Broker Reviews

12Trader Demo Account Review

Table of Contents

12Trader Demo Account Review

When Trading with Any broker you have to carefully consider which of the Forex brokers meets your requirements for trading platform, Mobile trading, social trading or trading signals. There are many forex broker reviews that do not go beyond the minimum deposit, account type and deposits and withdrawals options with a broker.

But we try in this broker review to show you that 12 trader can hold its own among forex brokers. The financial markets since when you trade forex, (you capital is at risk), requires to have access to a solid support team of wide range financial experts and 12trader is offering exactly this . for beginning traders and the more seasoned ones there are not many brokers offering better service

- Regulated By FSP

- Headquarters United Kingdom

- Foundation Year 2015

- Web: https://www.12trader.com

Phone: +442031502019 - Email: [email protected]

12Trader is an online Forex, CFD and cryptocurrencies trading platform. They have been on the market no that long but already slowly started to gather some followers.

The maturity of the company is due to the fact that the founders are all people that have been active within this industry for years. As such their combined knowledge and experience has taken this new brokerage to higher service and trader experience within a few years where an other broker might have taken longer.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

12Trader Demo accounts and live trading

When you want to become a trader, professional or as a way to supplements your income and even those that just look to add some excitement to their lives, 12Trader gives you the option to open the 12trader demo account that will allow you to start trading without actually having to put up any funds.

I believe that every trader should always first open a demo account. The 12trader demo account allows you to learn about the mechanics of trading and develop and test your acquired trading skills and processes without any risk.

12Trader Trading Education

On the 12Trader Forex Broker website, you have straight away access to several tools that are to educate you on what trading actually means and what you should be aware of.

The courses are separated in clear categories and if you go through all of them you will find that you have become knowledgeable in topics that you were not even aware existed a few days earlier.

The reason this broker is doing that or any other broker for that matte is that for them money is in the retention not in a new client that puts $50 loses it and never wants to trade again, as they earn on the spread they want you to trade make profits and keep on trading. This requires patience and education.

Since they also understand that most people are inherently lazy everything is made for you to sit watch and just absorb.

12trader Free Signals

When you start, trading signals are one of the tools you should use to learn how to identify a good trading opportunity. This broker offers free signals to their traders and this will be a perfect opportunity for traders to test their signals and see if they are any good. At the same time, it will show traders when to enter the market and what to do.

Even I have been trading for years I still use signals as a tool to test my strategy and see if I missed anything, so once you start using them it will be hard to let go. The good thing is that this broker keeps on providing quality signals so you don’t have to trade without.

That said I urge you to never take them for law and always due your own analysis of the markets.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

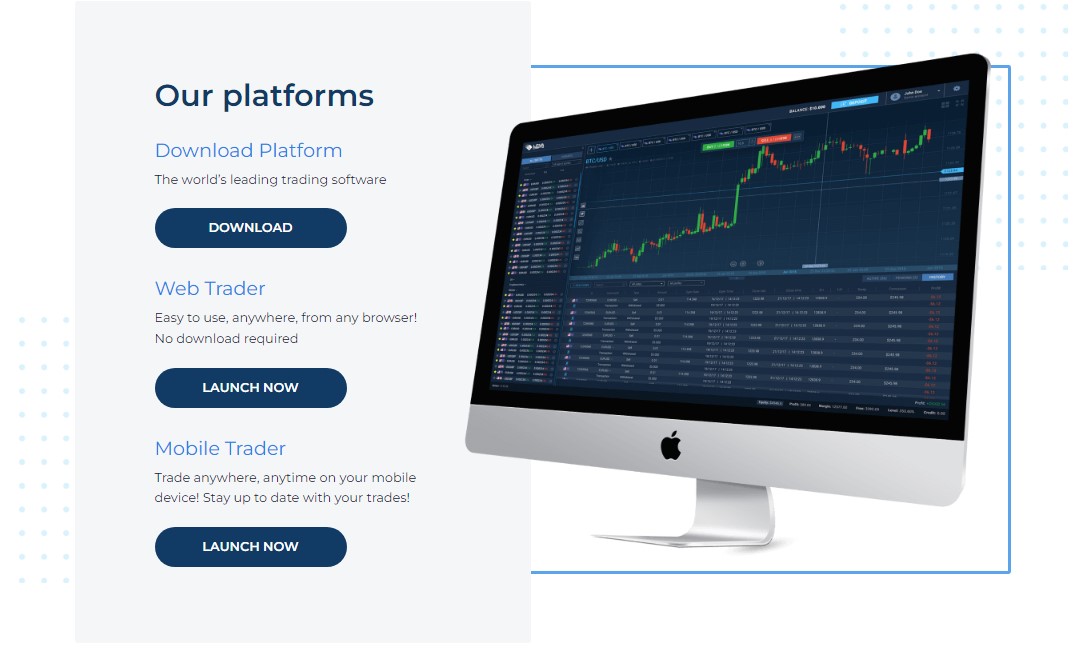

Trading Platforms

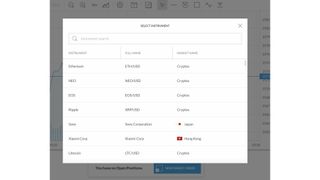

In order to provide the trader with the rifght trading experience and trtrading conditions 12trader is using the Sirix Trading platform.

This platform is an advanced web based trading platform which requires no download or software installation is required. The 12traders platform comes with a extensive charting package and a wide range of technical indicators that enable traders to stay updated with all the latests market developments.

Social Trading

The 12trader trading platform offers also an aspect of social Trading. This Feature Helps them to shorten their learning curve. the social Trading options offers you access to the live trades of others.

These live trades and pending orders show what other traders are doing and you will be able to see how many other traders have copied these trades. This is like a social trading indicator that will give you the trend at that moment

placed by other traders as well other updates such as how many people copied the trade. If you like you can directly copy trades from the “Social Stream”.

In addition, you can follow traders that you believe to be very good by analyzing their historical performance data. Once you have located a few of these traders (you are not limited but I would suggest to just follow a few) you can “watch” them.

Their activity is then updated in your “Traders I watch” stream which then gives you the opportunity to actually just automatically copy their trades. This is an amazing feature but be careful with this as you basically let someone else trade with your money.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

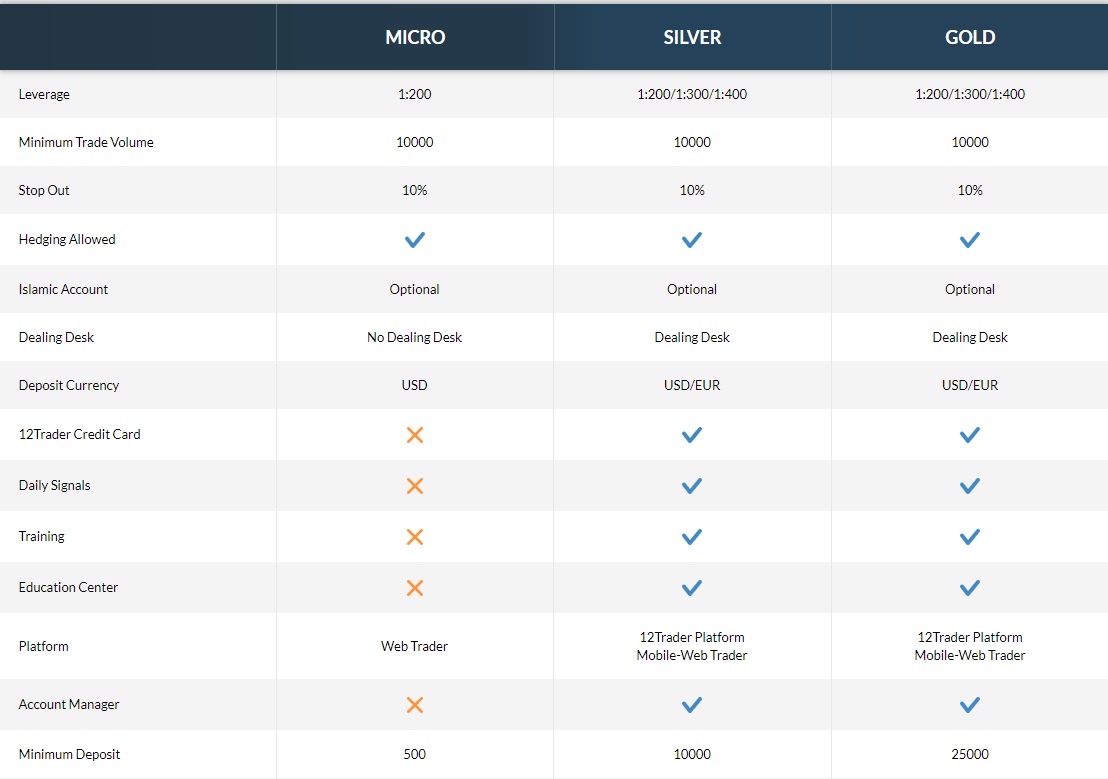

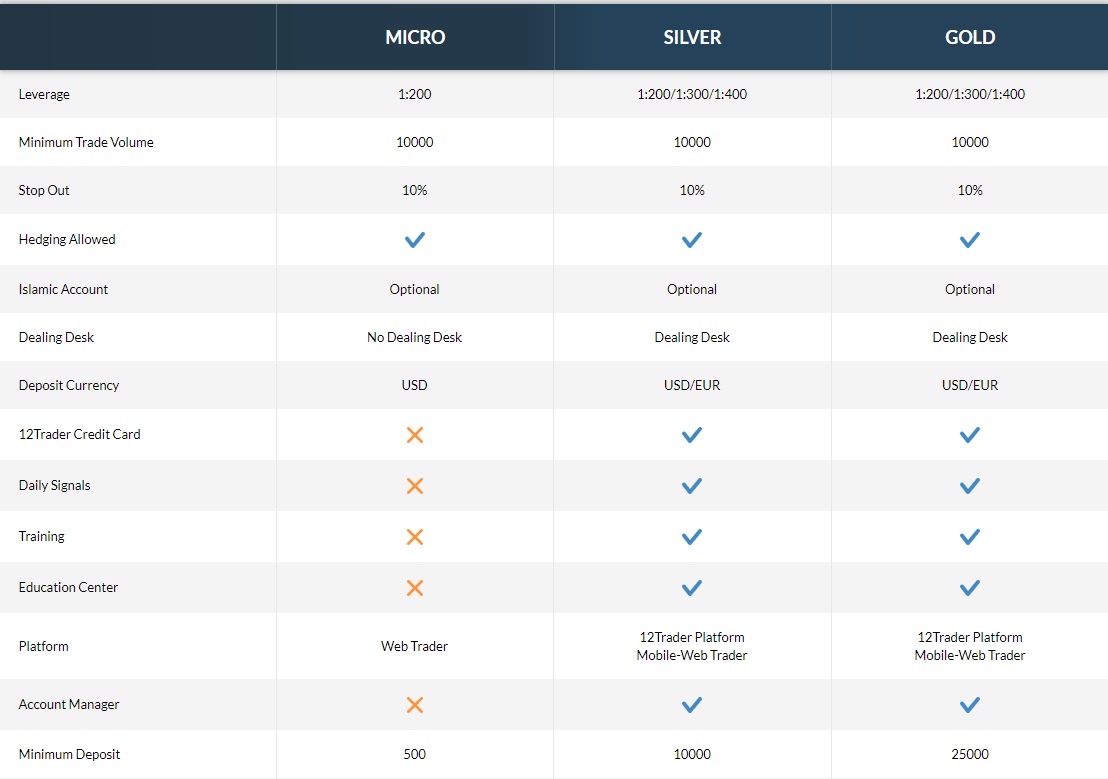

12trader trading accounts

this broker offers different trading accounts in order to accommodate all level of traders,

there is another type of account but those are on invite only as they are for a minimum $100,000 investment.

12trader demo account Conclusion

The 12trader demo accounts is one of the better demo accounts for beginning traders, this fresh and young broker deserves the benefit of the doubt and is on its way to make a solid and respectable name for itself

Broker Reviews

A Detailed Lovacrypto Review

Table of Contents

A Detailed Lovacrypto Review

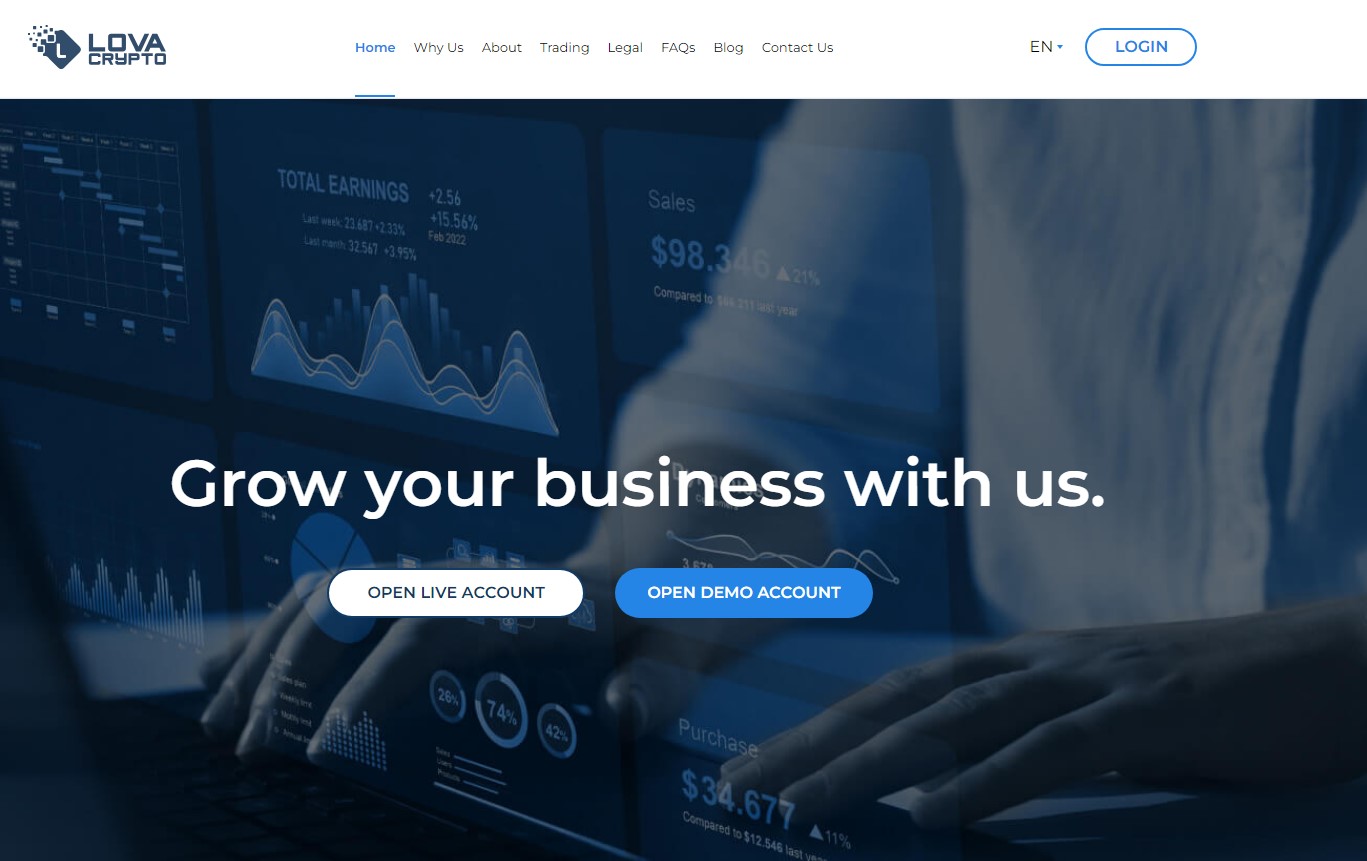

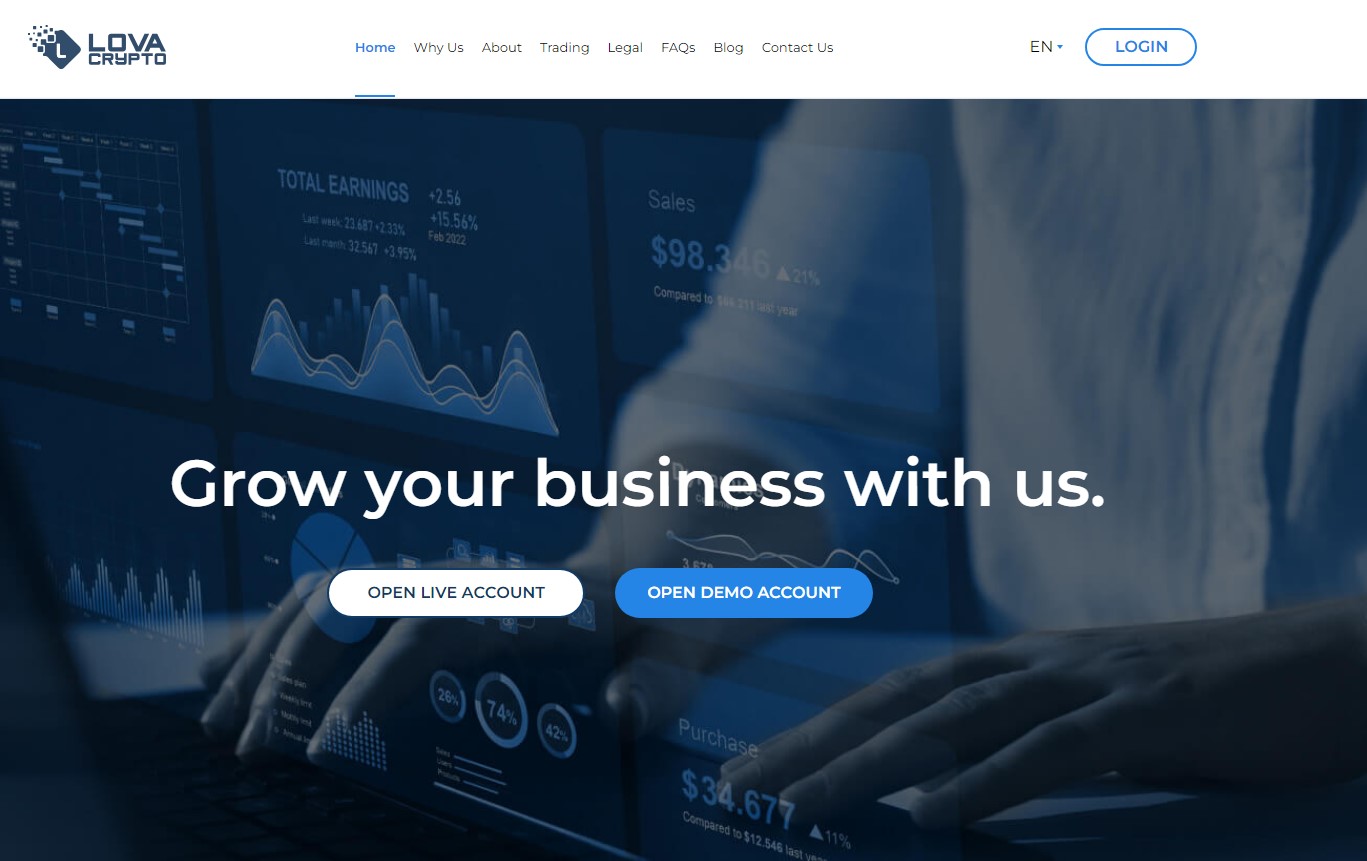

Looking for a reliable forex brokerage that puts your trading needs first? Enter Lovacrypto – your gateway to the exciting world of forex trading. With a user-friendly platform, competitive spreads, and a wealth of educational resources, Lovacrypto.com is designed to help traders of all levels succeed in the forex market.

In today’s fast-paced trading environment, having access to the right tools and information can make all the difference. That’s why Lovacrypto offers a range of features designed to empower traders and enhance their trading experience. From advanced charting tools to real-time market data, Lovacrypto.com provides everything you need to make informed trading decisions.

But what truly sets Lovacrypto apart is its commitment to customer satisfaction. With a dedicated support team available 24/7, you can rest assured knowing that help is always just a click away. Whether you have a question about a trade or need assistance with a technical issue, Lovacrypto’s support team is there to help.

Of course, no brokerage is without its flaws, and Lovacrypto.com is no exception. But despite its shortcomings, Lovacrypto remains a top choice for traders worldwide. With its intuitive platform, competitive pricing, and commitment to customer service, Lovacrypto is well-positioned to help you achieve your trading goals.

So why wait? Sign up for a Lovacrypto account today and take your trading to the next level. Whether you’re a seasoned trader or starting, Lovacrypto.com has everything you need to succeed in the forex market.

Introduction to Lovacrypto.com

Assessing LovaCrypto’s WebTrader Capabilities:

Exploring the functionality and features of LovaCrypto’s WebTrader platform, let’s break down its capabilities into a concise bullet list:

- User-Friendly Interface: The WebTrader platform boasts an intuitive and user-friendly interface, making it easy for traders of all experience levels to navigate and utilize its features effectively.

- Multi-Asset Trading: Traders have access to a wide range of tradable assets, including forex currency pairs, commodities, indices, stocks, and cryptocurrencies, providing ample opportunities for diversification.

- Real-Time Market Data: The platform offers real-time market data, including live price quotes, charts, and market depth, enabling traders to stay informed and make timely trading decisions.

- Advanced Charting Tools: Traders can utilize advanced charting tools and technical indicators to conduct in-depth technical analysis. Features include customizable chart layouts, drawing tools, trendlines, and various technical indicators to assist in market analysis.

- Order Management: The WebTrader platform provides robust order management functionalities, allowing traders to place, modify, and close orders with ease. Features like stop-loss and take-profit orders help traders manage risk and optimize their trading strategies.

- Social Trading Integration: Traders can directly engage with a vibrant social trading community within the WebTrader platform. Features may include social feeds, trader sentiment analysis, and the ability to follow and copy trades from successful traders.

- Educational Resources: The platform may offer access to academic resources, including ebooks, video tutorials, and webinars, to help traders enhance their knowledge and skills.

- Mobile Compatibility: While primarily accessed through web browsers, the WebTrader platform may offer mobile compatibility, allowing traders to access the platform from smartphones and tablets for convenient online trading.

- Security Features: LovaCrypto.com prioritizes the security of its WebTrader platform, implementing encryption protocols and robust security measures to safeguard traders’ personal and financial information.

- Customer Support: Traders can access customer support directly from the WebTrader platform, with options for live chat, email support, and comprehensive FAQs to address any inquiries or issues they may encounter.

In summary, Lova Crypto’s WebTrader platform offers comprehensive features to meet traders’ diverse needs. With its user-friendly interface, multi-asset trading capabilities, advanced charting tools, social trading integration, and robust security measures, the platform provides traders with the tools and support they need to succeed in today’s dynamic markets.

Lova Crypto’s Range of Tradable Assets:

At LovaCrypto, traders can access diverse financial instruments spanning various markets, empowering them to explore and capitalize on various opportunities. Whether you’re a seasoned investor or just starting your trading journey, our platform offers the tools and resources you need to thrive. Let’s delve into the array of assets available for trading:

- Forex (Foreign Exchange):

- Engage in forex trading with major currency pairs like EUR/USD, GBP/USD, USD/JPY, and minor and exotic currency pairs.

- Leveraged trading can amplify your purchasing power and potentially magnify your profits or losses. Leverage allows you to control a larger position with a relatively small investment, but managing risk effectively is essential.

- Commodities:

- Trade diverse commodities, including precious metals like gold and silver, energy commodities like crude oil and natural gas, and agricultural products.

- Leverage enables traders to access larger positions in the commodity markets, amplifying potential gains or losses. However, it’s crucial to understand the risks associated with leveraged trading and implement risk management strategies.

- Cryptocurrencies:

- Dive into the dynamic world of cryptocurrencies with leading digital assets such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP).

- Leverage allows traders to take advantage of the volatility in the cryptocurrency market, amplifying potential returns. However, before trading cryptocurrencies on margin, it is important to exercise caution and conduct thorough research.

- Indices:

- You can access major global indices, including the S&P 500, NASDAQ 100, FTSE 100, and Nikkei 225.

- With leveraged trading, you can amplify your exposure to index movements and capitalize on market trends. However, assessing your risk tolerance and implementing risk management strategies when trading on margin is essential.

- Stocks (CFDs):

- Trade contracts for difference (CFDs) on a wide range of individual stocks from global exchanges.

- Leverage allows traders to access a more extensive range of stocks with a smaller initial investment, potentially magnifying profits and losses. Understanding the implications of leveraged trading and managing risk prudently is crucial.

By offering leveraged trading on diverse assets, LovaCrypto.com provides traders the flexibility and opportunity to pursue their investment objectives. However, it’s essential to approach leveraged trading cautiously and prioritize risk management to safeguard your capital and maximize your potential returns.

Security, KYC/AML Compliance, and Fund Protection

When it comes to online trading, security and regulatory compliance are non-negotiables. Lova Crypto understands this imperative and has implemented robust measures to safeguard user accounts, ensure KYC/AML compliance, and protect user funds.

Advanced Security Measures:

- Encryption Protocols: Lova Crypto employs cutting-edge encryption protocols, including SSL encryption, to secure user data and transactions. This encryption technology ensures that sensitive information, such as personal details and financial data, remains confidential and inaccessible to unauthorized parties.

- Two-Factor Authentication (2FA): To enhance login security, LovaCrypto offers 2FA to all users. This additional layer of authentication requires users to provide a unique verification code, usually sent to their mobile device and their password. By requiring both factors for authentication, 2FA significantly reduces the risk of unauthorized access to accounts.

- Firewall and Intrusion Detection Systems: The platform has advanced firewall and intrusion detection systems that continuously monitor network traffic for suspicious activities and potential threats. This proactive approach helps thwart cyber attacks and safeguard the platform’s infrastructure and users’ sensitive information.

KYC/AML Compliance:

- Identity Verification: To comply with KYC regulations, LovaCrypto.com requires users to undergo identity verification by submitting valid identification documents and proof of address. This stringent verification process helps verify users’ identities, prevent fraudulent account creation, and mitigate the risk of money laundering and other illicit activities.

- Transaction Monitoring: Lova Crypto employs sophisticated algorithms and manual review processes to monitor real-time transactions. By analyzing transaction patterns and detecting suspicious activities, the platform can identify and prevent potential instances of money laundering, fraud, and other illicit financial activities.

- Compliance Oversight: A dedicated compliance team oversees the platform’s KYC/AML procedures, ensuring adherence to regulatory requirements and industry best practices. This team continuously updates internal policies, monitors regulatory developments, and collaborates with regulatory authorities to maintain compliance standards.

Fund Protection:

- Segregated Accounts: User funds deposited on the LovaCrypto platform are held in segregated bank accounts, separate from the company’s operational funds. This segregation of funds ensures that users’ trading capital remains protected and inaccessible to creditors or third parties, even in insolvency.

- Regulated Banking Partners: Lova Crypto partners with reputable, regulated financial institutions to provide banking services and custody solutions for user funds. These banking partners adhere to strict regulatory standards, undergo regular audits, and maintain sufficient capital reserves to safeguard client assets.

- Insurance Coverage: Besides segregation and regulatory oversight, LovaCrypto may offer insurance coverage to protect user funds against unforeseen events, such as cyber theft or insolvency. This insurance policy provides additional financial security and peace of mind for traders.

Lova Crypto maintains a secure and trustworthy trading environment by prioritizing security, ensuring KYC/AML compliance, and implementing stringent measures to protect user funds. Traders can confidently engage with the platform, knowing their assets are safeguarded, and regulatory obligations are diligently met.

Exploring Regulatory Oversight: Understanding LovaCrypto’s Regulatory Status

When considering investing with LovaCrypto, it’s natural to wonder about regulation. Here, we’ll explain what it means for you as an investor.

Concerns about Regulation:

- Protecting Investors: Regulations are like safety nets for investors. They set rules to make sure your money is safe and that you have a way to resolve any issues. Without regulation, there may be worries about how well your investments are protected and what happens if something goes wrong.

- Keeping Things Fair: Regulations also ensure that markets are fair and transparent. They prevent things like cheating or hiding important information. Without these rules, there could be doubts about everything being done fairly.

- Managing Risks: Regulated platforms must follow strict rules to manage risks and keep enough money in reserve. Without regulation, there might be concerns about how well risks are managed and whether there’s enough money to cover losses if things don’t go as planned.

Reassurances and Responses:

- Being Open and Honest: Although LovaCrypto isn’t regulated, it believes in being open about how it works. It provides clear information about its policies and procedures so that you know what to expect. This transparency helps you make informed choices.

- Building Trust: Lova Crypto has built a good reputation in the trading world, even without regulation. People have had positive experiences and trust the platform. While regulation is nice, knowing others trust the platform can also give you confidence.

- Learning and Growing: LovaCrypto wants you to understand trading and the risks involved. They offer many educational materials, like tutorials and webinars, to help you learn. By knowing more about trading, you can make smarter decisions and better protect your investments.

In short, while regulation is important, it’s not the only thing to consider when choosing a platform like LovaCrypto.com. Transparency, reputation, and education also play big roles in building trust. Do your homework and be cautious with any investment, whether the platform is regulated.

Educational Resources at LovaCrypto

LovaCrypto.com prioritizes trader education, offering a range of resources to enhance trading knowledge and skills:

1. Dive into Knowledge

Traders can access a wide range of materials, including webinars, articles, and e-books. These resources cover various topics, from basic trading principles to advanced strategies, catering to traders of all experience levels.

2. Empower Your Trading

The platform provides robust trading tools such as economic calendars, e-books and technical analysis indicators. These tools equip traders with real-time market insights, helping them make informed decisions and seize opportunities as they arise.

3. Elevate Your Trading Journey

Education is key to success in trading, and LovaCrypto is committed to supporting traders on their journey. The platform empowers traders to grow their skills and navigate the markets confidently by offering comprehensive educational resources and powerful trading tools.

Bonuses and Promotions:

LovaCrypto understands the value of rewarding its traders, so it offers a range of bonuses and promotions to enhance their trading journey. Here’s what traders can expect:

- Welcome Bonus: New traders may be eligible for a welcome bonus from LovaCrypto.com upon signing up. This bonus serves as a token of appreciation for choosing LovaCrypto as their trading platform and can provide them with additional funds to kick-start their trading activities.

- Deposit Bonuses: LovaCrypto occasionally provides deposit bonuses to incentivize traders to fund their accounts. These bonuses are typically offered as a percentage of the deposited amount, giving traders extra capital to explore the markets and potentially increase their trading opportunities.

- Referral Program: LovaCrypto offers a referral program where traders can earn rewards for referring others to the platform. By inviting friends, family, or acquaintances to join LovaCrypto, traders can receive bonuses or other incentives when their referrals sign up and begin trading.

Traders should carefully review the terms and conditions of each bonus and promotion LovaCrypto offers. These terms outline requirements or restrictions, such as minimum deposit thresholds, trading volume targets, and withdrawal conditions. By familiarizing themselves with the terms and conditions, traders can maximize the benefits of bonuses and promotions while ensuring responsible trading practices.

Understanding Regulation: Evaluating LovaCrypto’s Regulatory Landscape

Delving into the regulatory aspect of Lova Crypto is crucial for investors seeking security and trustworthiness in their trading platform. Let’s explore the significance of regulation and how it pertains to Lova Crypto.

Raising Concerns about Regulation:

- Investor Protection: Regulation serves as a shield, safeguarding investors’ interests and ensuring a level playing field. The absence of regulatory oversight may raise concerns about the platform’s commitment to protecting investors’ funds and resolving disputes effectively.

- Ensuring Fairness: Regulatory frameworks uphold fairness and transparency in the market, preventing fraudulent activities and providing equal opportunities for all participants. Without regulatory oversight, questions may arise regarding the platform’s adherence to fair practices and disclosure of vital information.

- Mitigating Risks: Regulated entities are bound by stringent risk management protocols and capital requirements, minimizing the likelihood of financial instability and ensuring adequate reserves to cover potential losses. The absence of regulation could lead to uncertainties regarding risk management practices and the platform’s economic resilience.

Addressing Concerns:

- Transparency and Accountability: Despite lacking regulatory oversight, LovaCrypto emphasizes transparency and accountability in its operations. The platform provides comprehensive information about its policies, procedures, and security measures, empowering investors to make informed decisions.

- Establishing Trust: Lova Crypto has garnered a positive reputation within the trading community, bolstering investor confidence despite the absence of regulation. The platform’s reliability and integrity track record instils trust among users, demonstrating its commitment to ethical business practices.

- Empowering Investors: Lova Crypto prioritizes investor education, offering resources such as tutorials, webinars, and educational materials to equip users with the knowledge and skills to navigate the trading landscape effectively. The platform aims to mitigate risks and enhance trading outcomes by educating investors.

In conclusion, while regulatory oversight provides an additional layer of assurance, investors can still find value in platforms like Lova Crypto that prioritize transparency, trustworthiness, and investor education. By conducting thorough due diligence and leveraging available resources, investors can make informed decisions tailored to their financial goals and risk tolerance.

Exploring Financial Transactions with Lova Crypto: An In-Depth Review

As investors navigate the realm of online trading, understanding the intricacies of depositing and withdrawing funds is paramount. Here’s an extensive analysis of the financial transactions process with Lova Crypto, presented from the perspective of a third-party reviewer.

Depositing Funds:

LovaCrypto offers investors many funding methods catering to diverse preferences and needs. From traditional bank wire transfers to modern online payment platforms and cryptocurrency wallets, users have ample choices to initiate deposits seamlessly. The platform’s intuitive interface guides investors through the deposit process, ensuring a user-friendly experience. Moreover, LovaCrypto maintains transparency regarding deposit fees, empowering investors to make informed decisions about their financial transactions.

Withdrawing Funds:

Compliance with Anti-Money Laundering (AML) regulations is a top priority for LovaCrypto, as evidenced by its stringent security protocols and Know Your Customer (KYC) procedures. By implementing robust measures to mitigate the risk of illicit activities, LovaCrypto instils trust and confidence in its investor community. Withdrawal requests are processed efficiently, with the platform striving to expedite transactions and provide timely access to funds. Responsive customer support channels further enhance the withdrawal experience, ensuring investors receive prompt assistance whenever needed.

Regulatory Considerations:

While LovaCrypto operates as a reputable online trading service provider, it’s essential to note that no financial authority regulates the platform. While this lack of regulation may raise concerns among some investors, it’s important to consider Lov Crypto’s reliability and transparency track record. By adhering to stringent security measures and industry best practices, LovaCrypto aims to mitigate risks and protect investors’ interests to the best of its ability.

Summary:

LovaCrypto.com offers investors a comprehensive and secure financial transaction experience cwithdiverse funding options, robust security protocols, and responsive customer support. While regulatory considerations may warrant attention, LovaCrypto’s commitment to transparency and investor protection remains steadfast. As investors navigate their financial journey with Lova Crypto, they can trust the platform’s reliability and dedication to facilitating seamless transactions.

LovaCrypto’s Fee Structure

In the realm of trading, comprehending the financial intricacies is paramount. LovaCrypto provides a comprehensive insight into its fee structure, ensuring users understand the costs involved. Let’s delve into the specifics:

1. Spreads: A Comprehensive Analysis

Spreads, the disparity between the bid and ask prices, are the spreads that are the main income of a broker. LovaCrypto is committed to offering competitive spreads across a spectrum of trading instruments, fostering an environment where users can execute trades with confidence and efficiency.

2. Commissions: Shedding Light on Trade Execution

Beyond spreads, users may encounter commissions and charges levied for executing trades. These fees are explicitly disclosed, enabling users to accurately assess the cost implications of their trading activities. LovaCrypto strives to maintain equitable commission rates, ensuring users receive fair transaction value.

3. Additional Charges: Exploring Beyond Spreads and Commissions

In addition to spreads and commissions, users should be aware of ancillary charges such as inactivity fees or withdrawal charges. While LovaCrypto endeavours to keep these fees to a minimum, users must familiarize themselves with any potential additional costs associated with their trading activities.

4. Fee Transparency: Empowering Informed Decision-Making

Transparency lies at the core of Lova Crypto’s ethos. LovaCrypto.com empowers users to make informed decisions regarding their trading endeavours by providing a detailed breakdown of its fee structure. With a commitment to fair pricing and transparent communication, LovaCrypt.como aims to facilitate a seamless trading experience for all users.

Customer Support:

LovaCrypto strongly emphasises providing exceptional customer support to its users, ensuring a seamless trading experience. Here’s how they make themselves available to assist traders:

Contact Channels:

- Phone Assistance: Traders can easily contact LovaCrypto’s dedicated support team by dialing +1-718-488-5710. The phone lines are operational 24 hours daily from Monday to Friday, accommodating traders from various time zones.

- Email Support: For more detailed inquiries or assistance, traders can send their questions to [email protected]. LovaCrypto’s support team endeavours to respond promptly to all email queries, providing comprehensive solutions and guidance.

- Live Chat Feature: LovaCrypto.com offers a live chat feature directly on its website, enabling traders to engage with support representatives in real time. Clicking on the live chat icon allows traders to initiate conversations and receive immediate assistance with their concerns.

- FAQ Section: To address common questions and concerns, LovaCrypto maintains a comprehensive FAQ section on its website. This resource serves as a valuable self-help tool, offering quick answers to queries related to account management, trading processes, deposit and withdrawal procedures, and more.

By offering multiple communication channels, including phone support, email assistance, live chat, and a detailed FAQ section, LovaCrypto ensures that traders can access the necessary support and guidance to navigate the platform effectively and address any issues they may encounter.

Johnathan Edwards

The Author Jonathan Edwards, based in London, UK, is a distinguished financial analyst and forex trading specialist with a rich background spanning over 15 years in the financial sector. With a Master’s degree in Finance from Kingston University, he has carved out a niche as a global currency strategist for top-tier banks and trading firms. Johnathan is a prolific contributor to financial magazines and online trading communities, offering expert analysis on forex market dynamics, trading strategies, and comprehensive broker reviews. His expertise is not just limited to analysis; he is deeply committed to educating traders and guiding them through the complexities of the forex market with clarity and authority. Johnathan’s insights are sought after for their thoroughness, precision, and his dedication to empowering traders with knowledge to navigate the forex market confidently.

Forex Trading Risk Disclaimer

Forex trading involves significant loss risk and is unsuitable for all investors. The high level of leverage can work against you and for you, potentially leading to substantial losses, including exceeding your initial investment. Before engaging in forex trading, it’s crucial to carefully consider your financial objectives, level of experience, and risk appetite. Do not invest money that you cannot afford to lose. Seek advice from an independent financial advisor if you have any doubts. The content on this website is provided for informational purposes only and should not be taken as investment advice.

Share ForexYour Experience with Us!

We value your insights and personal stories about trading with Lovacrypto or other forex brokers. Your experiences can provide invaluable guidance to fellow traders and those considering their options in the forex market. Whether it’s about regulation, leverage, cryptocurrency trading, or any other aspect of your trading journey, we’d love to hear from you.

Please leave a comment below to share:

- Your overall experience with Lovacrypto or another broker

- Specific features or services that stood out to you

- Challenges or issues you encountered

- Advice for traders navigating their broker selection

Your feedback enriches our community’s knowledge and helps traders make informed decisions based on real-world experiences. Let’s build a supportive and informative trading community together!

Broker news

Capitalix-It is a good choice in 2024?

Range of Markets

Capitalix offers a diverse range of trading instruments, catering to the varied interests and strategies of traders. Here’s a closer look at what you can trade on Capitalix:

- Forex Pairs: Capitalix provides traders with the opportunity to trade in a wide variety of major, minor, and exotic currency pairs. This includes popular pairs like EUR/USD, GBP/USD, and USD/JPY, allowing traders to take advantage of the liquidity and volatility in the forex market.

- Commodities: For those interested in commodities trading, Capitalix offers access to a range of commodities, including precious metals like gold and silver, energy commodities such as crude oil and natural gas, and agricultural products like coffee and sugar. Commodities trading can be a good way to diversify your portfolio.

- Indices: Capitalix also provides the option to trade on leading global indices, which is perfect for traders looking to gain exposure to specific economies or market sectors. This includes indices like the Dow Jones Industrial Average, NASDAQ, S&P 500, and others.

- Stocks: Traders at Capitalix can engage in stock CFD trading, with access to shares from leading global companies. This allows traders to speculate on the price movements of individual companies without needing to own the underlying stocks.

- Cryptocurrencies: Recognizing the growing interest in digital currencies, Capitalix offers trading on some of the most popular cryptocurrencies, including Bitcoin, Ethereum, Ripple, and Litecoin. Cryptocurrency trading is known for its high volatility, which can present both opportunities and risks for traders.

Unique Offerings: One of the unique aspects of trading with Capitalix is their commitment to providing traders with access to a wide range of markets and instruments. This diversity enables traders to explore different sectors and asset classes, all from a single trading platform. Additionally, Capitalix’s platform includes advanced charting tools and real-time market data, which can help traders make informed decisions.

Risk Management

Capitalix provides traders with a suite of top-tier risk management tools, including:

1. Stop Losses: This tool enables traders to set predefined exit points to mitigate losses if the market moves unfavorably.

2. Take Profits: Take Profits allows traders to secure profits by automatically closing positions when a specified price target is reached.

3. Limit Orders: Limit Orders empower traders to enter the market at predefined price levels, ensuring execution at favorable rates.

4. Trailing Stop: The Trailing Stop feature empowers traders to safeguard their profits by automatically adjusting stop loss levels as the market moves favorably. This dynamic tool helps traders lock in gains while allowing for potential further upside.

5. Margin Calls: Margin Calls serve as alerts, notifying traders when their equity falls below a certain threshold, prompting them to take necessary action to manage risk.

Trading Hours

When it comes to trading hours, you will be able to trade between 5-7 days a week, depending on your chosen market:

- Forex 24/5. Monday through Friday.

- Crypto assets 24/7. From Monday to Sunday.

- Commodities usually 23/6. From Sunday to Friday. Closed for one hour, from 22:00 to 23:00

- The opening hours of the Indices and stock market depend on the country and the session: North American, European, or Asian.

Capitalix offers a trio of platforms designed to cater to the needs of modern traders: the widely acclaimed MetaTrader 4 (MT4), their proprietary WebTrader, and a mobile application for trading on the go. Each platform is engineered with precision, focusing on enhancing the trading experience through a blend of functionality and accessibility.

MetaTrader 4 (MT4): MT4’s reputation precedes itself, being the choice of many professional traders for its robust analytical tools, advanced charting capabilities, and the ability to support automated trading systems known as Expert Advisors (EAs). Its user-friendly interface, combined with powerful technical analysis features, makes it a top pick for traders looking for depth and flexibility in their trading operations.

WebTrader: Capitalix’s WebTrader platform is a testament to their commitment to providing seamless trading experiences. It’s accessible directly from your web browser, eliminating the need for any downloads. This platform stands out for its intuitive design, making it easy for both novices and experienced traders to navigate. Features like real-time quotes, customizable indicators, and advanced charting make it a solid choice for those who prefer web-based trading.

Mobile Application: Recognizing the shift towards mobile trading, Capitalix has developed a mobile app that mirrors the functionality of its desktop counterparts. Available for both iOS and Android devices, the app ensures traders can manage their portfolios, monitor the markets, and execute trades anytime, anywhere. With push notifications for market events and a user-friendly interface, it’s an excellent tool for traders who value mobility and convenience.

In summary, Capitalix’s suite of trading platforms is designed to meet the diverse needs of the trading community. Whether you’re drawn to the advanced capabilities of MT4, the accessibility of WebTrader, or the convenience of mobile trading, Capitalix provides a solid foundation for your trading activities.

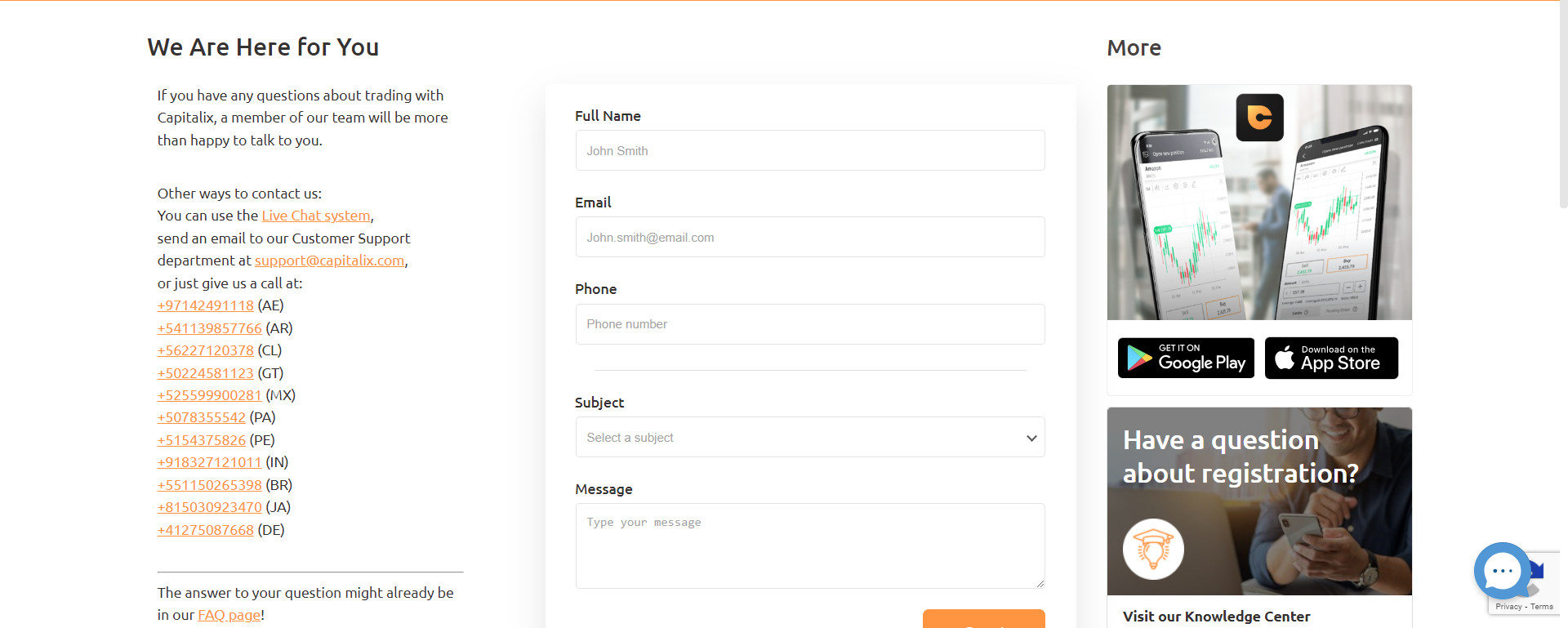

Customer Service

Capitalix emphasizes the importance of accessible and responsive customer support for its traders. Recognizing that timely assistance can significantly impact trading success, Capitalix has developed multiple channels for traders to reach out for help:

Live Chat Functionality: Available directly on the Capitalix platform, the live chat feature offers immediate assistance from knowledgeable support staff, ensuring that your trading queries are resolved without delay.

Email Assistance: For queries that require detailed explanations or for traders who prefer written communication, Capitalix can be reached at [email protected]. The support team is dedicated to providing prompt and thorough responses.

Phone Support: Capitalix understands the value of human interaction and offers phone support through several international numbers, catering to traders worldwide:

- Argentina: +541139857766

- Chile: +56227120378

- Guatemala: +50224581123

- Mexico: +525599900281

- Panama: +5078355542

- Peru: +5154375826

- India: +918327121011

- Brazil: +551150265398

- Japan: +815030923470

- Germany: +41275087668

- Seychelles: +2484632032

- United Arab Emirates: +97142491118

Online Presence and Messaging: Engage with Capitalix on social media and through messaging apps for updates, support, and community interaction. The official Telegram channel, @capitalixbot, is a great resource for direct communication.

Comprehensive FAQ Page: Before reaching out, traders can explore the FAQ page for answers to commonly asked questions, offering an immediate resource for information and support.

Conclusion capitalix review

Capitalix is preferred for traders due to its competitive leverage offerings, comprehensive asset selection, including forex, cryptocurrencies, commodities, indices, and stocks, exceptional customer support, commitment to regulatory standards, user-friendly platforms, and extensive educational resources. Capitalix provides traders the tools and support to navigate the financial markets effectively and maximize their trading potential.

FAQ:

What is Capitalix?

Capitalix is a dynamic online trading platform offering forex, stocks, commodities, and cryptocurrencies trading with a focus on providing a secure, innovative, and user-friendly trading experience.

Where is Capitalix based?

Capitalix operates from Seychelles, adhering to the regulatory framework established by the Financial Services Authority (FSA).

Is Capitalix regulated?

Yes, Capitalix is regulated by the Financial Services Authority (FSA) of Seychelles, ensuring a trustworthy and transparent trading environment.

What types of accounts does Capitalix offer?

Capitalix offers several account types, including Basic, Silver, Gold, Platinum, and VIP, to cater to various trading needs and experience levels.

What is the minimum deposit required at Capitalix?

The minimum deposit to start trading with Capitalix is $250, making it accessible for beginners and experienced traders alike.

Does Capitalix offer educational resources?

Absolutely! Capitalix provides a wealth of educational materials, including webinars, e-books, and articles, to help traders at all levels improve their trading skills.

What trading platforms are available at Capitalix?

Traders at Capitalix can use the MetaTrader 4 platform, WebTrader, and a mobile trading app, all equipped with advanced trading tools and features.

Can I trade cryptocurrencies on Capitalix?

Yes, Capitalix offers trading on a variety of cryptocurrencies, including Bitcoin, Ethereum, and Litecoin, among others.

Are there any fees for depositing or withdrawing funds?

Capitalix does not charge any fees for deposits. While withdrawals are also free of charge from our side, it's wise to check if your bank or payment provider applies any fees.

How long do withdrawals take at Capitalix?

Withdrawal requests are processed within 1 to 2 business days, ensuring you can access your funds promptly.

Is customer support available at Capitalix?

Yes, Capitalix provides 24/5 customer support through live chat, email, and phone to assist you with any queries.

How can I open an account with Capitalix?

Opening an account is simple. Just visit the Capitalix website, fill out the registration form, and follow the steps to complete your account setup.

Does Capitalix offer a demo account?

Yes, Capitalix offers a demo account loaded with virtual funds, allowing you to practice trading strategies risk-free.

What leverage does Capitalix offer?

Capitalix offers leverage up to 1:200 for forex trading, with variations depending on the account type and instrument.

Are my funds safe with Capitalix?

Absolutely. Capitalix employs strict security measures, including segregated accounts, to ensure the safety of your funds.

Can I trade on mobile with Capitalix?

Yes, Capitalix's mobile trading app allows you to trade on the go, providing access to all the major features of the desktop platform.

What instruments can I trade with Capitalix?

Capitalix offers a wide range of trading instruments, including forex pairs, commodities, indices, stocks, and cryptocurrencies.

Does Capitalix offer any bonuses or promotions?

While Capitalix occasionally offers bonuses and promotions, we encourage traders to check our website for the latest offers and read the terms and conditions carefully.

How does Capitalix protect my personal information?

Capitalix uses SSL encryption and adheres to strict data protection policies to safeguard your personal and financial information.

Can I lose more money than I deposit?

No, Capitalix offers negative balance protection, ensuring you can never lose more than your account balance.

What are the spreads at Capitalix?

Spreads at Capitalix are competitive and vary by account type and market conditions. Detailed information is available on our website.

How can I learn to trade with Capitalix?

Capitalix offers comprehensive educational resources, including webinars, articles, and e-books, catering to both beginners and experienced traders.

What makes Capitalix stand out among other brokers?

Capitalix's commitment to security, customer support, and providing a user-friendly trading experience sets it apart in the forex trading industry.

Can I trade with Capitalix from any country?

Capitalix serves traders from various countries. However, due to regulatory restrictions, our services might not be available in certain jurisdictions.

How can I contact Capitalix for more information?

For more information, you can contact our customer support via live chat, email at [email protected], or by calling our direct support numbers available on our website.

Risk Disclosure:

Trading with Capitalix involves significant risk and might not be suitable for everyone. You could lose more than your initial deposit, so don’t invest money you can’t afford to lose. Market prices can change quickly, and using leverage increases both potential gains and losses. Make sure you understand the risks, consider your investment goals and experience level, and seek advice if needed. Capitalix offers resources to help, but the final decision on trades is yours. Remember, past success doesn’t guarantee future results.

Author :

Broker Reviews

Buycryptomarkets Review – top 75 Broker?

Table of Contents

Buycryptomarkets Review

buycryptomarkets is a global forex and CFD broker with trading platforms that is suitable and fully functional for all devices.

This is a good option for all levels of traders, although the product portfolio is average, and there is an inactivity fee to be aware of.

Initially formulated in 2023 to provide a robust forex trading platform, buycryptomarkets offers to include CFDs, indices, shares, commodities, and cryptocurrencies.

buycryptomarkets has several trading tools and features designed to make your trading experience as smooth as possible. The trading platform has been heralded as a simple and convenient platform without losing the functionality you would find at MetaTrader 4. Some education is also available through the trading platform, and highly responsive customer service is available 24 hours a day.

Please read my full buycryptomarkets review for further details of this forex broker so you can decide whether buycryptomarkets can meet your needs.

Who is buycryptomarkets?

buycryptomarkets is a global forex, spread betting, and CFD online broker. buycryptomarkets is an online Crypto and Forex Broker providing traders across the globe with cutting-edge technology to trade the world’s markets. In a continuous effort to give their traders a more comfortable and safe trading experience, their experts have been improving their service and solutions ensuring traders have the freedom to trade whenever and wherever they like.

buycryptomarkets product range overview

The product range at buycryptomarkets is average compared to other brokers. They offer a solid selection of currency pairs and CFDs, no futures CFDs, and an average number of commodity and stock index CFDs. additionally, they do offer leverage trading on the main cryptocurrencies.

Forex trading

More than 50 Forex pairs are available at buycryptomarkets with no commission and some of the tightest spreads in the industry.

Indices and Financial Trading

Indices and financial CFDs have flexible margin requirements and low spreads, representing some of the industry’s best spreads. There are no overnight or hidden fees of any description to worry about.

Commodities Trading

At buycryptomarkets, there are several commodity CFDs, including metals and energies.

Share CFDs Trading

Trade more than 100 company shares without ever owning the underlying security. At buycryptomarkets, you can access global stock exchanges with the option to go long and short and benefit from leverage. For non-leverage trading, there is zero commission.

Buycryptomarkets Accounts

There are a few trading account options at buycryptomarkets. there is not a lot of info concerning this till you are actually in the registration process.

the only thing you should know is that the minimum deposit for opening an account is only $250.

Variety of Trading Accounts

No matter your trading exposure, you deserve an opportunity to trade in CFDs. With access to multiple trading account types, you can choose the right account for yourself and start performing trades in multiple CFDs.

The more experience you gain in the online trading market, the higher trading account you can adopt to trade in more challenging environments. If you are a beginner, start by making a minimum deposit of $250 to trade with a basic account.

Buycryptomarkets web trading platform

The web platform allows you to place trades directly from your web browser in an easy-to-use interface that is customisable and available in several languages. The web trading platform falls short because of its lack of social trading; however, it is well-designed with several useful features.

There is a two-step login for additional security, and you can search for an asset using its name or by category. Order types include:

- Market order

- Limit order

- Stop order

I was impressed with both the portfolio and fee reports which were comprehensive and easy to use, with clear information on commission, swap fees, and performance.

There are also the following useful features available on the trading platform:

Trailing stop

Trailing the position of a current price can then trigger a stop order as the price reaches a predetermined distance from a stop order. It works similarly to a stop order but in a more controlled way that aligns with movements in the market.

Market Sentiment

This allows you to closely monitor movements in the market using data from other traders concerning a specific instrument.

This allows you to mitigate risks by investing in the same product in a different direction.

Charts

Real-time charts provide up-to-the-moment information, including historical trends, forecasts, and current trends.

Buycryptomarkets mobile trading platform

The mobile trading platform is in keeping with the web trading platform, with much of the same functionality.

The actual design is well laid out and easy to use with customizability. I found the mobile app fast with personalised watch lists and the ability to open positions directly from real-time charts.

There are price alerts that include statistical alerts, which can be monthly or yearly for currency pairs, indices, etc. Clicking on the alert will automatically open the app on the instrument.

buycryptomarkets customer service review

Customer service is excellent at buycryptomarkets, with immediate response times across multiple channels.

There are several channels for contacting customer support, including phone and email. When I tested their service, my query was dealt with immediately without even the intervention of a chatbot. The service provided via email and phone was similar, with fast, relevant responses to my queries. Customer service is provided 24/5, which is above average.

buycryptomarkets is opening an account.

The account opening process is straightforward, fully digital and quick. You will need your ID.

To open your account, you should first decide on the account type you wish to open

Then you can follow these quick and easy steps:

- Select your country of residence

- Add personal information, including name and email address

- Choose a password

- Enter your home address and tax residency

- Complete some simple questions relating to your trading experience

- Fill in information about your personal finances, such as income savings and employment status

- Select your base currency

- Upload your ID documentation and proof of address, such as a utility bill or bank statement.

buycryptomarkets Deposit and Withdrawal

Deposits and withdrawals and essentially free, and the minimum deposit is high compared to what you would find at other brokers.

Before making your first deposit, you will need to choose between the following base currencies:

EUR, USD, GBP

Deposit options include:

- Bank transfer

- Credit and debit card

- Cryptocurrency

The minimum deposit is $5000, which is higher than other brokers. There are no fees should you choose to deposit via bank transfer from your bank account.

Bank transfers take several business days.

Withdrawals can be made using the same methods accepted for deposits, and there are no withdrawal fees for electronic wallets and credit/debit cards.

buycryptomarkets safety

buycryptomarkets is not regulated by the Financial Conduct Authority (FCA) but is performing full due diligence to comply with AML regulations.

In addition, all client funds are held in segregated bank accounts to protect those funds should buycryptomarkets go bust.

The buycryptomarkets negative balance protection protects client funds should their balance go negative.

buycryptomarkets fees

buycryptomarkets has low CFD and forex fees and average non-trading fees.

Fees can be separated into two main categories for a CFD and forex broker: trading and non-trading fees.

Trading fees

The trading fees will vary depending on the financial instruments you are trading within each asset class. Trading fees can be charged as a spread, a commission, or a financing rate.

Spreads differ between the bid and ask price for a foreign currency price. Here’s how buycryptomarkets spreads compare against some other forex brokers:

Non-trading fees

buycryptomarkets has low non-trading fees as they do not charge deposit and withdrawal fees, and there is no account fee.

Inactivity fees are charged. There are inactivity fees to be aware of. However, these will only kick in once your account has been inactive for several months and you have a positive balance.

Who is buycryptomarkets suitable for?

buycryptomarkets is suitable for all levels of traders looking for a solid trading platform and very competitive spreads.

The selection of account types is aimed at both retail and professional investors.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. Concerning margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to leverage, creditworthiness, limited regulatory protection, and market volatility that may substantially affect the price or liquidity of a currency or related instrument. It should not be assumed that these products’ methods, techniques, or indicators will be profitable or will not result in losses.

Broker Reviews

Equaledge Review – Demo Account – top 100 Broker ?

Table of Contents

equaledge Review

equaledge is a unregulated broker based in Kingstown St. Vincent and the Grenadines. They offer a fantastic selection of over 400+ trading instruments with very competitive trading conditions including reasonable spreads and minimal trading fees. You can get straightforward access to the markets via user-friendly platforms with a relatively high minimum deposit fee of $5000. Alternatively, they do provide free demo accounts if you want to practice your trading skills before making a financial commitment. You will find plenty of tools for assisting with your market analysis so you can pinpoint trading opportunities and make informed decisions.

I like how they are an experienced broker with a dedicated premium relationship management team to help guide you along the way. If you are a trader and want to trade in a professional environment across all of your devices, I think they are certainly worth consideration.

Pros & Cons

Pro’s

- Large choice of more than 400 trading instruments

- Trade on 40+ forex pairs with spreads from 0.8 pips

- Invest in the world’s largest indices and more

- Explore European and US shares CFDs

- Cutting edge platforms suitable for all types of traders

- Choose from and trade a wide range of both soft and hard commodities

- Good variety of quick and easy payment options

- Free demo accounts available to practice trading

- Excellent customer support

Con’s

- Clients from a few countries are not accepted

- No daily market analysis to inspire trade ideas

- Market maker broker means they don’t have the lowest spreads

- Only provide support during office hours

- Inactivity fees apply

- Not regulated

Summary

equaledge is a online brokerage where you can open an account to trade shares, indices, forex, commodities and more. Equaledge was launched in 2023 as to satisfy demand for a fast, professional and easy-to-use online spreads trading platform. With a quick registration process and friendly website, equaledge soon will become a prominent player in the financial trading sector. equaledge.com, a powerful, advanced trading platform with a fresh new feel.

The broker offers a very impressive selection of more than 400 financial instruments for online trading via its cutting edge trading platforms. I found the spreads to be very good and trades executed swiftly. On its proprietary platform, there are plenty of powerful trading tools available to you for analysing the markets and to manage your trade positions.

Funds

Client funds are kept in segregated bank accounts held with the top-rated banks. This helps to ensure that they are not used for any other purposes such as business running costs.

‘Know Your Customer’ (KYC) verification is carried out on every client. This procedure entails uploading a ‘government issued id card’ and ‘a utility bill’. This is a regulatory requirement and it is important in order to identify every client to ensure that illegal acts like money laundering, financing terrorism, etc, are not carried out on the pretext of forex or CFD trading.

Countries

equaledge does not accept clients who are residents of the United States, Belgium, NKorea, Singapore or any particular country where its services will be contrary to the local law or regulations.

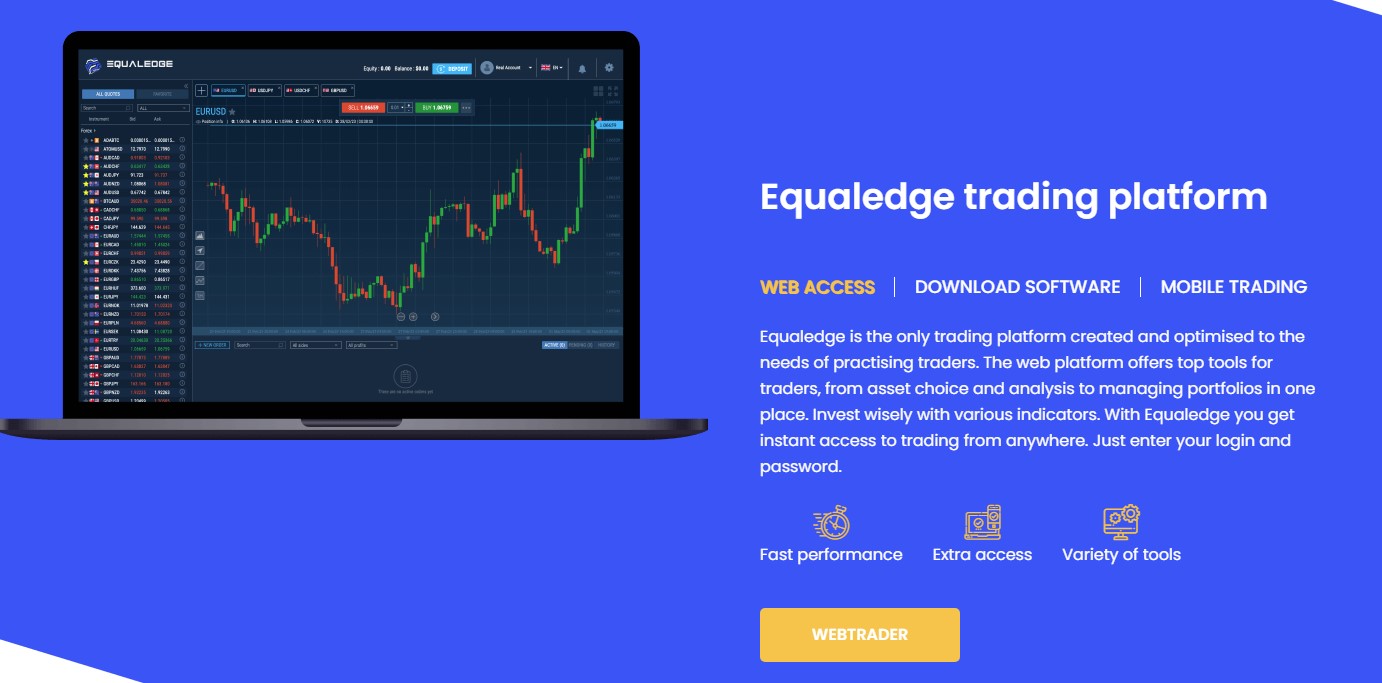

Equaledge.co Trading Platforms

You can enjoy a seamless trading experience wherever you are with a powerful and advanced trading platform from equaledge. You can get the full functionality with all the bells and whistles using the desktop platform or download the equaledge mobile platform and trade market moves as they happen from the palm of your hands. I personally find the desktop platform ideal for when I need to conduct detailed chart analysis but like the convenience of the trading app for keeping track of my account and the latest market news whenever I feel like it. Either way, I think the platforms are very user-friendly and provide everything you need for trading online without any hassle.

equaledge Platform

This is the proprietary trading platform from equaledge. This intutive platform is web based which makes it convenient as it requires no downloads or installations. It is also versatile because it runs across all operating systems and comes with useful market analysis and trading tools. You can analyse markets using a multitude of indicators and drawing tools across various chart types. I like how you are able to create your own watchlists and set price alerts to keep track of the markets you follow and trade. It is flexible as you are able to customise and save up to 10 unique workspaces with the chart views and time frames that you need, when you need them. The intuitive trade tickets make it simple to set up and understand your Stop and Limit levels for neccesary risk management.

Tools

The equaledge platforms come fully loaded with more tools than most of you will ever need. The abundance of built-in indicators and other useful tools, it is nice to see that equaledge have a few more to improve your trading possibilities.

Markets

There is a great selection of more than 400 trading instruments for you to choose from. I think there should be enough to build a diverse portfolio for anyone, regardless of your interests.

Forex Trading

Trade forex with 45+ majors, minors, and exotics with spreads as low as 0.6 pips. FX is traded in pairs, where one will rise (or fall) in value against the other.

Indices Trading

Invest in the world’s largest indices. An index measures the performance of a group of companies, typically weighted by market capitalization.

Shares Trading

Explore 10s of European and US shares CFDs. Shares CFDs give traders a way to speculate on the value of publicly listed companies without needing to physically own stocks.

Commodities Trading

Choose from and trade a wide range of both soft and hard commodities ranging from traditional markets like gold and oil, to wheat, cotton, and even orange juice.

Accounts

I found the broker to provide transparent and fair spreads across all markets. They only offer five account types which are based on investment amount. You can choose between the different account buy simply investing a different amount. Inactivity fees are charged from accounts that have been dormant for 6 months and above. The fee is charged monthly until the account is depleted or the client begins trading again. They don’t provide spreads from 0.0 pips so might not be ideal for those of you who are planning to use scalping systems.

| BASIC ACCOUNT | STANDARD ACCOUNT | GOLD ACCOUNT | PRO ACCOUNT | VIP ACCOUNT | |

|---|---|---|---|---|---|

| MINIMUM DEPOSIT | $5,000 | $10,000 | $25,000 | $100,000 | $250,000+ |

| ORDER EXECUTION | Instant | Instant | Instant | Instant | Instant |

| ACCOUNT CURRENCY | USD, EUR, GBP | USD, EUR, GBP | USD, EUR, GBP | USD, EUR, GBP | USD, EUR, GBP |

| ACCOUNT MANAGER | yes | yes | yes | yes | yes |

| SPREAD, PIPS | Fixed | Fixed | Fixed & Floating, Variable | Fixed & Floating, Variable | Fixed & Floating, Variable |

| QUOTATION (NUMBER OF MARKS AFTER POINT) | 5 marks | 5 marks | 5 marks | 5 marks | 5 marks |

| LEVERAGE | 100 | 100 | 200 | 500 | 500 |

| MAX. TRADE SIZE | 10 lots | 20 lots | 40 lots | 50 lots | 100 lots |

| RE-QUOTES | None | None | None | None | None |

| MARGIN CALL LEVEL | 40% | 40% | 40% | 40% | 40% |

| STOP OUT LEVEL | 30% | 30% | 30% | 30% | 30% |

| TRADING PLATFORM | all devices | all devices | all devices | all devices | all devices |

| CUSTOMER SUPPORT | 24/5 support | 24/5 support | 24/5 support | 24/5 support | 24/7 support |

Support

The equaledge customer service team works during office hours CET time from 8:30 am to 9:00 Mondays to Fridays. The team can be reached on various phone numbers and emails. . I think they could improve by adding live chat support as I often find this to be the quickest way to speak with someone.

But they offer to chat direct to their support through WhatsApp +447835182154

Alternatively, you can explore the most frequently asked questions on everything from setting up your account, to getting more out of the platforms and tools, or send them an email through [email protected]

Funding

This is an aspect of the broker I was also impressed by. I like how they have a good variety of quick and easy account funding options for you to choose from. This includes digital wallets which I find to be the most convenient for moving funds around between my trading account. Withdrawal requests received before 2pm are attempted to be processed on the same working day. Just keep in mind that they do not accept third party deposits. All deposits must emanate from the same name on the trading account.

Bank Transfer

Take 3-7 days for the funds to reach equaledge bank accounts.

Credit/Debit Cards

Deposits made by cards are processed instantly. But, card withdrawals can take up to 7 days depending on the location of the client and the card processors.

Online Payments

Deposits are processed instantly while withdrawals take up to 24 hours.

Cryptocurrency

Payment is processed within 2 hours.

Conclusion

equaledge is a online broker that offers Hundreds of tradable assets to its clients via its flexible and sophisticated trading platform. The Brand abide by the regulatory rules which include account segregation, digital security, client verification without actually being regulated.

The wide array of tradable assets on the broker’s platforms is impressive at over 400. It is an outstanding platform replete with essential trader tools for conducting comprehensive market analysis. Their trading platform very popular and widely accepted by professional traders across the globe. You can seamlessly access your account and trade between all of your devices.

However, in the area of market news and analysis, I think the broker is lacking behind when compared to other top-rated brokers. There is limited expert analysis, daily insights and trading ideas. Trading accounts are limited with no mini/micro accounts for testing the real trading conditions but free demo accounts are available. I didn’t find the spreads to be the lowest but it is worth considering there is no commission fee on trades. There is also an inactivity fee to be aware of and funding without any fees is limited.

Overall, I think they can be a good choice of broker for anyone who is looking for easy market access with decent trading conditions and excellent customer support.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. Concerning margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to leverage, creditworthiness, limited regulatory protection, and market volatility that may substantially affect the price or liquidity of a currency or related instrument. It should not be assumed that these products’ methods, techniques, or indicators will be profitable or will not result in losses.

Broker Reviews

Exallt Review – Demo Account – top 75 Broker ?

Table of Contents

Introduction to Exallt Review

Let us start from the beginning. People should remember that Exallt offers many investment tools in the capital markets. Creating a portfolio with cryptocurrencies, stocks, commodities, ETFs, and more is possible.

It is a new brokerage that has just opened its door. That said, Exallt Live can offer exemplary services and products.

To get more details, proceed with Exallt review. The next sections will provide a detailed professional analysis of the broker and its offerings.

| Broker Name: | Exallt |

| Broker Type: | CFD broker |

| Operating since year: | 2023 |

| Regulation: | Only KYC/AML |

| Broker status: | Independent Broker |

| Customer Service | |

| Phone: | +44 2086382873 |

| Email: | [email protected] |

| Languages: | English, Spanish |

| Availability: | phone, email, Social Media |

| Trading | |

| Trading platforms: | Desktop, Mobile and Webtrader |

| The Trading platform Time zone: | |

| Demo account: | Yes |

| Mobile trading: | yes |

| Web-based trading: | yes |

| Bonuses: | yes |

| Other trading instruments: | Forex, CFD, crypto, commodities, indices, stocks |

| Account | |

| Minimum deposit ($): | $5000 |

| Maximal leverage: | 1:400 |

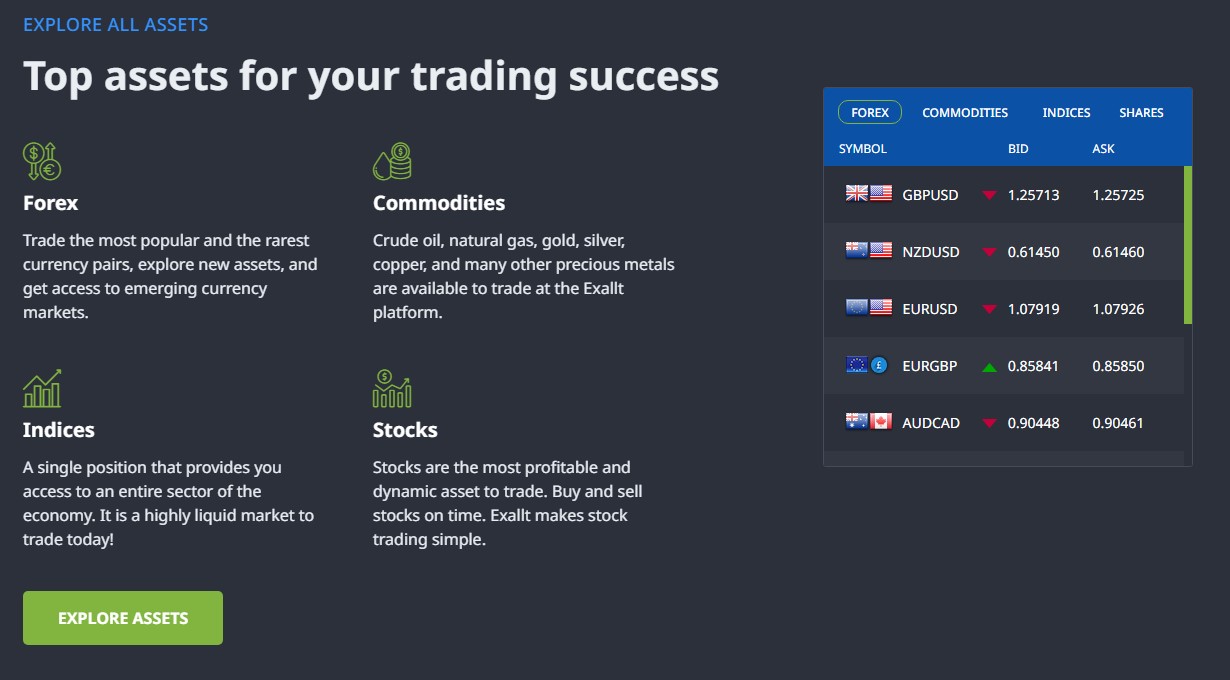

Exallt Trading Products and Interesting Details

Commodities

Explore top commodities, trade what you want, when you want.

Explore trending commodities such as gold, silver, oil, and others, use innovative tools and make informed trading decisions at Exallt. Benefit from advanced charting and analysis as well as ultra-fast transaction processing. Exallt delivers a trading environment that helps investors to grow.

Interestingly, it is possible to trade different types of commodities. For example, oil and natural gas. Moreover, precious metals such as gold and silver.

Forex

Forex trading is made simple by Exallt.

Forex is the most traded market in the world. It is a decentralised global market for the trading of currencies. The most popular FX pairs involve major international currencies and experience the highest trading volumes and liquidity. This market determines foreign exchange rates for every currency.

Indices

Expand your trading opportunities. Trade the most popular indices at Exallt!

Indices are another in-demand trading asset. An index measures the performance of a group of stocks, bonds, or other assets. By trading indices, you can gain exposure to a wide range of assets without buying them individually. Most index trading is done with financial derivatives like CFDs. This makes it an ideal way to diversify your portfolio and manage risk.

Stocks

Trade stocks at Exallt.

Exallt is about making stock trading easier. Get real-time access to stocks from top exchanges of the world. Diversify your portfolio with a large variety of leading global stocks. Stock trading ensures two ways of earnings: through capital appreciation or dividend payments. This market features the potential for the highest returns.

Cryptocurrencies

Exalt – the easiest and the most secure way to trade cryptocurrencies.

If you can time the market right, trading cryptocurrencies gives you much higher returns than traditional investments. It minimizes risk as you speculate on the rise and fall of the market without owning the asset. Being decentralised, cryptocurrencies allow for more freedom in trading, as there are no restrictions on how much can be traded or how often.

Exallt and its Trading Platform

It is hard not to mention its platform. Hopefully, it is quite easy to use the platform.

As a reminder, trading is simple. The first step is to select an asset. All users have to do is click on the “asset” tab on the platform. They need to choose a preferred asset from the extensive tradable asset selection offered by the firm.

The next step is deciding on the amount a trader wants to invest in any trade. Unsurprisingly, the higher the investment, the higher the potential rewards.

Moreover, deciding whether to go short or long on their preferred asset is important. Advanced charts, graphical trading tools, technical indicators, and live analysis help to make an informed decision on probable future price movements.

It is important to remember about risk factors. When a trade position opens, customers should protect their positions from market risks. Customers should use Stop Loss and Take Profit orders. Thanks to Stop Loss orders, it is possible to reduce potential losses. Moreover, Take Profit orders allows users to lock in their profits.

Users should remember that Stop Loss and Take Profit orders will automatically close their positions when triggered.

Exallt and Education

Hopefully, Exallt Live offers interesting information. It is desirable to read every chapter of the guide. Moreover, people will find this guide brimming with information for their financial education. Furthermore, Exallt ’s goal is to educate investors and bring transparent investing to anyone who wants it, not just the elite.

Security Of Funds

RISK MANAGEMENT

Exallt continually detects, assesses, monitors, and controls each risk associated with platform users’ trading transactions, operations, and actions. This means that they continuously evaluate the effectiveness and compliance of the policies, approaches, and procedures. Such a system approach allows Exallt to cover its financial needs and capital requirements quickly.

SEGREGATED ACCOUNTS

Exallt is incredibly proud of ensuring the ultimate protection of clients’ funds. They apply a model that keeps our clients’ funds separate from the company funds. In the unlikely event that Exallt would ever enter liquidation, the clients’ funds are wholly segregated off the balance sheet and cannot be used to cover the company’s debts and pay back creditors.

REACHING THE TOP EU BANKING INSTITUTIONS

Exallt attentively chooses the financial services to partner with. Exalt needs additional facilities to support and conduct transactions. They partnered with payment service providers to work with numerous banks worldwide, including central tier-one banks such as Barclays, HSBC & Deutsche Bank. Rest assured, the security of Clients’ funds, alongside Execution and Customer support, forms the essential focus of Exallt’s activity.

Exallt Review: Conclusion

As can be seen from the review of Exallt , it makes sense to cooperate with this firm. . Moreover, its website provides many interesting details, and it is desirable to have a look through their website to see how well Exallt suits you.

We strongly hope that this Exallt review will give you accurate information about the broker enabling you to make the right decision of choosing this broker.

Broker Reviews

Trading 212 review

Trading 212 Trading 212 deals View Similar Amazon US Trading 212 is a London-based brokerage platform that aims to democratize trading by making it accessible to the masses. Founded in 2006, Trading 212 allows users to trade in a variety of assets including Forex and currencies, gold, commodities, crypto, and stocks, etc.

Trading 212 is a London-based brokerage platform that aims to democratize trading by making it accessible to the masses. Founded in 2006, Trading 212 allows users to trade in a variety of assets including Forex and currencies, gold, commodities, crypto, and stocks, etc.

Trading 212 got the license to operate in the UK in 2013 and is approved by the FCA (Financial Conduct Authority of England and Wales). It has a freemium model offering the basic services without any charge hoping that the users opt for other paid services or transact on the CFD area of the platform.

As a user, you can use their web-based trading suite or download the application on your computer. There is even a mobile app available for both iOS and Android phones, in case you want to transact on the go.

Table of Contents

What to expect

Trading 212 offers an easy DIY platform and allows over 1,800 instruments to trade, offering enough options to traders to decide where and how they want to invest their money. These instruments include major cryptocurrencies like Bitcoin, Ripple, LiteCoin, Ethereum, Monero, EOS, Dash, Neo and more. Traditional assets like stocks, commodities and indices can also be traded on the platform. The diverse list of assets and choices available to trade on the platform should be attractive to many users.

For first-timers, Trading 212 offers a demo account which lets you try out the platform and perform test transactions without registration. This demo account gives you a real-time experience of how the platform works on your computer and mobile applications. In case you decide to sign up, you do need to provide some official documents to verify your identity and address. These documents include:

- ID Proof: a scanned color copy of passport, driving license or national ID

- Address Proof: a utility bill or bank statement from the past three months carrying your address

These are simply standard requirements as part of anti-money laundering legislation.

There is a set of questions which you need to answer for the company to understand your experience level as a trader. Trading 212 might reject your application on sign up, if the firm feels that it might be too risky for you to transact on such a platform. The entire signup process may take a good 10-15 minutes, so keep that much time handy.

Trading 212 offers you three different types of account: Trading 212 Invest, Trading 212 CFD and Trading 212 ISA.

Trading 212 Invest is best suited for traders who like to invest and trade in equities. However, the platform does not allow short-selling of equities, so in case you’re only interested in this type of trading then Trading 212 is not the right platform for you. Trading 212 ISA is only for UK-based traders who want to benefit from tax-free trading up to a certain amount, while Trading 212 CFD is open for all international traders.

In terms of deposit and withdrawal options, Trading 212 offers multiple choices like bank transfers, credit and debit card payments, Skrill, PayPal, Dotpay, Giropay, and Direct eBanking. Note that it only accepts payments in currencies like GBP, EUR and USD.

The web platform is very easy to use and it offers an organized layout. On the extreme left, you have the instruments you follow by adding them to your watch-list. All your pending orders or previous purchases show right next to the watch-list. In case you want to modify your transaction after looking at the live trends, this can be done here as well.

The center part of the screen displays a detailed graph of any instrument that you want to follow. Useful tips and videos can be found on the bar on the right side. Various reports can be found grouped right under the login section.

Mobile app

The Trading 212 mobile application is also fairly easy to use and shows information in an easy to understand graphical format. Simple swipe gestures help you switch between different sections and instruments. You can set price alerts, access forum, reports, or training videos right from the menu. There is a demo account available for the mobile app too that allows you to transact in all the instruments.

Charges

Trading 212 is one of the few platforms that does not charge you for transactions and is transparent about the costs applicable with paid-for services. While withdrawing funds, there is a fee applicable on the wire transfers. Third-party transfer fees may also be levied, if applicable. The platform wants you to remain active and charges you for inactivity, if inactive for over 180 days consecutively.

Support

Customer support is one of the most important features of any trading platform. Support is available by calling in, email or even through the contact page on the site. The website also has a live chat option in case you want to chat with a representative.