helpful to review why many market members take a gander at the theoretical situating in the cash fates advertise. It is not that the outside trade is essentially a prospects showcase. It is principally an over-the-counter market in which every day turnover midpoints in abundance of $5 trillion a day.

Trade exchanged monetary forms and alternatives represented around 3% of the normal day by day turnover as indicated by the BIS study. Be that as it may, past reviews have discovered some contemporaneous connection between’s market heading and net position changes. We think it additionally offers knowledge into a specific market section of pattern supporters and energy brokers. It is not by any means the only device, yet one of a few data sources.

One ramifications of this is albeit theoretical positions in the money fates market are moderately extensive, it is still little contrasted and the money showcase. Along these lines, it is difficult to see the genuine essentialness of a record vast position, as though there is some market top. At some point, examiners are not driving the costs, possibly there is another fragment, national banks, enterprises, as well as genuine cash that is more essential at any given minute.

We invest some energy taking a gander at gross positions instead of just net theoretical positions, which is the more customary approach. We think a more granular look is frequently fundamental. There is a distinction between short-covering, for instance, and new purchasing, however it appears to be identical in the net. Additionally, the gross position is the place the introduction is not the net position. A net position of zero does not mean the market is nonpartisan. Net positions could be huge, which implies a short press or a negative stun could in any case troublesome. The positions that must be balanced are captured in the gross measure not the net figure.

We find numerous customers are likewise keen on theoretical situating in the US Treasuries and oil. The net and gross short theoretical Treasury position has swelled to new records. The bears added 23.8k contracts to the as of now record net short position, lifting it to 616.2k contracts. The bulls attempted to pick a base and added about 20k contracts to the gross long position, which now remains at 471.2k contracts. These modification prompted to a 3.8k contract increment in the net short position to 344.9k contracts.

The bulls delayed in the oil prospects toward the finish of 2016. They exchanged short of what one thousand contracts, leaving 608.1k gross in length contracts. The bears added 4.1k contracts to the gross short position, giving them 168k. These conformities trimmed the net long position by very nearly 5k contracts to 440.1k.

In December, the Federal Reserve raised loan fees for the second time since the Great Recession and included the desire of a 2017 financing cost climb to its gauge. Furthermore, only a couple days prior, the abundantly anticipated minutes from the most recent Fed meeting demonstrated the most hawkish tone from the national bank in two years.

In the meantime, Europe has been dove into political turmoil after a year ago’s Brexit vote and the later abdication of Italy’s leader. Somewhere else, the Bank of Japan proceeds down the way of negative rates and forceful security purchasing.

Put it all together, and it isn’t astounding that the U.S. Dollar Index is up against 14-year highs.

Speculators may have missed so much discussion on account of babble about the Dow Jones Industrial Average at the end of the day almost hitting 20,000. Be that as it may, paying little respect to your assignment to stocks or your venture skyline, this sort of huge picture incline in the dollar implies right now is an ideal opportunity to position your portfolio to benefit and, maybe most critical, to keep away from a portion of the pitfalls that can originate from a solid local cash.

Here are a couple ideas dollar exchanges ought to consider:

Residential plays over multinationals

There’s a considerable measure of seek after shopper stocks in 2017 on account of an enhancing work market and any desires for a jolt under a GOP-controlled Congress and President Donald Trump. In any case, remember that not all retailers are made equivalent especially those with abroad operations that are adversely affected by the wide dissimilarity in monetary standards at this moment.

For example, retailer Wal-Mart Stores Inc.(WMT) said troublesome money trade rates shaved very nearly 2.5% off profit for each partake in the second quarter of 2016. On the other hand consider that in the monetary final quarter of 2016, athletic attire goliath Nike Inc.(NKE) saw its income development cut down the middle because of forex weights, from 12% year-over-year in consistent cash measures to only 6% including real money changes.

To take advantage of the “reflation” exchange that numerous financial specialists are counts on in 2017, you need to represent the headwinds that a solid dollar are making for multinationals at this moment. The most ideal approach to do that is to consider customer plays that do by far most of their business here in the U.S. – for example, Foot Locker Inc.(FL), which has been an uncommon splendid spot in retail throughout the most recent couple of years.

Supported money ETFs

Obviously, in the event that you need a steady portfolio, you can’t just purchase just local centered values. Geographic expansion is similarly as imperative as enhancement crosswise over parts and resource classes. Such a large number of financial specialists keep on holding worldwide plays in light of a legitimate concern for a balanced portfolio, regardless of the possibility that it implies battling a daunting struggle as a result of a solid dollar.

The uplifting news, notwithstanding, is that you don’t need to leave yourself to torment through a solid dollar and a powerless euro when you put resources into Europe. Nor do you need to stress over the yen-dollar conversion standard when you put resources into Japan. That is on account of there’s an entire group of cash supported ETFs to permit financial specialists to put their cash in outside business sectors yet keep away from forex issues.

Consider that Japan’s Nikkei 225 file is up around 25% from its July 2016 lows. The WisdomTree Japan Hedged Equity Fund(DXJ) is up 35% in a similar period on account of assurance from forex issues and a somewhat better-performing rundown of stocks – while the non-supported iShares MSCI Japan ETF(EWJ) is up only 10% in a similar period because of battling a difficult task against a solid dollar.

In the event that you need to differentiate your portfolio comprehensively, you ought to consider supported assets that incorporate the Japan-centered DXJ, the WisdomTree Europe Hedged Equity Fund(HEDJ) to play Europe or the iShares money Hedged MSCI EAFE ETF (HEFA) for developing markets.

Dollar list ETF

In the event that you are searching for an immediate play on a rising dollar as opposed to putting resources into stocks, figuring out how to exchange remote trade can appear like an overwhelming undertaking. Gratefully, there’s the PowerShares DB US Dollar Index Bullish Fund(UUP).

This ETF is attached to the U.S. Dollar Index, which is a measure of the greenback against a wicker container of other worldwide monetary standards including the yen and the euro. It’s a straight money play, however that doesn’t make it straightforward or hazard free. In the event that the dollar debilitates, you’ll lose cash similarly as though you’re putting resources into a stock that has fallen on difficult circumstances. Furthermore, obviously, PowerShares takes a little cut of your speculations en route that indicates 0.8% yearly, or $80 a year on each $10,000 contributed.

Still, in the event that you need to conjecture on the dollar or support against a solid U.S. cash keeping down other worldwide ventures on your rundown, it’s maybe the least demanding approach to do as such for generally financial specialists.

The records recorded underneath are capacities and frameworks that were distributed in the “Merchants’ Tips” area of Technical Analysis of Stocks and Commodities (TASC) magazine. It likewise permits you to compose new capacities and frameworks, and import capacities and frameworks composed by different clients. Volume Indicator Mt4 Free Download Hedging How To Win In Binary Options Gambling Forex Volume Indicators Download Volume pointers are utilized to decide financial specialists’ enthusiasm for the market. Day by day Free FX Signals in view of NEWS. This cautions brokers about a conceivable inversion ahead. In the event that you accept there is copyrighted material in this segment you may utilize the Copyright Infringement Notification shape to present a claim. Once composed or imported, these capacities and frameworks can then be utilized precisely like those included as a part of the product.

For instance, if cost has as of late broken an uptrend line, to affirm it CMF will cross underneath its zero line after some time, demonstrating that the market is prepared to Sell. Free MetaTrader Indicators and Trading Systems Collection. Menu. On Balance Volume OBV. On Balance Volume Forex Indicator. Download On Balance. Volume Indicator Mt4 Free Download is double alternatives legitimate in the usa In our Free MT4 Indicator Download Category, you will find that we are. The Klinger Volume Oscillator MT4 was produced by Stephen J. Klinger and it has the. It has an every day volume assessed at around two trillion dollars, and as with some other. in MQL4 programming dialect – and the majority of them are free MT4 markers. We cleared up the MT4 markers download methodology so on the off chance that you wish to introduce. While advertise shortcoming is regularly joined by the cost shutting in the lower half of its day by day run on expanded volume also. Forex Volume Indicators Download Volume pointers are utilized to decide financial specialists’ enthusiasm for the market. Day by day Free FX Signals in light of NEWS. Exchanging Solutions End-of-Day and Real-Time are effective toolboxs that empower you to actualize your own thoughts without hiring software engineers or get a Ph. Exchanging Solutions incorporates a few hundred pointers, frameworks, and other scientific capacities to help you prepare your information.

It’s like MACD disparity, in this manner please take after the connection to peruse more. Volume Indicator Mt4 Free Download Therefore, if cost reliably shut in the upper portion of its day by day run with expanded volume, then the CMF marker will read over zero – positive CMF, which proposes that the market is strong.Trade On Forex Without Investments Money In our Free MT4 Indicator Download Category, you will find that we are. The Klinger Volume Oscillator MT4 was produced by Stephen J. Klinger and it has the. MetaTrader Indicators Tagsbetter volume, volume, vsa 6 Comments. Schaff Trend Cycle Indicator Download. Enroll for our FREE week after week bulletin. Double Option Identification Decoded Forex Volume Indicators Download Volume pointers are utilized to decide financial specialists’ enthusiasm for the market. Every day Free FX Signals in view of NEWS. A circumstance in which the cost achieves new highs and the CMF Oscillator does not achieve its new high makes a bearish disparity when the offering weight starts to develop. While readings over 0.25 would be an indication of a truly solid purchasing weight. CMF pointer offers great affirmation signs of breakouts for different support/resistance levels, specifically, incline lines. Download: CMF_v1.mq4 Download: CMF_T3_v1.1.mq4 (You require both CMF_v1 and CMF_T3_v1 for CMF_T3_v1 to stack appropriately.) Chaikin Money Flow (CMF) is another pointer created by Marc Chaikin, a stockbroker since 1966. Volume Indicator Mt4 Free Download Easy Trade Binary Option University The thought behind CMF marker lies in joining cost and volume with a specific end goal to see the stream of the cash (in or out of the market) amid a picked period. Subsequently, the CMF Formula which demonstrates the whole of the estimations of the 21 time frame Accumulation/Distribution Line separated by the 21 time frame aggregate of volume: sum(((( C-L )- ( H-C ))/( H-L ))*V )/sum(V) Where: C-close L – low H – high V – volume (21 period) Understanding of the Chaikin Money Flow marker depends on the hypothesis that general market quality is regularly joined by the cost shutting in the upper portion of its day by day high/low range on expanded volume. Volume Indicator Mt4 Free Download We don’t have such hued marker in this way; CMF_T3 form can demonstrate pointer as histogram, which can be exchanged in the settings). CMF over zero – bullish flag – the marker hints at purchasing weight – collection. Download forex meta broker Volume with custom MA Indicator Download. for an absolutely free download of t3 Moving Volume Average Metatrader Indicator, then. Take note of, that CMF is a slacking pointer, therefore it would set aside opportunity to affirm a flag, which would suite moderate dealers, however may not awe more forceful brokers. A difference amongst cost and Chaikin Money Flow pointer can give early flags about fundamental shortcoming of the move.

Warning Publishing copyrighted material is entirely precluded. Volume Indicator Mt4 Free Download And tight clamp verse: if the cost reliably shut in the lower half of its every day go with expanded volume, then the CMF pointer will read underneath zero – negative CMF, which demonstrates that the market is weak.The Best Free Advisers Mt4 Forex CMF beneath zero – bearish flag – the marker hints at offering weight – appropriation. Urban Forex 10 Pips System(Note, the zones has been shaded for the representation purposes as it were.

The U.S. dollar record surged to a close to 14-year high after the Fed’s rate climb on Wednesday and its amaze conjecture for three more builds — rather than the two that were normal already — to come in 2017.

Higher loan fees in the United States make it enticing for China to raise its own particular rates, since Beijing doesn’t need more cash to escape the nation into higher-yielding U.S. bonds. That flight additionally damages China’s money, the yuan. Be that as it may, Beijing could cause its economy harm by climbing rates, since its proceeded with monetary development is intensely determined by getting.

“You had this weight was at that point building, and the Fed has fundamentally entangled and added to that with a more hawkish message,” said Logan Wright, chief, China markets explore at Rhodium Group.

China’s yuan along these lines tumbled to its most minimal level since 2008, and the nation’s 10-year security yield bounced to its largest amount in over a year. Decreases in five-year and 10-year Chinese security prospects were allegedly so extraordinary Thursday that exchange was ended because of a market exchanging limit.

“The security advertise itself, it’s raising a considerable measure of consideration, and it’s imaginable reflecting [that] policymakers in China are confronting a troublesome decision at this moment,” said Kai Yan, a financial analyst at the International Monetary Fund. He noticed that “the theory in the market is high on the grounds that the national bank needs to remain before money weight to avert capital surge.”

Chinese policymakers must “either climb the loan cost (as) the U.S. does, or they surrender the conversion scale,” Yan said. “It is likely they will do a blend of the two.”

Presently there are rising worries that issues on the planet’s second-biggest economy may again shake advertises comprehensively.

China’s money related and financial difficulties have been in a lower priority status for U.S. markets for a great part of the previous year. The yuan’s deterioration versus the dollar has been to a great extent disregarded by worldwide markets, as financial overhauls out of China have held up on account of a surge of obligation that is propping up the nation’s economy.

Not long ago, the Fed was viewed as giving China some breathing space to balance out its coin and monetary development. The U.S. national bank refered to worldwide worries in keeping away from a rate climb in the fall of 2015 and decreasing its desires for 2016 rate increments.

Those choices from the Fed kept the dollar enduring, permitting China to maintain a strategic distance from a critical devaluation of its money.

Presently, in any case, some say the Fed might be less worried about China since the U.S. economy is on firmer balance and can expect huge household government spending from President-elect Donald Trump’s recommendations.

In the event that Fed policymakers “feel Trump’s approaches can protect the U.S. from worldwide instability (still an obscure in my view), then the Fed would be all the more eager to endure with its standardization with less respect for worldwide advancements,” Tai Hui, overseeing executive and boss Asia advertise strategist at JPMorgan Funds, said in an email.

This is one of the questions I am usually asked. There are so many traders who have been learning and practising for several months or even years. Now, they are ready to open a live account and start trading with real money. But the problem is, they don’t have enough money to open a live account with a true ECN/STP broker.

As you know, 0.1 lot is the minimum lot size that true ECN/STP brokerssupport. The reason is that the true and real liquidity providers don’t support smaller lot sizes (micro lots), and, as true ECN/STP brokers are directly connected to liquidity providers, they transfer the orders directly to them, and if the orders lots sizes are lower than what liquidity providers support, they reject the orders.

Therefore, when you want to open a live account with a true ECN/STP broker, your account size has to be large enough to handle the minimum of 0.1 position. For example, if you open a $1000 account, and you locate a trade setup that needs a 100 pips stop loss, then the risk of taking this trade setup will be about $100 which is 10% of your account. Taking a 10% risk is too much, specially when you are a new live Forex trader. If you want to take a 3% risk with this trade setup, then your account balance has to be about $3,400 at least. But the problem is, some traders cannot afford to open a $3,400 account. I know some good and serious traders who have learned and practised enough and are now ready to start live trading, but cannot open even a $500 account.

Before talking about the real solution, I’d like to explain why you should not open a small live account with a true ECN/STP broker. Many of them allow you to open even a $500 account. But as 0.1 lot is the minimum lot size you can take, then you will have to take too much risk, and so, you can easily wipe out your account. Not only you will not be able to grow your small account, but you will easily lose that money. So, it is wasting of money to open a too small account that cannot handle the risk.

This is true that I always say you should start with an as small as possible live account, but I don’t mean a too small account that cannot handle the minimum risk you have to take. Your account has to be as small as possible, but it has to be big enough to handle the minimum possible risk.

The other thing is that, if you see a broker claims to be a true ECN/STP broker, but it offers micro-lots (0.01) too, it can have two meanings:

So, opening a too small account with a false ECN/STP broker, or a true ECN/STP that offers micro-lots is not the solution.

The last thing I’d like to tell you before talking about the real solution is that when you see you cannot open a live account with a reasonable account size with a true ECN/STP broker, you may decide to open a small account with a true ECN/STP, but instead of trading the long time frames that usually need wide stop loss orders, you decided to trade short time frames to have tighter stop losses to risk less. For example, while a 100 pips stop loss equals a 10% risk for a $1000 account, a trade setup with a 30 pips stop loss will have a 3% risk for such an account. And you can locate such trade setups on shorter time frames only. You can never take a position with a 30 pips stop loss on the daily or weekly chart.

Theoretically, trading the shorter time frames looks like a good solution. But it is terrible in reality. Trading the shorter time frames will be nothing but wasting of a lot of time and money. Before you come to this conclusion, you will waste and wipe out several accounts. You will stop trading short time frames after having a terrible back and neck pain (because you have to sit at the computer for several hours per day to trade the short time frames).

So, trading the short time frames is not a good solution. Forget about it: Forex Scalping Facts And Fictions

What if you borrow money from the others, trade with it, and pay it back when you made some profit? What if you ask the others like family members and friends to invest with you and allow you to manage their funds, so that you can open a big account with their money?

That is the most stupid thing a trader can do. Never even think about it. Even if someone, like your wife or parents offered you some money to help you open a big enough live account, you must refuse it immediately. The reason is that trading with the others’ funds creates some different kinds of emotions that prevent you from thinking and deciding properly. Therefore, you will make terrible mistakes and you will lose the money definitely. What will be left for you is the shame that will remain forever. You will feel guilty because of losing the others’ money. Never even think about it. It needs several years of successful and professional live trading to be able to manage the others funds and account. You will have a long way to reach that level. Even, 99.99% of the too professional and experienced traders don’t agree to trade with the others’ funds.

So, forget about this terrible solution too.

What Is the Real Solution?

There is a great and hassle free solution for this small problem. Yes, this is a very small problem from my point of view. It is not even a problem. It is an opportunity. Indeed, you are lucky if you don’t have enough money to open a reasonable live account with a true ECN/STP broker. It is a chance for you to keep on demo trading and mastering your trading system even more.

As long as you don’t have enough money to open a reasonable live account, you should keep on demo trading and practising your trading system, and saving money at the same time. No matter how long it takes. There is no rush. Keep on demo trading and saving money. When you have enough money, you can open a reasonable live account while you have already banked a lot of experience through demo trading. You are much luckier than the others, because you start live trading when you have already mastered your trading system perfectly, whereas many others who have enough money, start live trading when they are not ready for it. So they lose a lot and usually many of them give up on Forex trading.

As you see, sometimes having money is bad luck. Sometimes it is lucky to have no enough money.

Lesson 2 – Pair characteristics (the majors and the crosses), Understanding Forex Pairs

Lesson 3 – Introduction to charting

Lesson 1 – What is Forex and how does It work

What is Price Action Trading and How to Use it

How to Recognize False Breakouts

NSFX Demo Account Review | 2018 Must Read |

Stockscale io Review – Demo Account – top 100 Broker ?

FX Broker ActivTrades Wins the “Le Fonti Forex Broker of the Year Award”

4 Things to Always Do Before You Start Trading

Trade.com Demo Account Review | Must Read |